Kansas state government tax collections fell to $3,315 per person in 2020, a decrease of 4.9 percent from 2019.

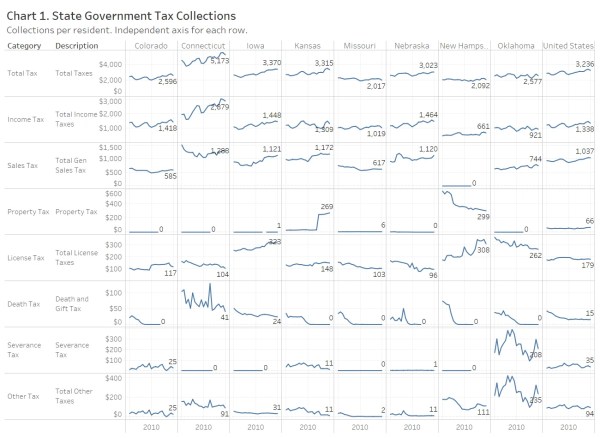

Each year the United States Census Bureau collects a summary of taxes collected by each state for 5 broad tax categories and up to 25 tax subcategories. (1)United States Census Bureau. Annual Survey of State Government Tax Collections (STC). Available at https://www.census.gov/programs-surveys/stc.html. I’ve collected this data and made it available in an interactive visualization. Data is through 2020.

Nationally, tax collections by state governments fell by 4.0 percent in 2020 from the prior year as the pandemic affected state economies. The decline in Kansas was greater, at 4.9 percent.

Kansas collects more taxes per resident than our surrounding states. For 2020, Kansas collected $3,315 in taxes per resident. Colorado collected $2,596, Nebraska $3,023, Missouri $2,017, and Oklahoma $2,577. Kansas slightly trailed Iowa, at $3,370.

Click here to learn more about the data and access the visualization.

Click images for larger versions.

In the following chart showing total tax collections per person over time, Kansas now collects more than our surrounding states.

This chart shows individual income tax collections only, with Kansas highlighted. The wide swings over the past decade are evident.

References

| ↑1 | United States Census Bureau. Annual Survey of State Government Tax Collections (STC). Available at https://www.census.gov/programs-surveys/stc.html. |

|---|