For the Wichita metropolitan area in June 2021, the number of unemployed persons is down, the unemployment rate is down, and the number of people working is up when compared to the same month one year ago. The recent trend is showing smaller changes. (more…)

Category: Economics

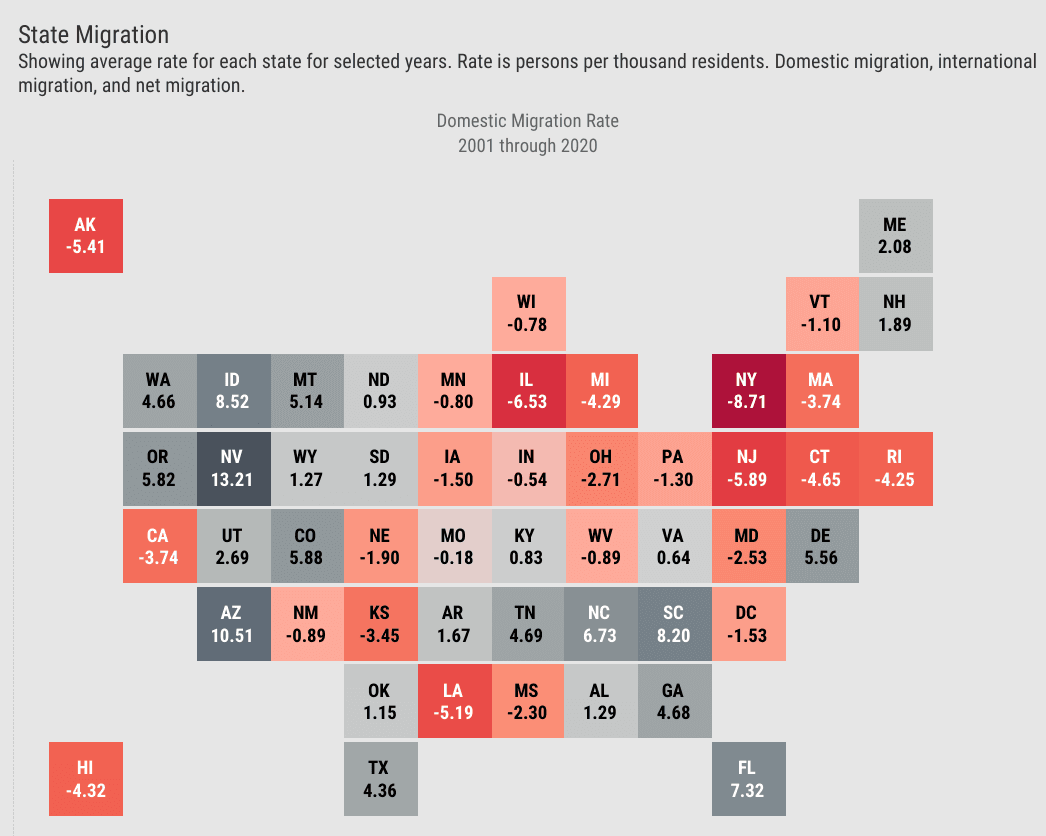

Migration trends in Kansas

New U.S. Census Bureau data shows that Kansas continues to have low rates of domestic migration, with more people moving from Kansas than moving to the state. (more…)

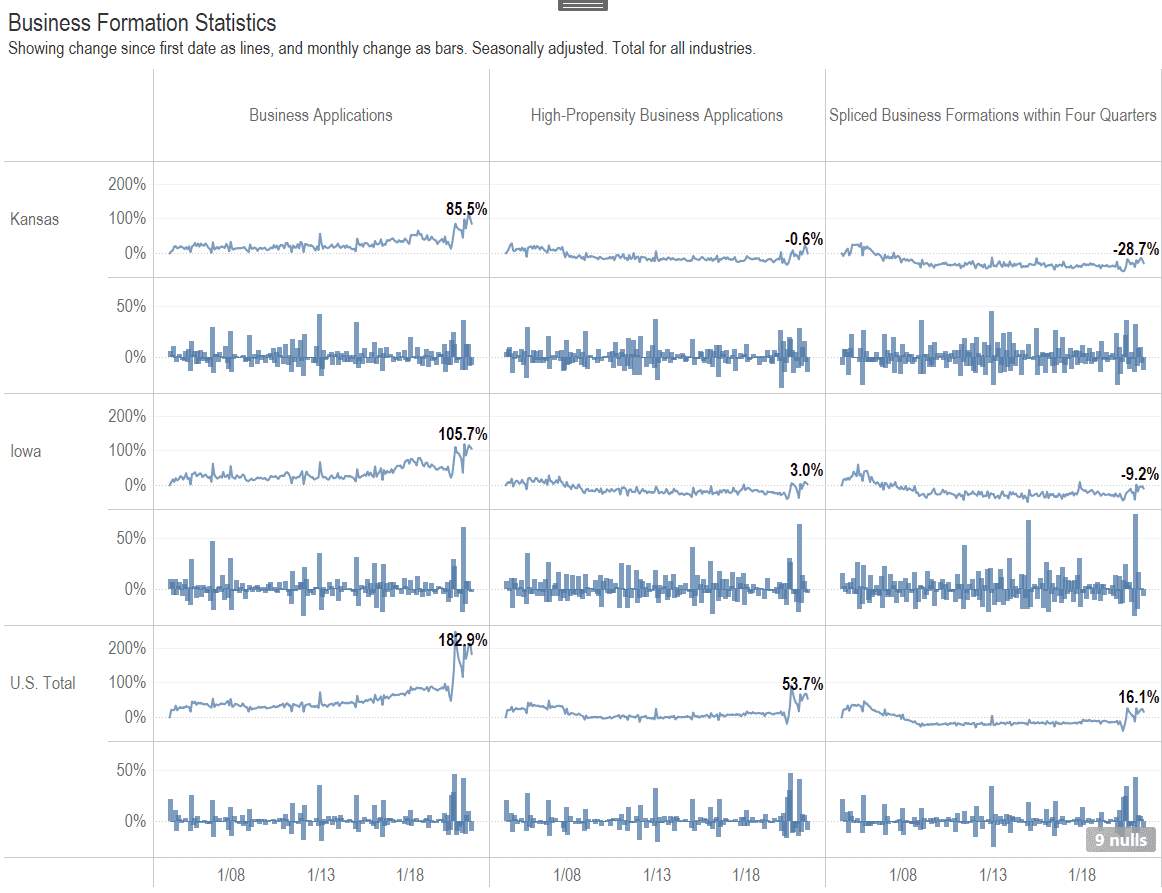

Business Formation in Kansas

For both business applications and business formations, Kansas is growing slowly compared to other states. (more…)

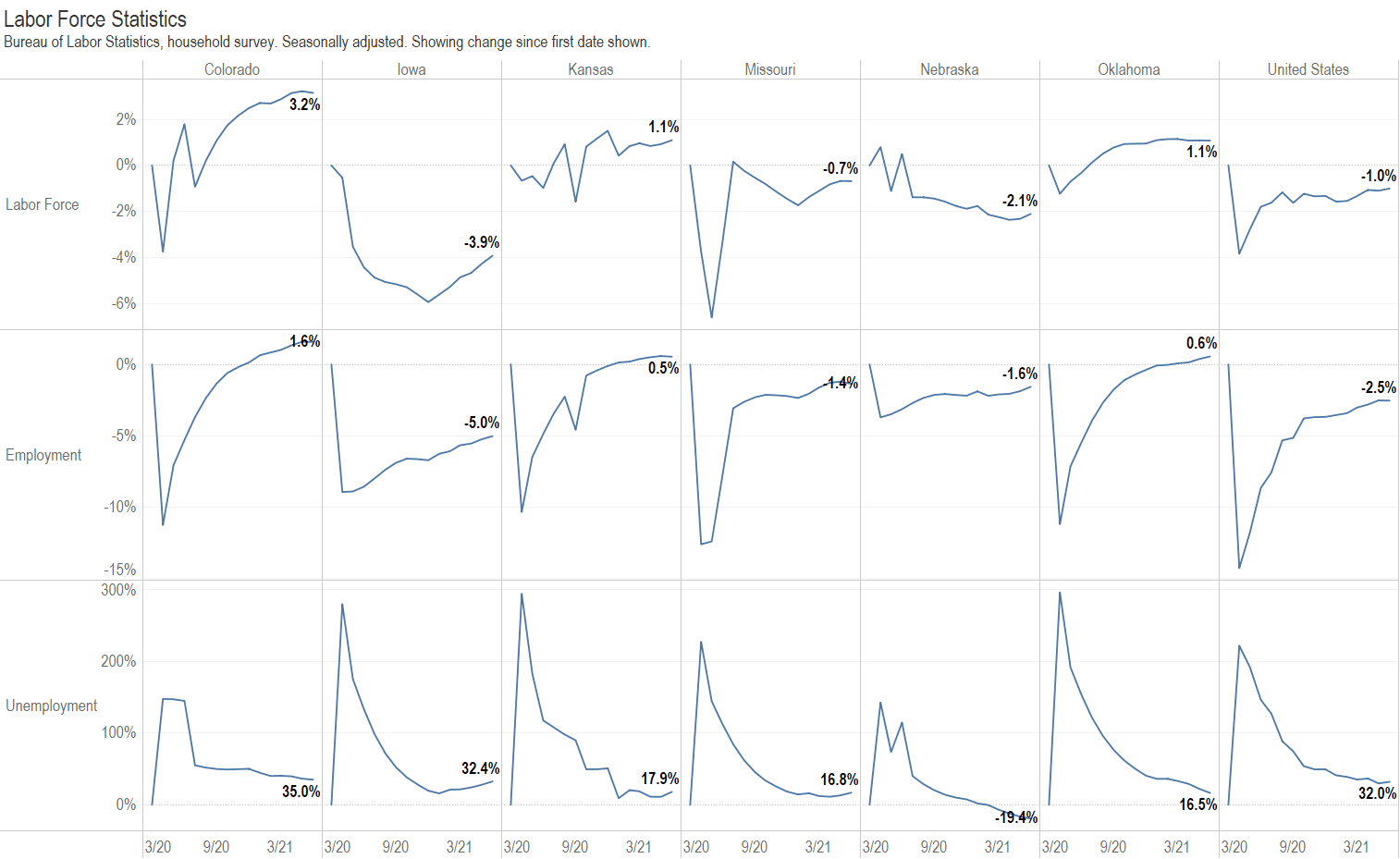

Kansas since the start of the pandemic

How has Kansas fared since the start of the pandemic compared to other states and the nation? Updated through June 2021. (more…)

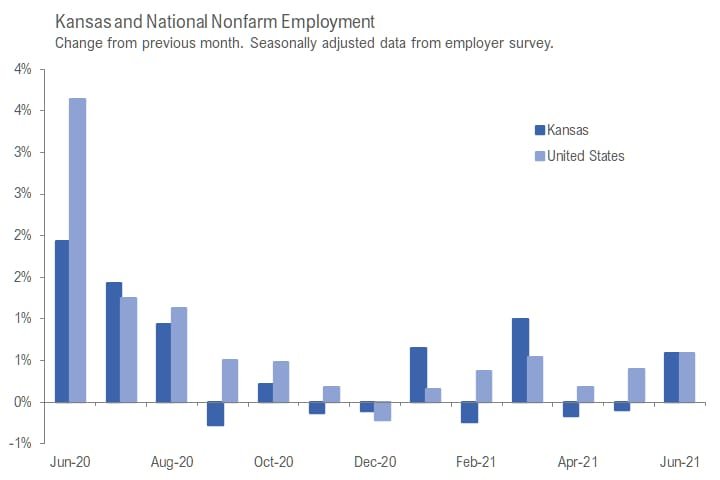

Kansas employment situation, June 2021

In Kansas for June 2021, the labor force rose, the number of people working rose, and the unemployment rate rose, all compared to the previous month. (more…)

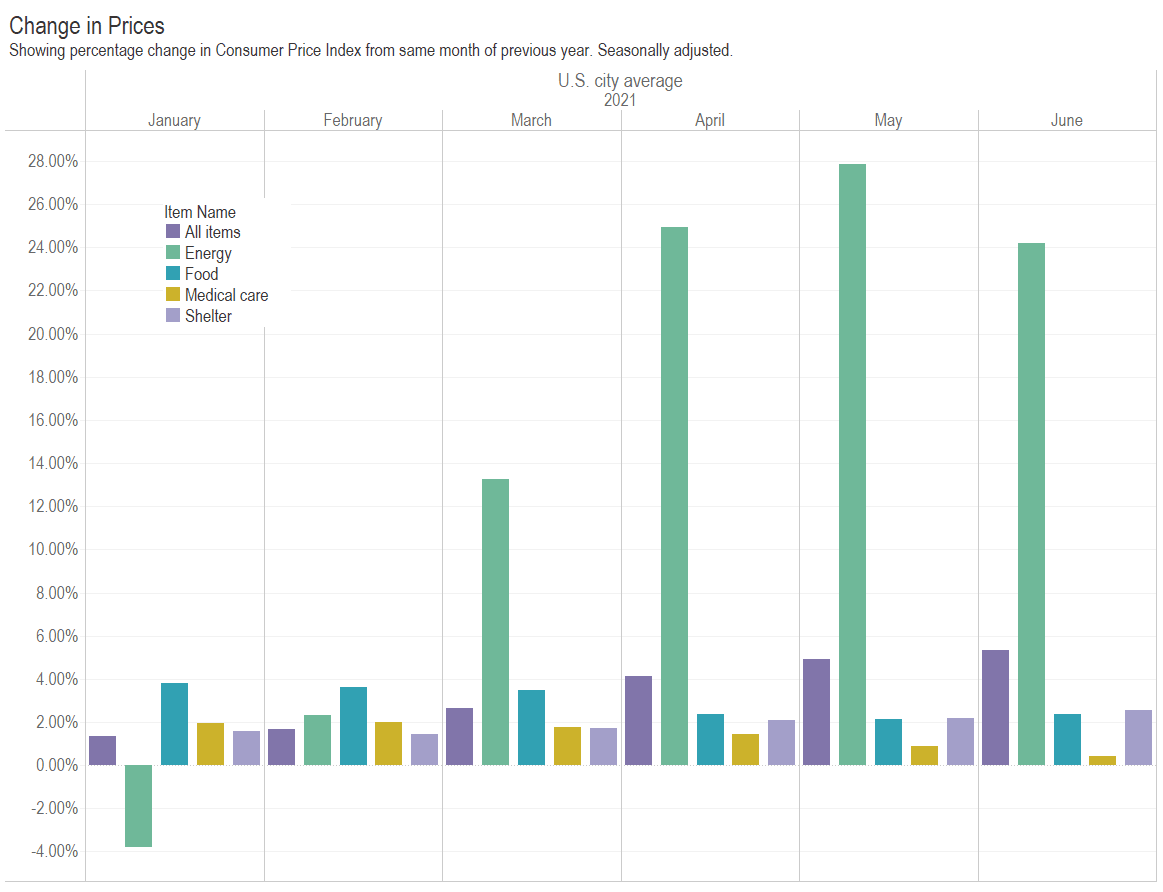

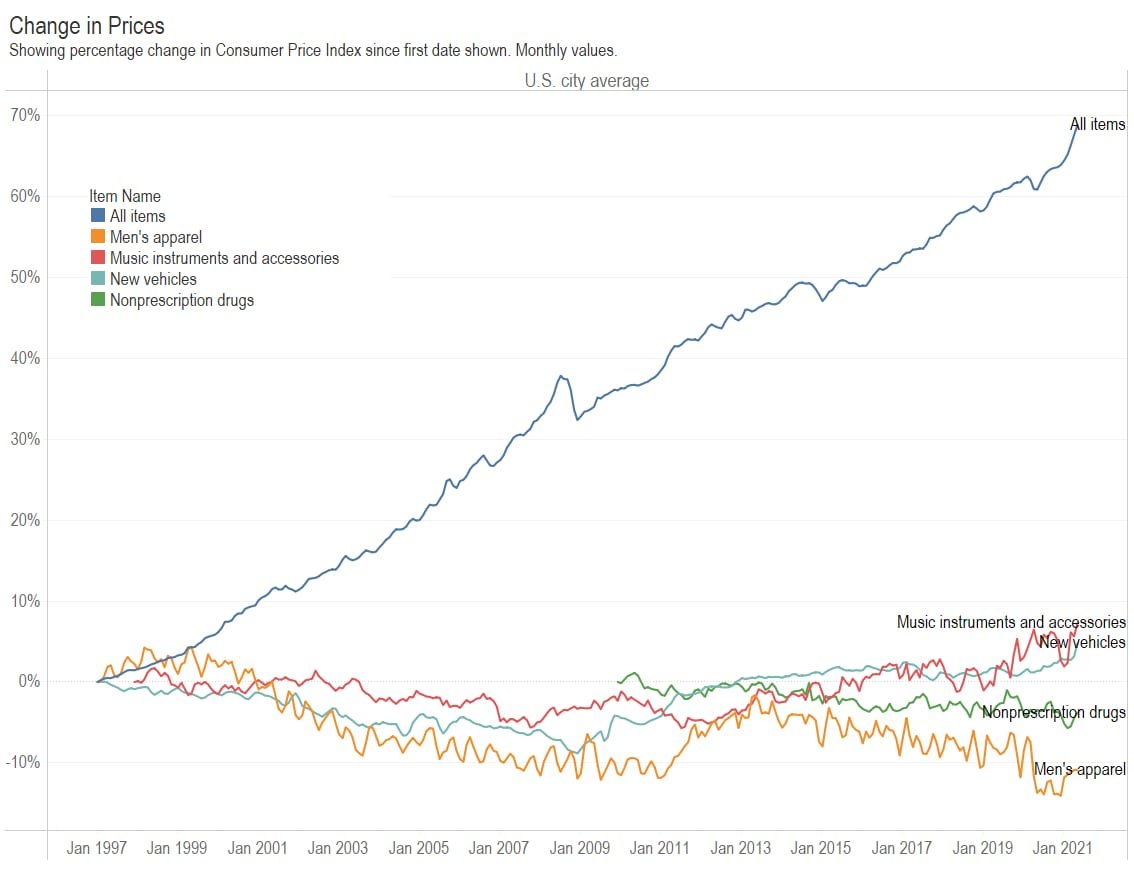

Inflation jumps in June 2021

In June 2021, inflation rose faster than at any time since 2008.

As measured by the Consumer Price Index, inflation jumped in June. (more…)

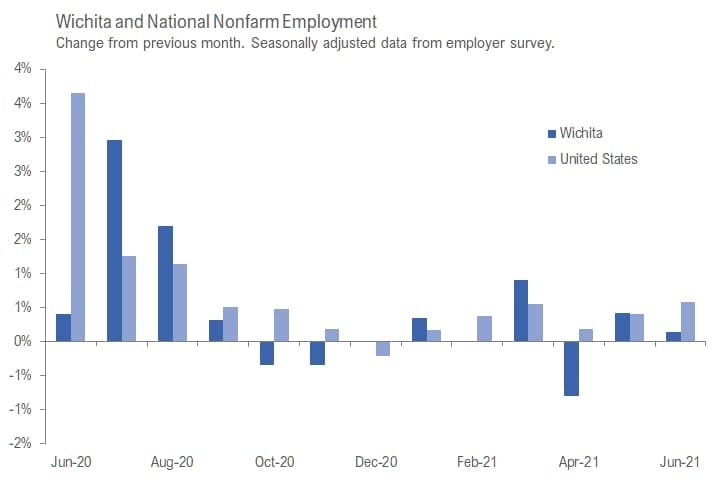

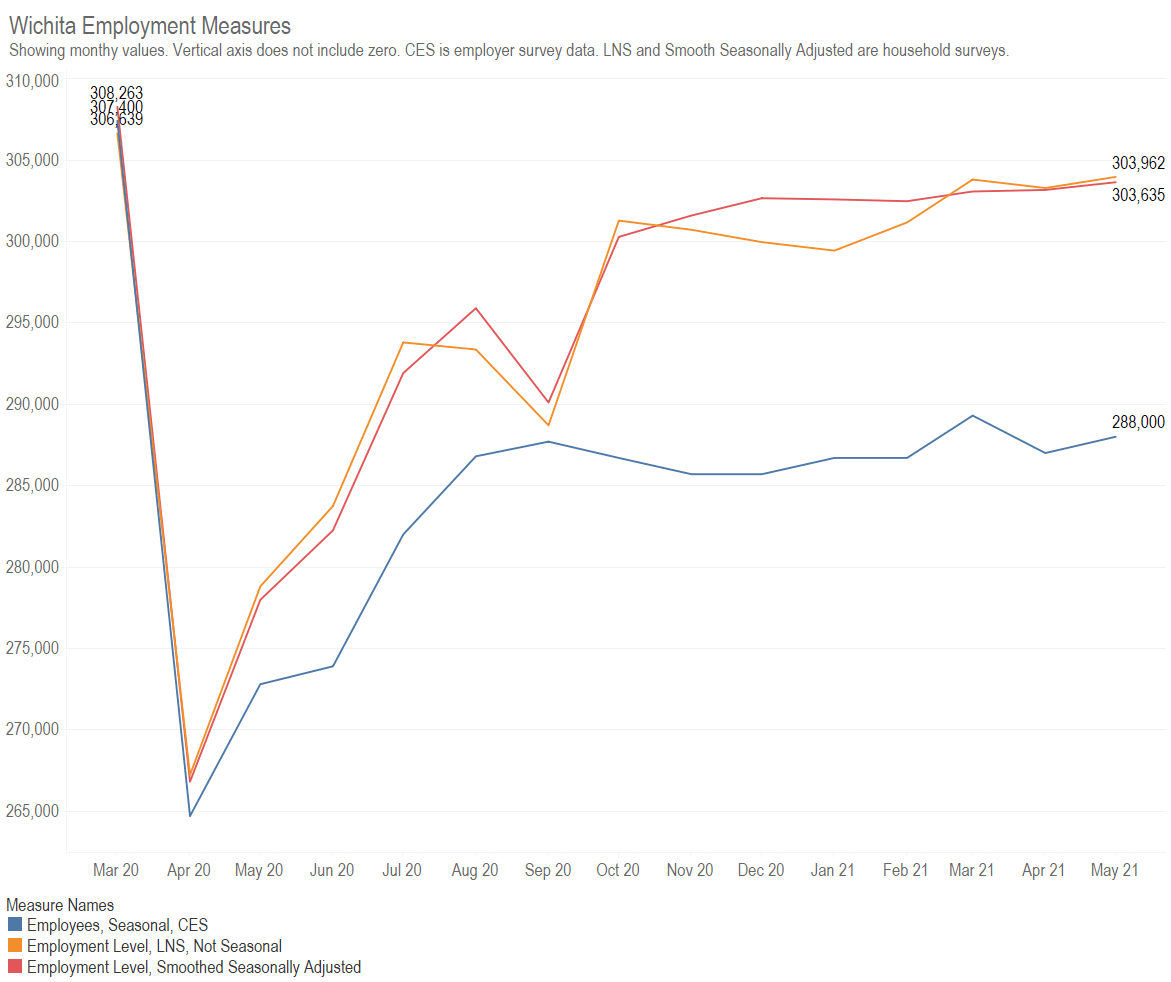

Counting jobs in Wichita

Since the start of the pandemic, has the employment situation in Wichita bounced back?

There is more than one way to evaluate jobs and employment. Depending on the method, the Wichita Metropolitan Statistical Area has either nearly recovered from the pandemic or is still behind. (more…)

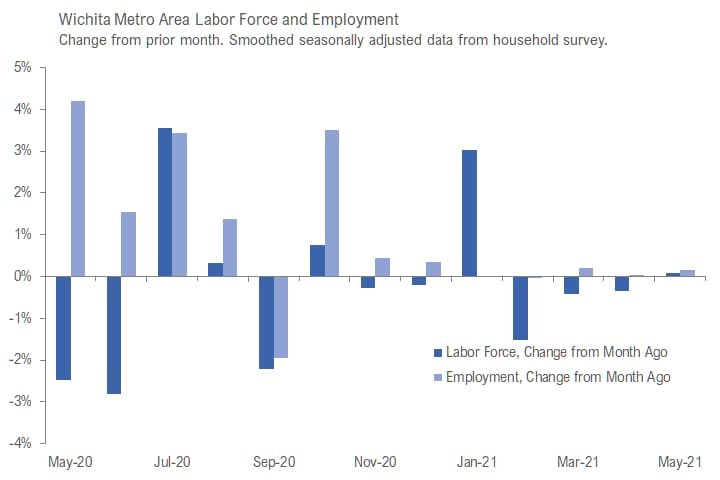

Wichita employment situation, May 2021

For the Wichita metropolitan area in May 2021, the number of unemployed persons is down, the unemployment rate is down, and the number of people working is up when compared to the same month one year ago. The recent trend is exhibiting only small changes. (more…)

Prices generally rise, but not all

While the price level as measured by the Consumer Price Index generally increases when considering all items, individual items may take different paths. (more…)