Examining state political sentiment and dependence on federal government.

How dependent are states on federal government for funding their governments economies? Wallethub has collected data, which it explains as follows:

States receive federal aid for many reasons, from providing relief during natural disasters and health crises to funding improvements in education, transportation, infrastructure, healthcare and more. Some states receive much larger aid packages than others, but it’s not just the dollar amount that matters. It’s important to contextualize the money flowing in by comparing it to things like what percentage of the state’s revenue it makes up and how much the federal government gets back through its taxes on the state’s residents.

In order to find out exactly how big the difference in federal dependence is from state to state, WalletHub compared the 50 states in terms of three key metrics: the return on taxes paid to the federal government, the share of federal jobs, and federal funding as a share of state revenue. (1)https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700

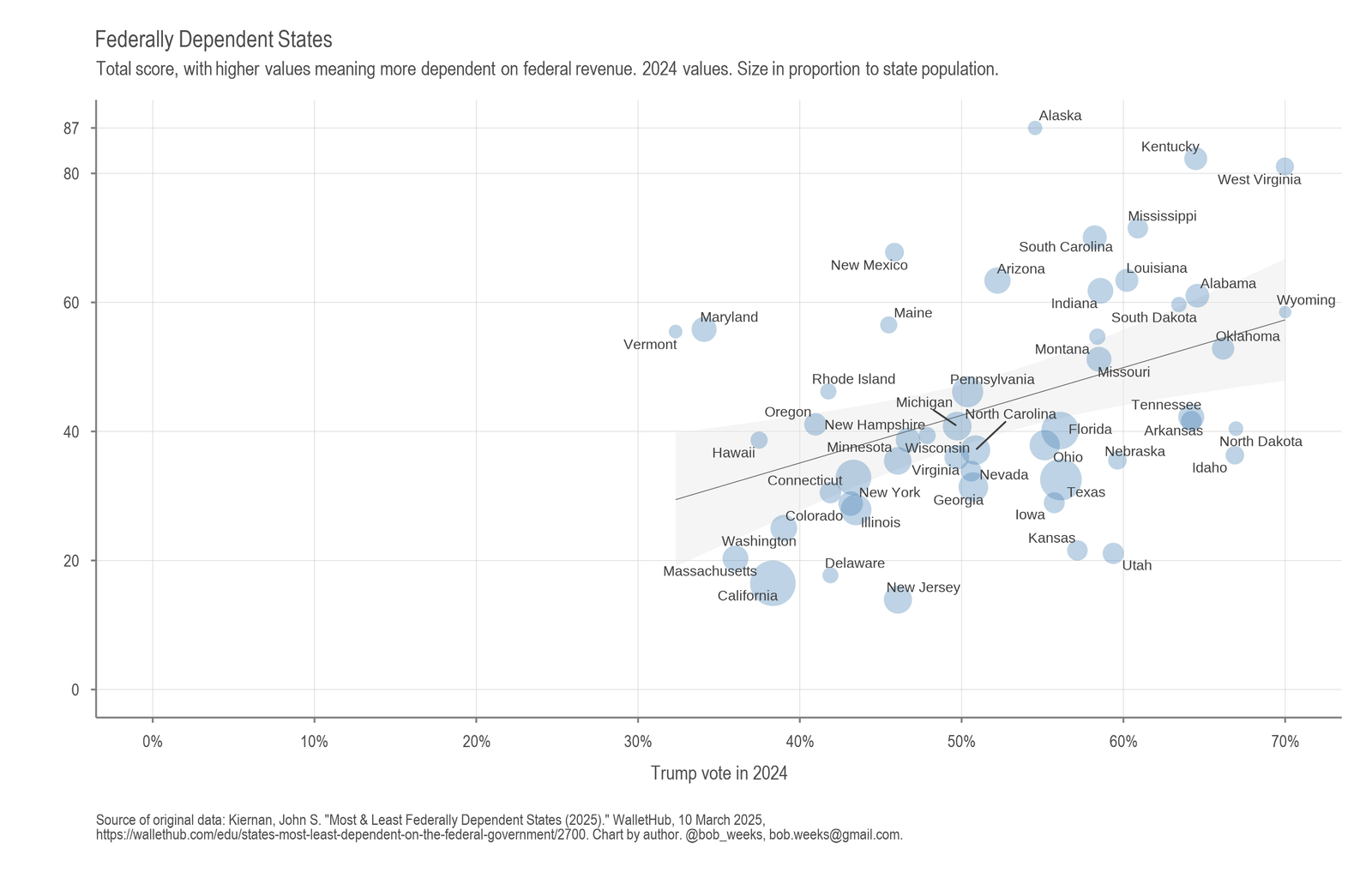

I created a chart, and asked ChatGPT to explain. (Click chart for larger)

This chart plots U.S. states by two main variables:

- Federal Dependency Score (vertical axis):

– A higher “total score” on this axis means the state is more dependent on federal funding (as measured by the study).

- Trump Vote in 2024 (horizontal axis):

– This is the estimated/actual percentage of the vote for Donald Trump in the 2024 election. Farther right indicates a higher Trump share.

Additionally, circle size corresponds to each state’s population — larger states are shown with bigger bubbles.

In short, the chart visually represents a relationship in which many states that vote more heavily for Trump also score higher on measures of federal financial dependence. Meanwhile, states that lean more Democratic in 2024 (to the left side) tend to have lower federal dependency scores, although there are exceptions in both directions.

General Pattern

- Overall correlation

There is a visible upward-sloping trend line (roughly from bottom-left to top-right).

– This suggests that, as a state’s share of the vote for Trump (2024) increases, so does its likelihood of having a higher federal dependency score.

- Clusters of states

– Lower federal-dependency / lower Trump vote (bottom-left): States such as Massachusetts, California, and New Jersey appear here with both low federal-dependency scores and lower Trump support.

– Higher federal-dependency / higher Trump vote (top-right): States such as Mississippi, Kentucky, West Virginia, and Alaska appear with both high federal-dependency scores and a high percentage of Trump votes.

- Mid-range

– Around the center, you find states like Michigan, North Carolina, Pennsylvania, Florida, and Texas—moderate-to-high Trump vote shares but with moderately high federal-dependency scores.

Notable Outliers

- Hawaii and Vermont appear relatively high on the dependency scale (above the mid-40s or 50s on the vertical axis) but still have lower Trump vote percentages.

- Alaska is an extreme case in the top-left corner (high dependency but not the absolute highest Trump vote).

- Utah and the Dakotas are further right on the x-axis (indicating higher Trump vote), but their vertical position isn’t as high as some other strongly Republican states.

Possible Explanation of Trends

- Economic Composition: States with larger proportions of federal land, defense spending, or social welfare needs (for instance, states with higher poverty or smaller tax bases) may rely more on federal support. These states (e.g., Alaska, West Virginia, Mississippi) often have strong Republican leanings but also benefit from federal dollars.

- Political History: Some states have historically voted Republican and have industries (mining, agriculture, defense installations) that draw significant federal funding—leading to higher dependency scores.

- Population Size: Larger states (California, Texas, Florida, New York) have large bubbles. Even if their “per capita” or “per dollar” federal dependency is moderate, the total funds are substantial. But in this chart, total state dependency is measured by the Wallethub scoring system—which typically weighs factors like grants, return on taxes paid, etc.

References

| ↑1 | https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700 |

|---|