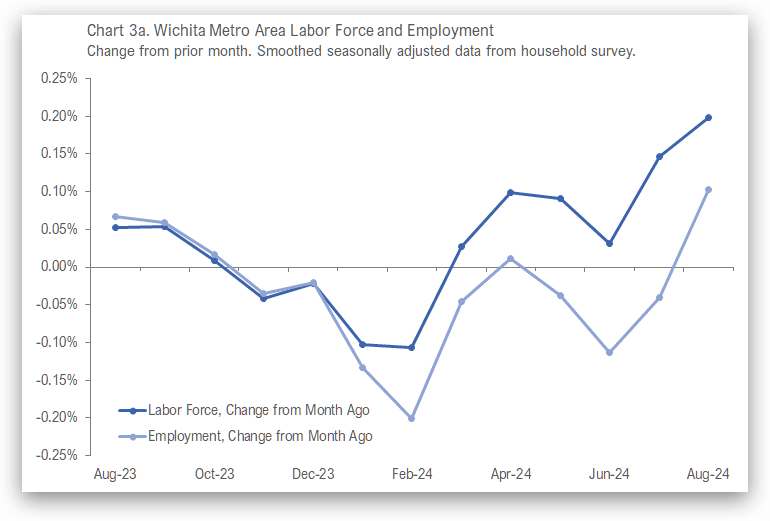

For the Wichita metropolitan area in August, most employment indicators improved slightly from the prior month. Wichita continues to perform poorly compared to its peers. (more…)

Tag: Economic development

Wichita Employment Situation, July 2024

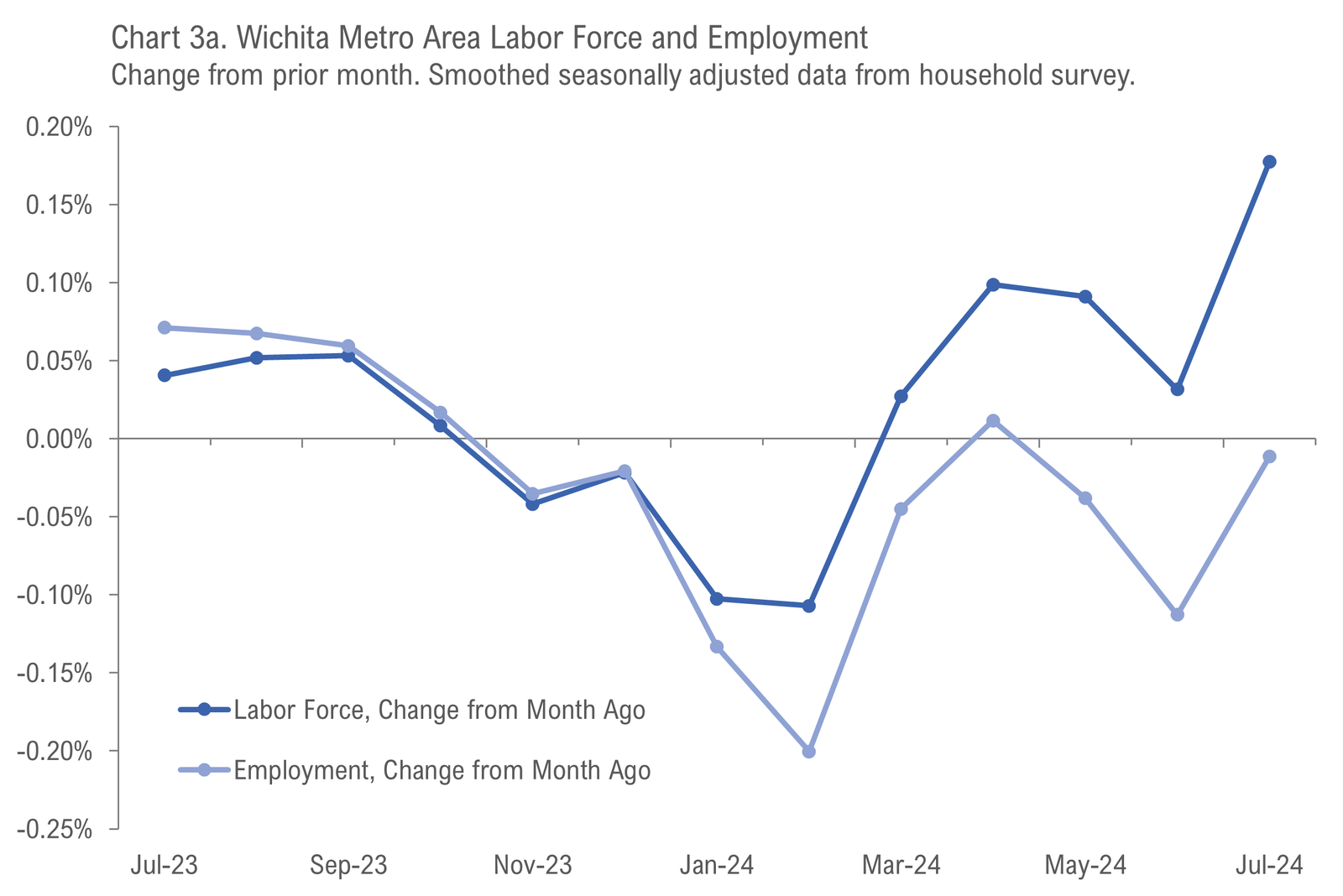

For the Wichita metropolitan area in July, most employment indicators worsened from the prior month. Wichita continues to perform poorly compared to its peers. (more…)

Wichita Employment Situation, June 2024

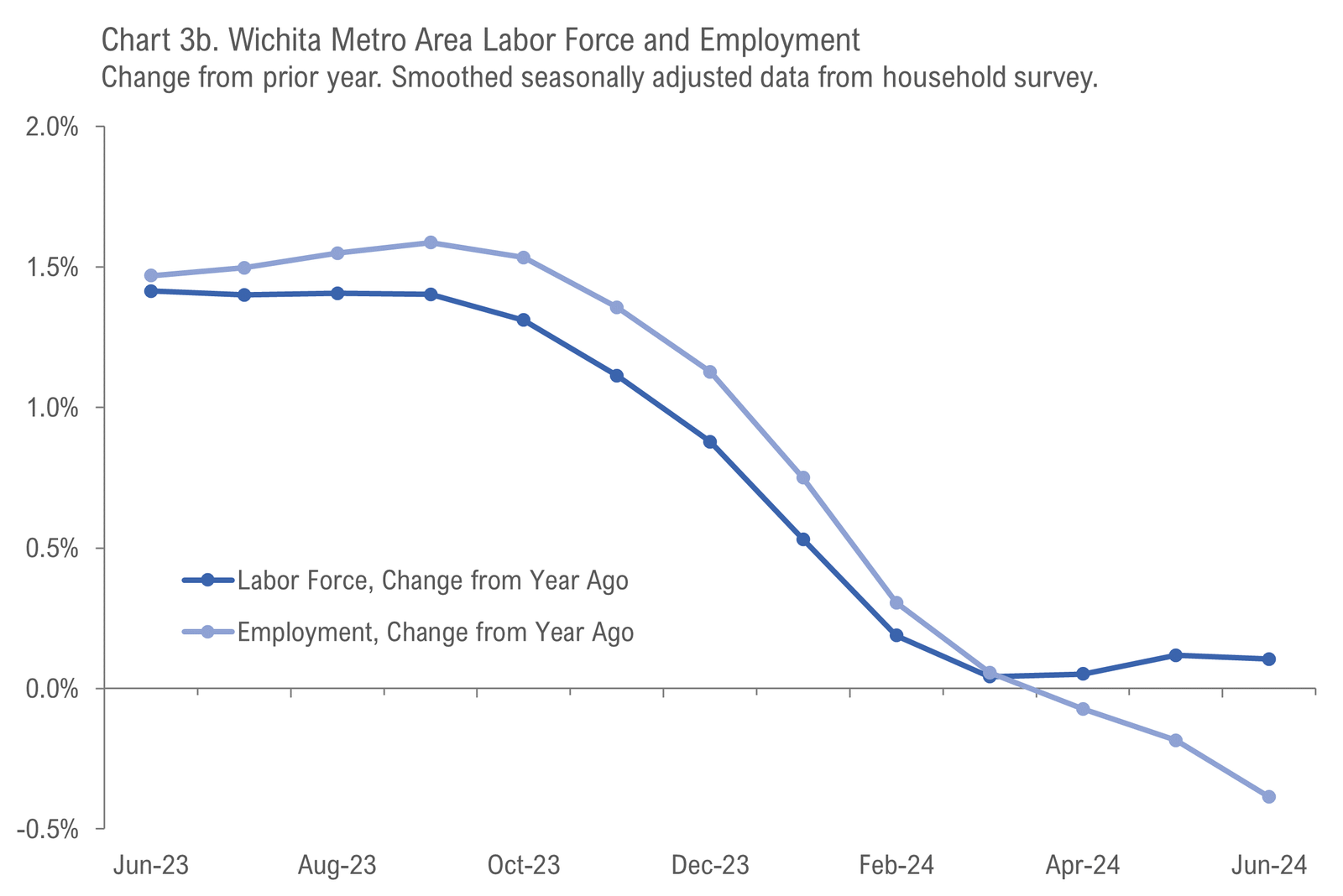

For the Wichita metropolitan area in June, most employment indicators worsened from the prior month. Wichita continues to perform poorly compared to its peers. (more…)

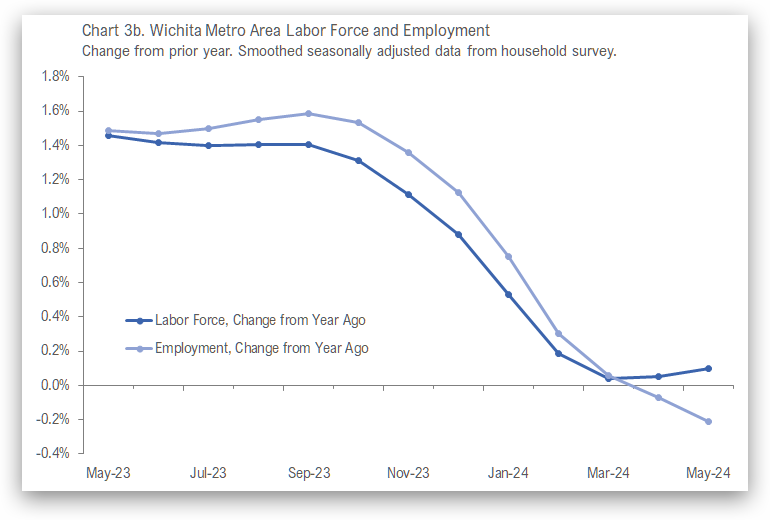

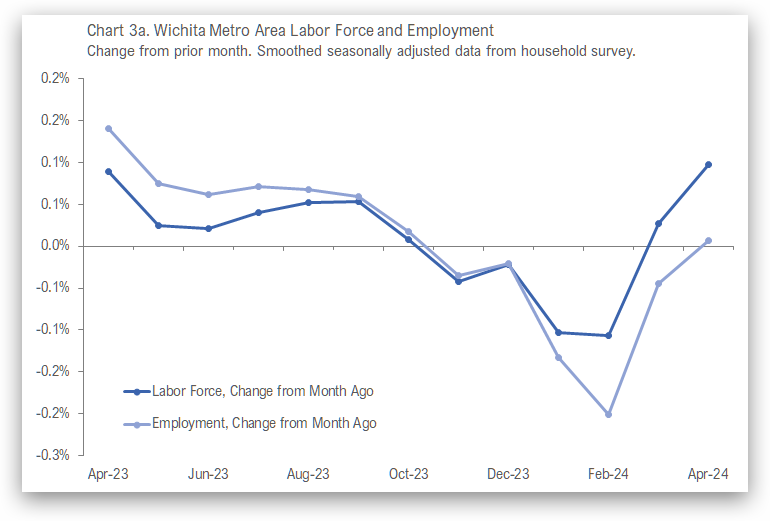

Wichita Employment Situation, May 2024

For the Wichita metropolitan area in May, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers. (more…)

Wichita Employment Situation, April 2024

For the Wichita metropolitan area in April 2024, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers. (more…)

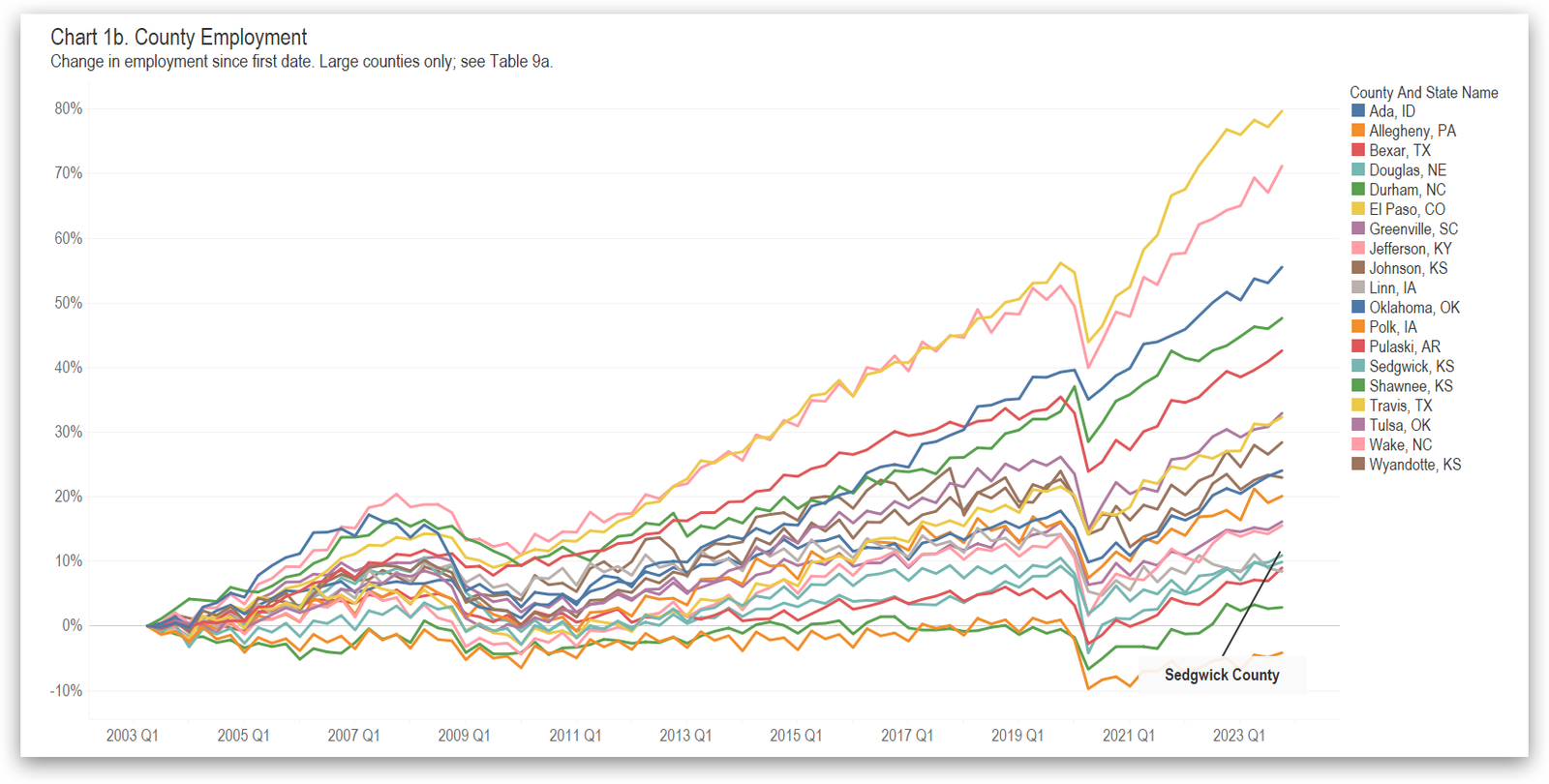

Large County Employment, Fourth Quarter 2023

Employment in large counties, including Sedgwick County and others of interest. (more…)

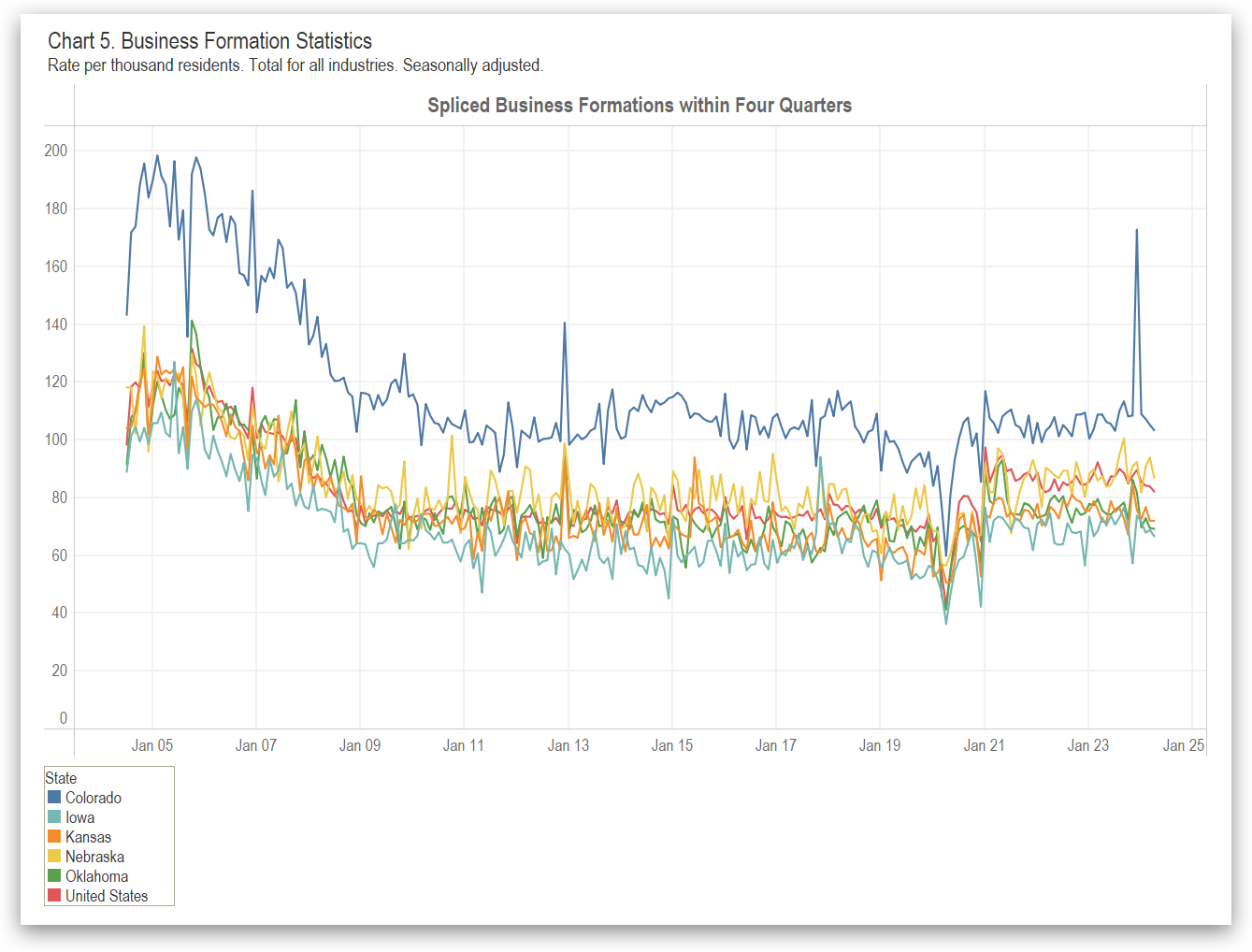

Business Formation in States

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation. (more…)

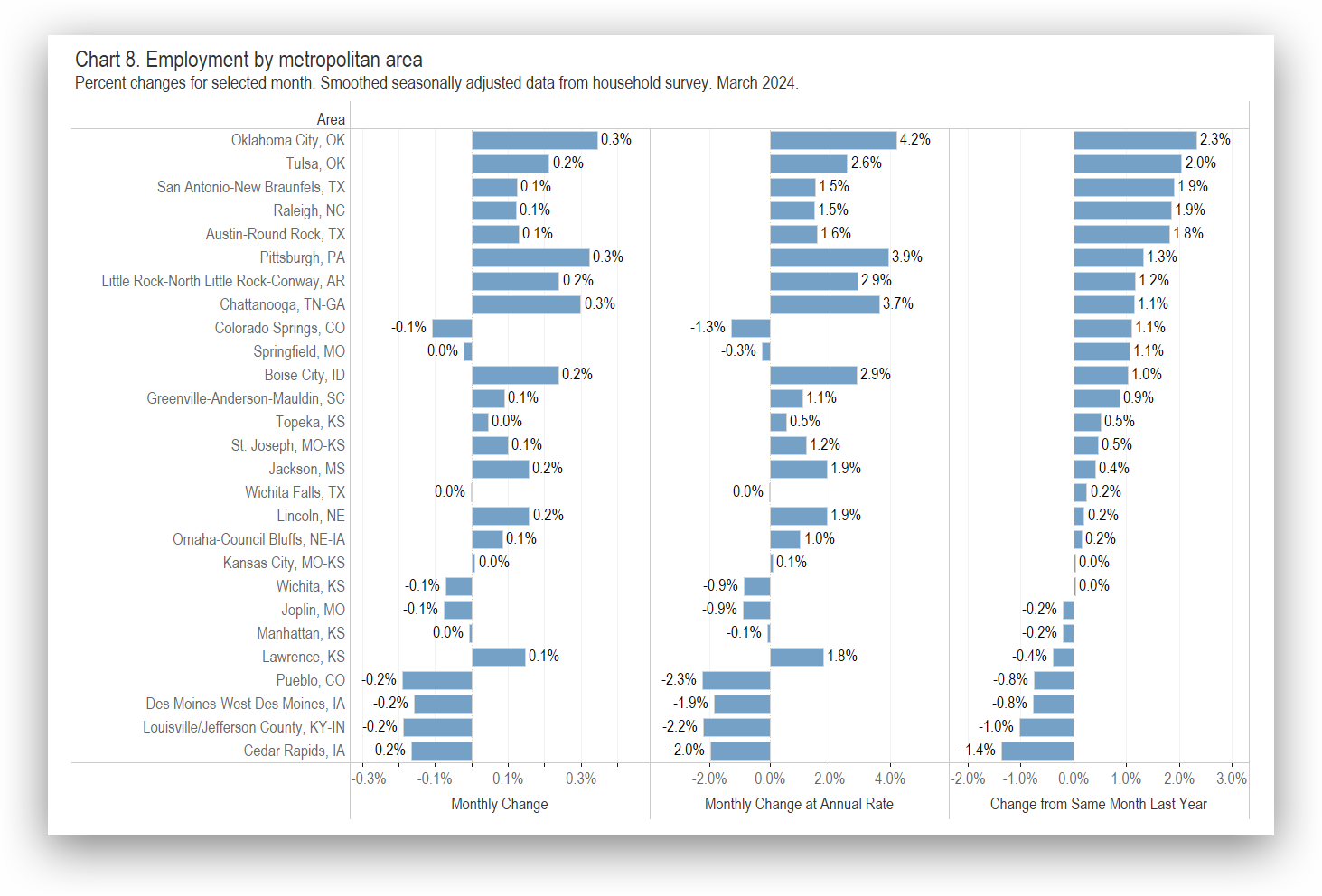

Wichita Employment Situation, March 2024

For the Wichita metropolitan area in March 2024, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers. (more…)