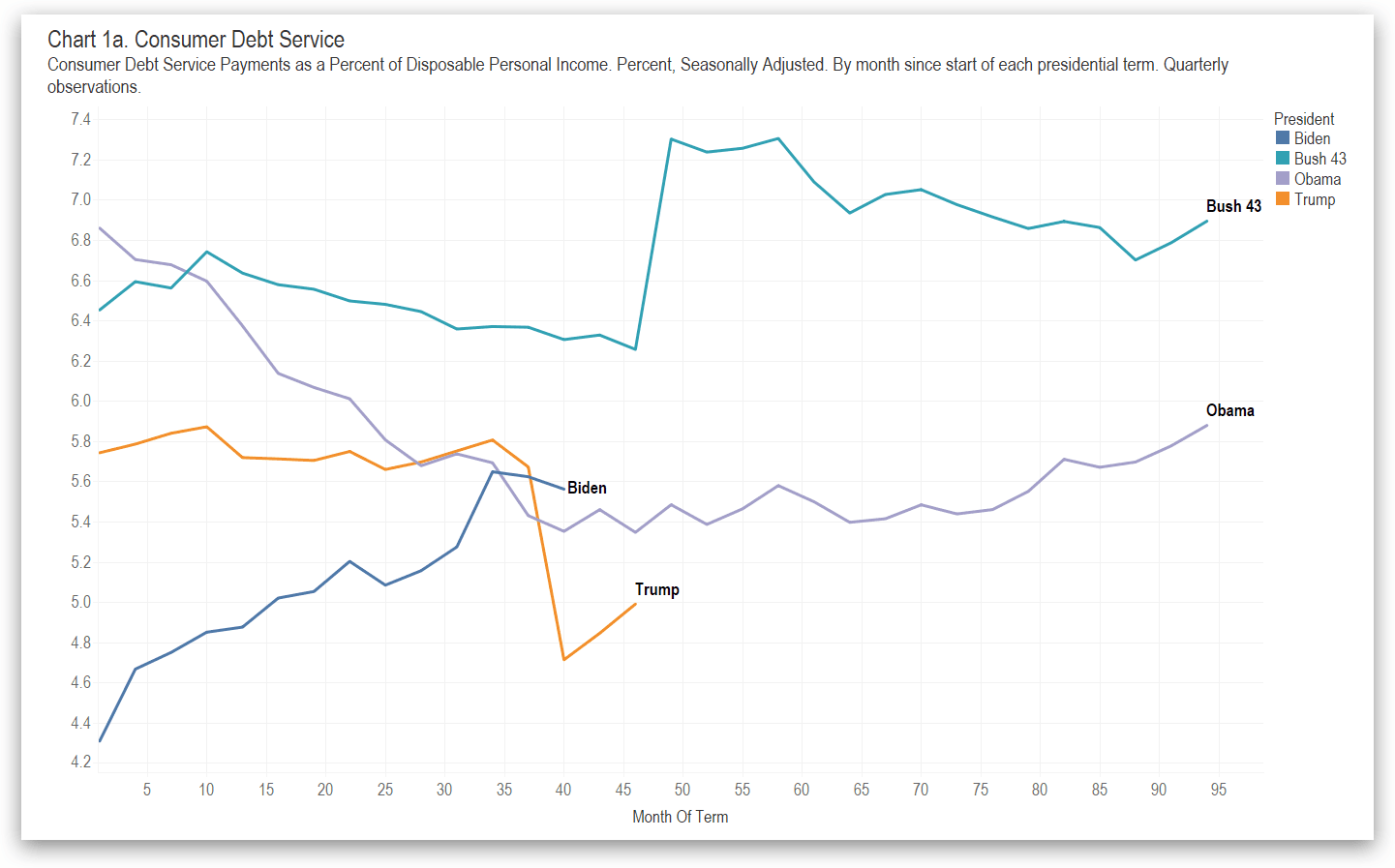

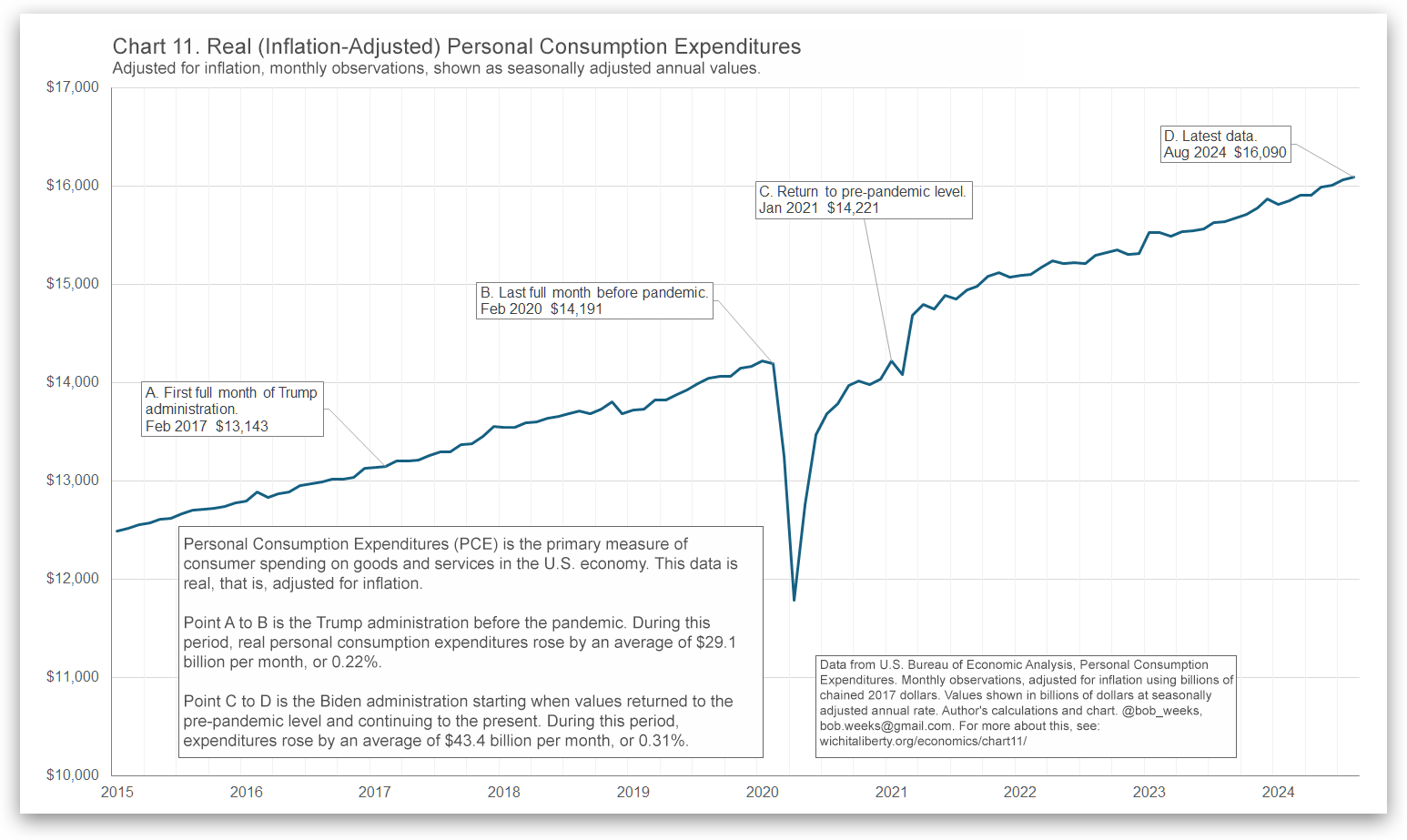

The United States economy grew while Donald J. Trump was president, until the pandemic. How does this growth compare with the previous administration?

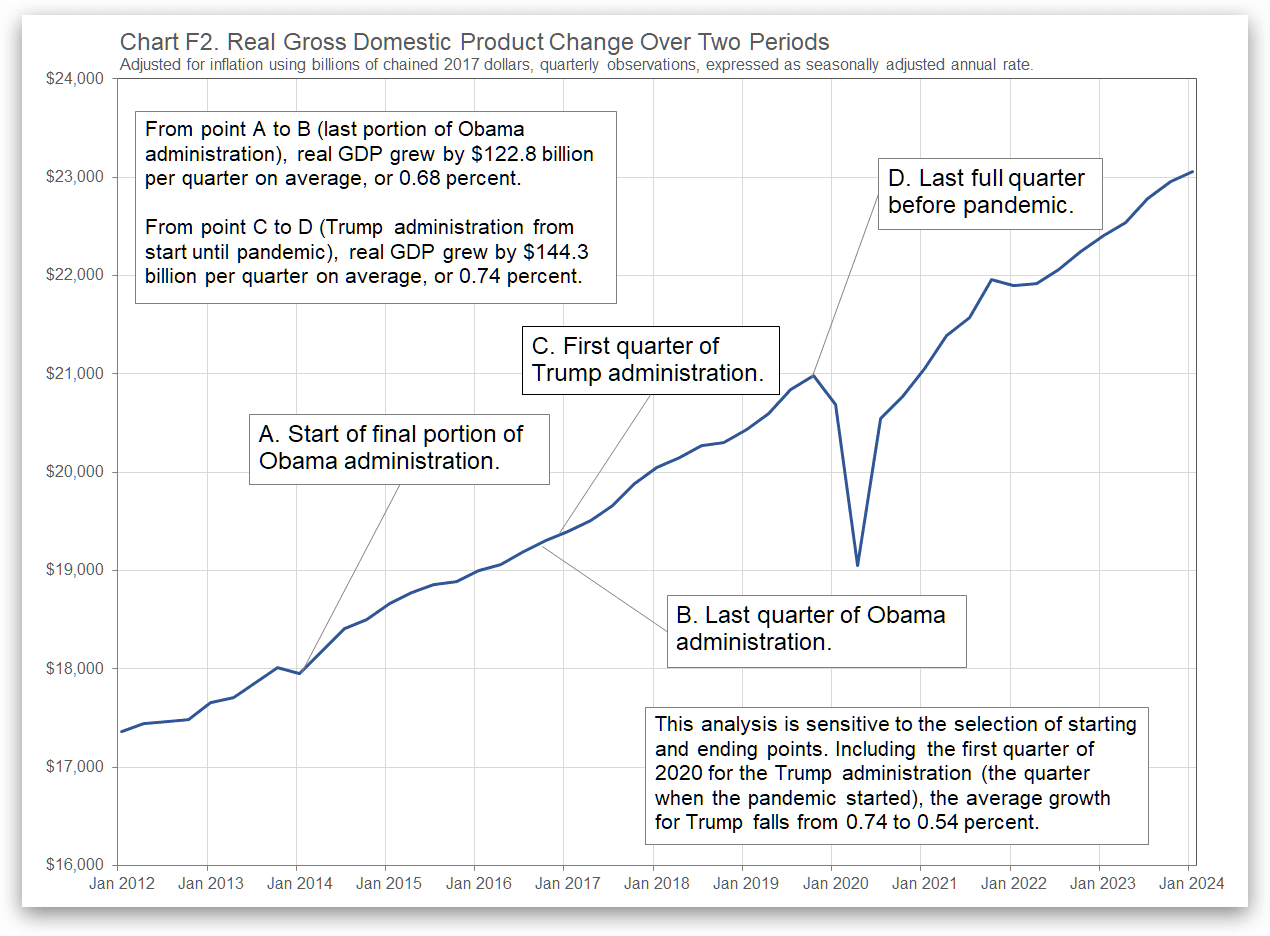

I wanted to compare the rate of economic growth of the Trump and Obama administrations. I gathered data from the U.S. Bureau of Economic Analysis on gross domestic product, which is the most commonly-used measure of an economy and its growth. I used real GDP, adjusted for inflation, which allows meaningful comparison of dollar values over time. This data is reported quarterly.

The nearby chart holds plots of real gross domestic product (GDP) over two periods of 12 quarters each. One period starts with the first quarter of 2017, which is the first quarter of the Trump administration. It ends with the fourth quarter of 2019, which is the last quarter that was not affected by the response to the pandemic. The other period starts with the first quarter of 2014 and covers the last 12 quarters of the Obama administration. A nearby table summarizes the data.

I also asked ChatGPT to help me summarize this data.

Points A to B (Last Portion of Obama Administration)

The chart shows that from point A to B (roughly from the beginning of 2015 to the end of 2016), during the final years of Obama’s presidency, the U.S. economy grew by an average of $122.8 billion per quarter, or 0.68%. This steady growth trend continues until the transition to the Trump administration.

Points C to D (First Portion of Trump Administration, Before the Pandemic)

From point C (the start of the Trump administration in early 2017) to point D (just before the pandemic in early 2020), the economy grew at a slightly faster rate of $144.3 billion per quarter, or 0.74%. This period showed a continuation of growth, although at a marginally higher rate compared to Obama’s final years.

The chart notes a significant drop in GDP in 2020, coinciding with the onset of the COVID-19 pandemic. The sharp drop visually represents the impact of the pandemic on the U.S. economy.

There’s also a note that the growth rate calculation for Trump is sensitive to how the periods are selected. If the first quarter of 2020 (when the pandemic started) is included in the analysis, Trump’s average growth rate drops from 0.74% to 0.54%. This illustrates how dramatically the pandemic disrupted economic growth.

Both administrations oversaw steady GDP growth, though Trump’s administration experienced a slight increase before the pandemic. The analysis shows how using different time periods can influence perceptions of economic performance, particularly considering the pandemic’s impact.