Category: Kansas state government

-

Kansas Center for Economic Growth

Kansas Center for Economic Growth, often cited as an authority by Kansas news media and politicians, is not the independent and unbiased source it claims to be.

-

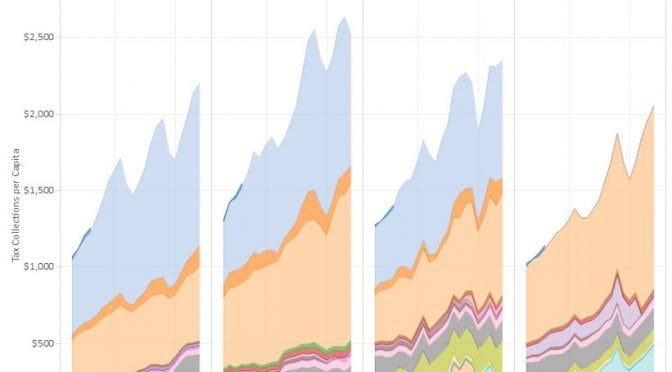

Kansas state tax collections, compared

An interactive visualization of tax collections by state governments shows Kansas distinguished from some of its neighbors.

-

In Wichita, revealing discussion of property rights

Reaction to the veto of a bill in Kansas reveals the instincts of many government officials, which is to grab more power whenever possible.

-

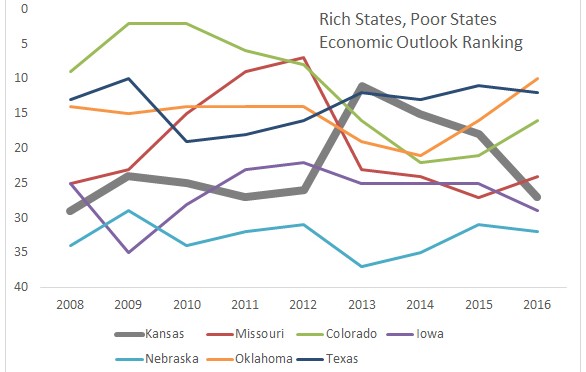

Rich States, Poor States, 2106 edition

In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell sharply in the forward-looking forecast.

-

Governor Brownback steps up for property rights

Senate Bill 338 opens the door for serious abuse in Kansas. Governmental authority to take property from one private citizen and give it to another private citizen should be limited, but this bill would have the effect of expanding such authority without adequate safeguards, wrote Kansas Governor Sam Brownback in his veto message.

-

Kansas support for higher education

How does Kansas state support for higher education compare to other states?

-

Opinion: GOP economics devastated Kansas

An op-ed on the Kansas economy needs context and correction.

-

Governor Brownback, please veto this harmful bill

Kansas Governor Sam Brownback should veto a bill that is harmful to property rights, writes John Todd.

-

Sales tax revenue and the Kansas highway fund

The effect of a proposed bill to end transfer of Kansas sales tax revenue to the highway fund is distorted by promoters of taxation and spending.

-

Kansas and Colorado, compared

News that a Wichita-based company is moving to Colorado sparked a round of Kansas-bashing, most not based on facts.

-

Math quiz on Kansas spending

The average Kansan is misinformed regarding Kansas school spending, and Kansas news media are to blame, writes Paul Waggoner of Hutchinson

-

Kansas Supreme Court judicial selection

Kansas progressives and Democrats oppose a judicial selection system that is used by U.S. Presidents, both Democrats and Republicans.