-

Kansas school employment: Mainstream media notices

Read more: Kansas school employment: Mainstream media noticesWhen two liberal newspapers in Kansas notice and report the lies told by a Democratic candidate for governor, we know there’s a problem.

-

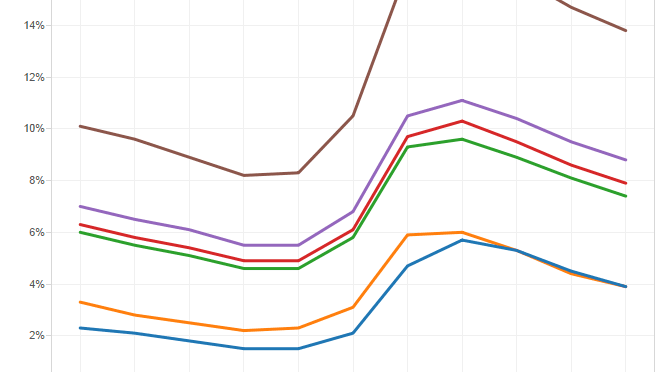

Alternative measures of unemployment

Read more: Alternative measures of unemploymentBesides the official unemployment rate that is the topic of news each month, the Bureau of Labor Statisticstracks and publishes five other series

-

Harry Reid takes money from companies under investigation for bribery law violations

Read more: Harry Reid takes money from companies under investigation for bribery law violationsSenate Majority Leader Harry Reid, D-Nev., has received campaign contributions from people and political action committees linked to multiple companies suspected of violating the Foreign Corrupt Practices Act.

-

Zoltan Kesz on collectivism and racism in Hungary

Read more: Zoltan Kesz on collectivism and racism in HungaryZoltan Kesz, founder of the Free Market Foundation in Hungary, speaks to a luncheon gathering at the Wichita, Kansas Pachyderm Club.

-

Rally for school choice in Kansas

Read more: Rally for school choice in KansasA grassroots coalition of educators, advocates, parents, and Kansans came together to make the case for school choice in the Kansas State Capitol on 11 February 2014.

-

Special interests defend wind subsidies at taxpayer cost

Read more: Special interests defend wind subsidies at taxpayer costThe spurious arguments made in support of the wind production tax credit shows just how difficult it is to replace cronyism with economic freedom.

-

Primary U.S. energy production by fuel source

Read more: Primary U.S. energy production by fuel sourcePrimary U.S. energy production by fuel source, an interactive visualization.

-

Energy subsidies for electricity production

Read more: Energy subsidies for electricity productionWhen comparing federal subsidies for the production of electricity, it’s important to look at the subsidy values in proportion to the amount of electricity generated, because the scales vary widely.

-

This is not parody: Koch Brother donates money to hospital, liberals protest

Read more: This is not parody: Koch Brother donates money to hospital, liberals protestThe donation was the largest in the hospital’s history, and will presumably create a fair number of new nursing jobs. So why are the usual suspects up in arms?