Tag: Center for Economic Development and Business Research

-

WichitaLiberty:TV: Wichita economy, Kansas schools

Karl Peterjohn and Bob Weeks discuss some statistics regarding downtown Wichita and then the Kansas school finance court decision.

-

Sales tax incentives yes, but no relief on grocery sales tax

Is it equitable for business firms to pay no sales tax, while low-income families pay sales tax on groceries?

-

Wichita Business Journal grants city council excess power

The Wichita Business Journal and the City of Wichita team to provide incorrect coverage and missing analysis.

-

More Cargill incentives from Wichita detailed

More, but likely not all, of the Cargill incentives will be before the Wichita City Council this week.

-

WichitaLiberty.TV: John Todd and Wichita issues

John Todd joins Bob Weeks and Karl Peterjohn to discuss issues involving the City of Wichita, including the future of Naftzger Park and economic development.

-

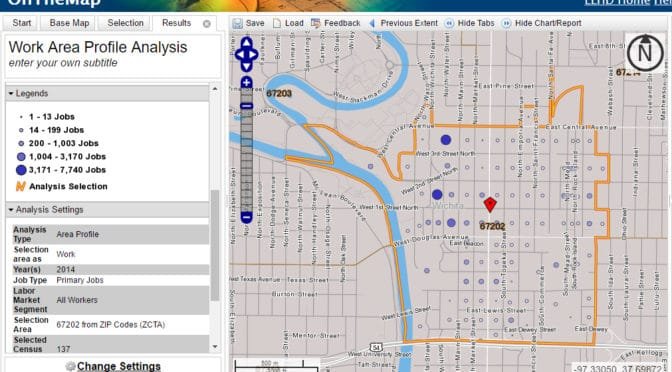

Coverage of Downtown Wichita workers

The Wichita Eagle’s coverage of the number of workers in Downtown Wichita isn’t fake news, just wrong news.

-

Census data for downtown Wichita workers

Is the presentation of the number of workers in downtown Wichita an innocent mistake, mere incompetence, or a willful lie?