Tag: Energy

-

Biggest Producer of Crude oil #FACT #PERIOD

A popular meme on social media is true, but doesn’t convey its intended message.

-

Presidential Data Explorer Updated

Explore the economic record of presidents, starting with Harry S Truman. Updated with recent data.

-

Presidential Data Explorer Updated

Explore the economic record of presidents, starting with Harry S Truman. Updated with recent data.

-

BP Oil Executive ‘Brice Cromwell’

A popular social media post makes a bogus appeal to authority.

-

Weekly Gasoline Purchases

A popular Facebook post makes claims about gasoline purchases that aren’t correct, or even close.

-

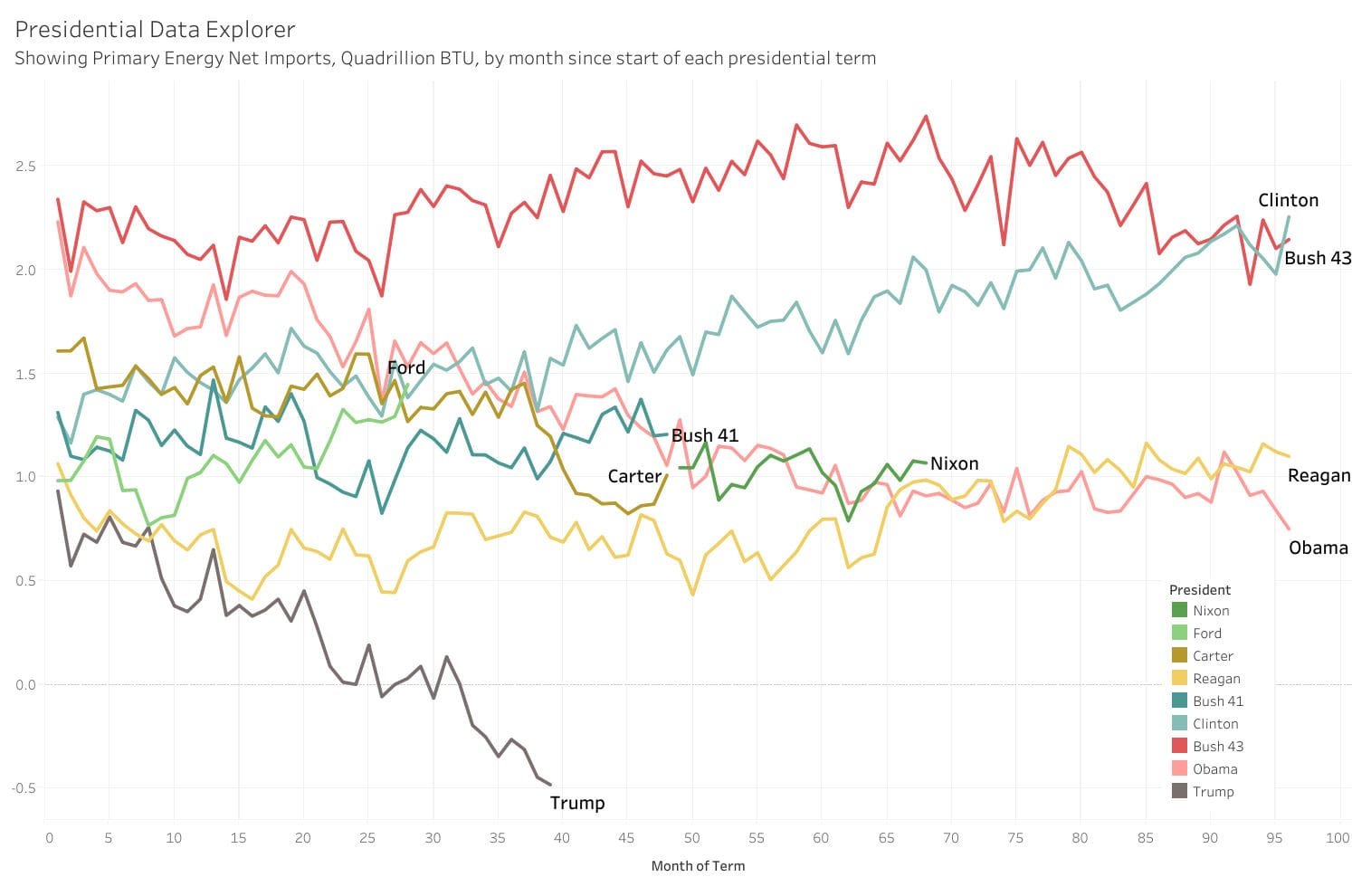

Added to presidential data explorer: Primary Energy Net Imports

Explore the economic record of presidents through the lens of energy independence.

-

From Pachyderm: Westar Energy

A presentation from Westar Energy titled “An overview of Westar Energy — Solar, Conservation, Community.”

-

Energy subsidies for electricity production

To compare federal subsidies for the production of electricity, we must consider subsidy values in proportion to the amount of electricity generated, because the magnitude is vastly different.

-

Abengoa, Kansas ethanol plant operator, may seek bankruptcy

A company that has a taxpayer-guaranteed loan may be entering bankruptcy. Will taxpayers have to pay?

-

Energy subsidies for electricity production, in proportion

To compare federal subsidies for the production of electricity, we must consider subsidy values in proportion to the amount of electricity generated, because the magnitude is vastly different.

-

Voice for Liberty Radio: Hydraulic fracturing: A conjured-up controversy?

In this episode of Voice for Liberty Radio: Dwight D. Keen is former chairman of the Kansas Independent Oil and Gas Association. He spoke to the Wichita Pachyderm Club on the topic “Hydraulic Fracturing: A Conjured-up Controversy.”

-

Kansas City Star’s dishonest portrayal of renewable energy mandate

The Star touts economic gains to the wind industry but ignores the reality that those gains come at the expense of everyone else in the form of higher taxes, higher electricity prices and other unseen economic consequences, writes Dave Trabert of Kansas Policy Institute.