Category: Kansas state government

-

Wichita State University degraded, says ad

A full-page advertisement critical of the leadership of Wichita State University, from “Friends of the University,” appearing in the Wichita Eagle, Sunday April 15, 2018.

-

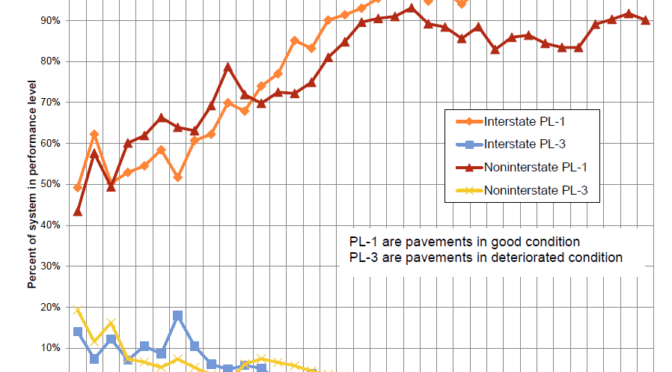

Kansas highways set to crumble, foresees former budget director

Duane Goossen, former high Kansas government official, says the state’s highways are in trouble. What is his evidence?

-

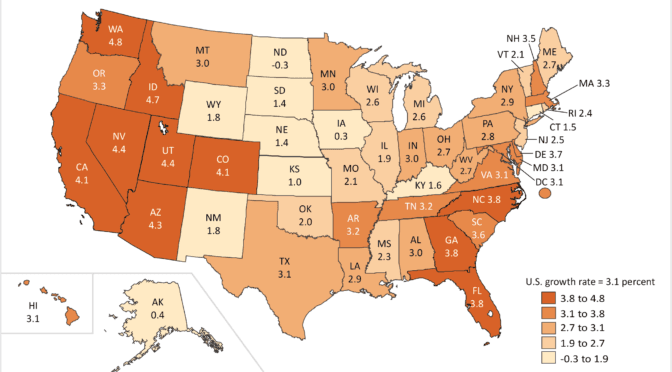

Kansas personal income

Personal income in Kansas rose in 2017 at a rate one-third that of the nation.

-

Kansas government data may not be available

There is a movement to increase the transparency of government in Kansas, but there’s much to be done, starting with attitudes.

-

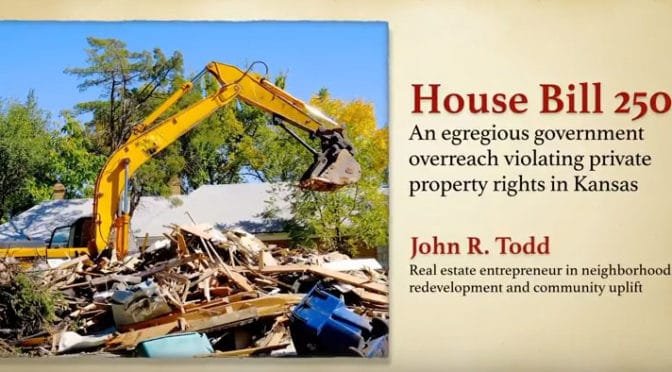

Property under attack in Kansas

Local governments in Kansas are again seeking expanded power to seize property.

-

What Was Really the Matter with the Kansas Tax Plan

Tax relief opponents have repeatedly pointed to the 2012 Kansas tax plan as their primary example of why tax cuts do not work. But, other states like North Carolina, Indiana, and Tennessee contemporaneously, and successfully, cut taxes. What was different about the Kansas experience?

-

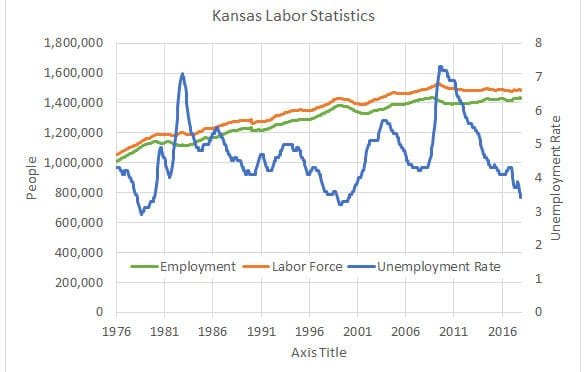

Unemployment in Kansas

New Kansas Governor Jeff Colyer proudly cites the low Kansas unemployment rate, but there is more to the story.

-

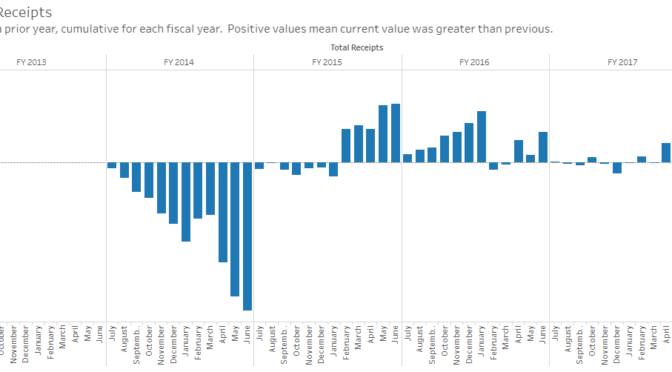

Kansas tax receipts

News about Kansas tax receipts for November 2017, along with an interactive visualization.

-

PEAK benefits across Kansas

The use of PEAK, a Kansas economic development incentive program, varies widely among counties.

-

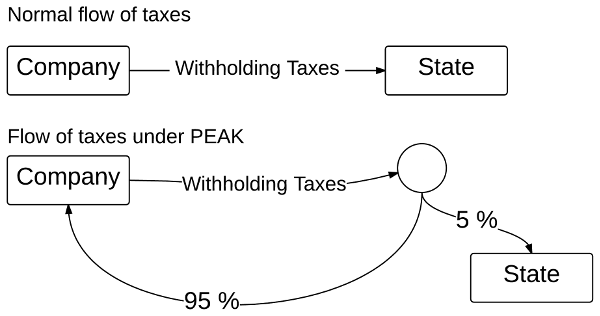

PEAK, or Promoting Employment Across Kansas

PEAK, a Kansas economic development incentive program, redirects employee income taxes back to the employing company.

-

From Pachyderm: Kansas Senate President Susan Wagle

Kansas Senate President Susan Wagle addressed members and guests of the Wichita Pachyderm Club on November 10, 2017. School finance and the Kansas Supreme Court was a prominent topic.

-

Kansas hotel tax collections

Kansas hotel guest tax collections presented in an interactive visualization.