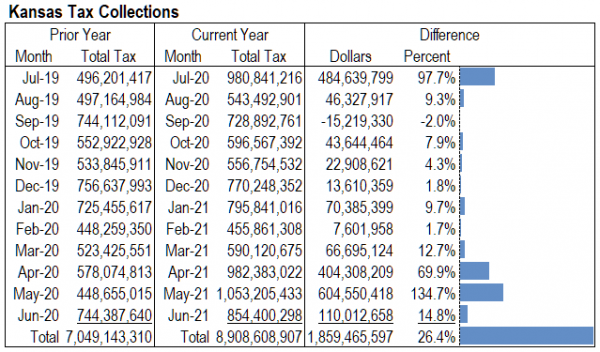

For June 2021, Kansas tax revenue was 14.8 percent greater than June 2020. Over the twelve months of the current fiscal year, revenue is 26.4 percent higher than at the same point of the previous year. There are important caveats to consider.

Tax reports from the State of Kansas for June 2021 show tax revenues falling from the previous month but higher than the same month the prior year. The decline from May was primarily due to May’s income tax deadline.

Fiscal year 2021 ends in June. Comparisons to fiscal year 2020 must consider that the tax deadline for 2020 changed from April to July. That shifted a large amount of revenue from fiscal years 2020 to 2021. The tax deadline for 2021 changed from April to May. This shift doesn’t affect revenue analysis for fiscal years, as the two months are in the same fiscal year. But that is not so for fiscal year 2020.

Also, after more than one year of pandemic, we know how it affected tax collections.

When reporting on Kansas tax collections, comparison is usually to the estimated tax collections. Those estimates are revised based on economic conditions affected by the response to the pandemic. To get a feel for the effects of the response to the pandemic, we should compare to the same month the prior year. But with shifting tax deadlines, these comparisons are difficult.

(The estimated revenue figures are still important because the state bases the budget on them. If the actual revenue is much below the estimated revenue, there may not be enough income to pay expenses.)

For June 2021, individual income tax collections were $372.7 million, up by 5.5 percent from the prior June. Retail sales tax collections rose by 10.5 percent to $224.2 million from June 2020. Total tax collections were $854.4 million, up 14.8 percent from June 2020. A nearby table summarizes. (Click charts and tables for larger versions.)

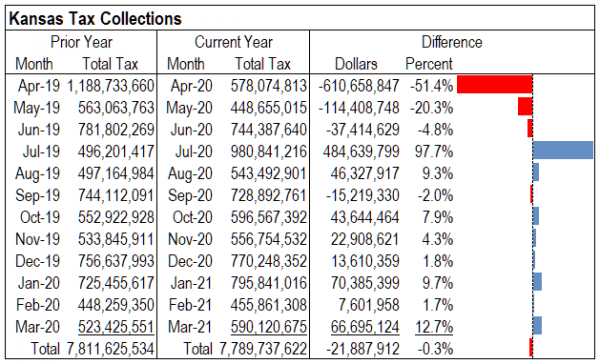

As can be seen in a nearby table, tax revenue for the full fiscal year 2021 is $1,859.5 million greater than the previous fiscal year. Of this, about $1,252.1 million is due to the shifting of individual income tax due dates.

Since the pandemic

The response to the pandemic started in March 2020. We have more than 12 months of pandemic-affected tax collection data. How does this period compare with the same period one year prior? This is an important question.

A nearby table shows tax collections for two periods of twelve months ending in March 2020 and March 2021. We can easily see the effect of shifting the tax due date from April 2020 to July 2020. Over each period, however, tax collections were nearly the same. The difference of $21.9 million is 0.28 percent. That is the effect of the pandemic on Kansas tax collections for one year.

I’ve also prepared a similar table, but for years ending in June, which means the table holds full fiscal years. For fiscal year 2021, tax revenue is $1,859.5 (26.4 percent) greater than the previous fiscal year. But we must remember that the current period contains two income tax deadlines for two tax years, which is not the norm. In her press release on the April collections, Kansas Governor Laura Kelly noted the significant increase (69.9 percent) over last April: “This increase is due, in part, to businesses having opened back up compared to the same month last year.” While true, this is quite an understatement. The change in income tax deadlines had a far more significant effect, perhaps four times as large.

My interactive visualization of Kansas tax revenue has been updated with this data. Click here to use it.

The governor’s press release for this data is at Kansas’ Total Revenue Receipts Outperform Estimates by $157.4 Million for June. The report from Kansas Legislative Research Department is available on this page.