Author: Bob Weeks

-

Wichita Employment Situation, January 2024

For the Wichita metropolitan area in January 2024, most employment indicators declined slightly from the prior month, and the unemployment rate did not change. Wichita continues to perform poorly compared to its peers.

-

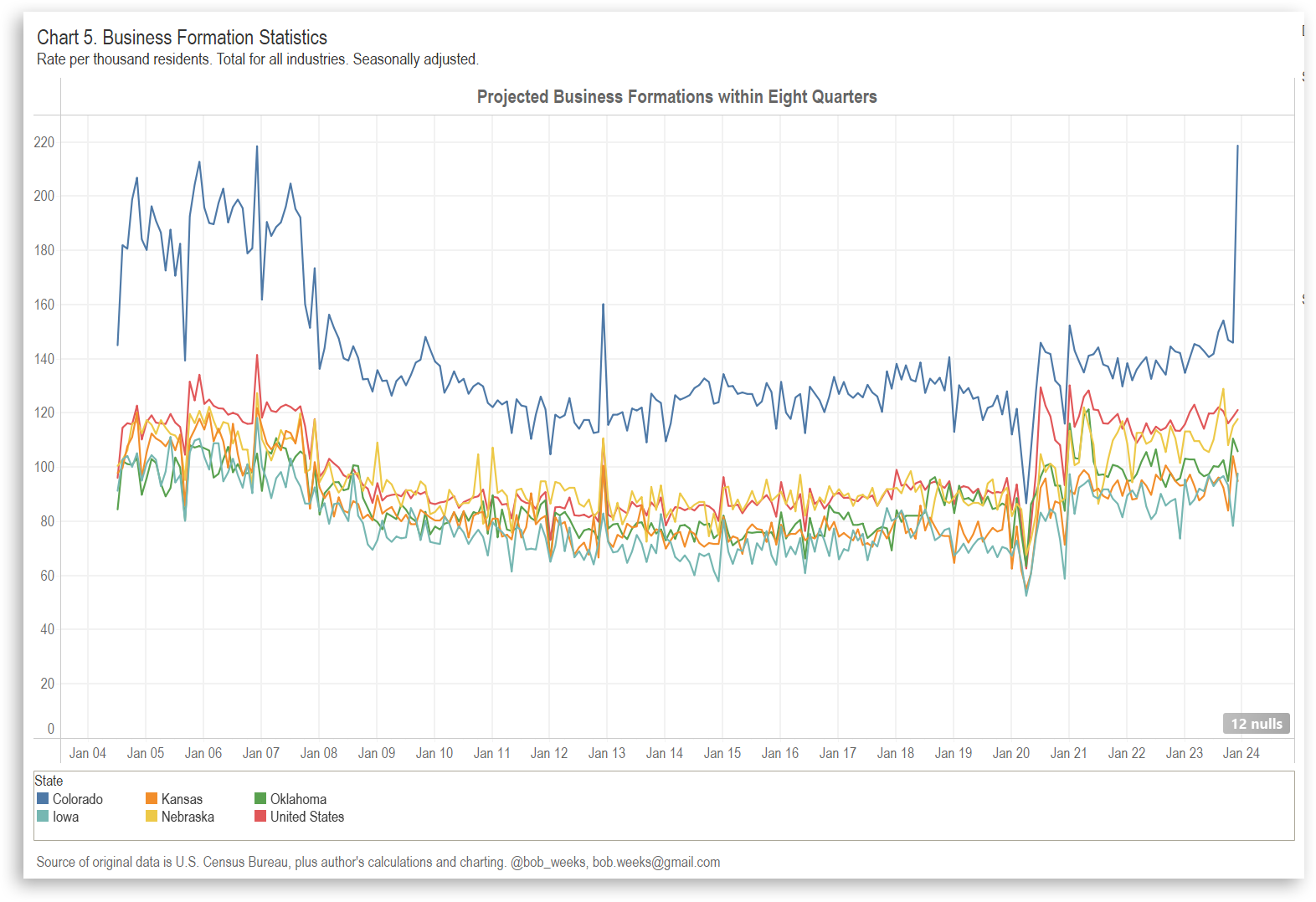

Business Formation in States

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.

-

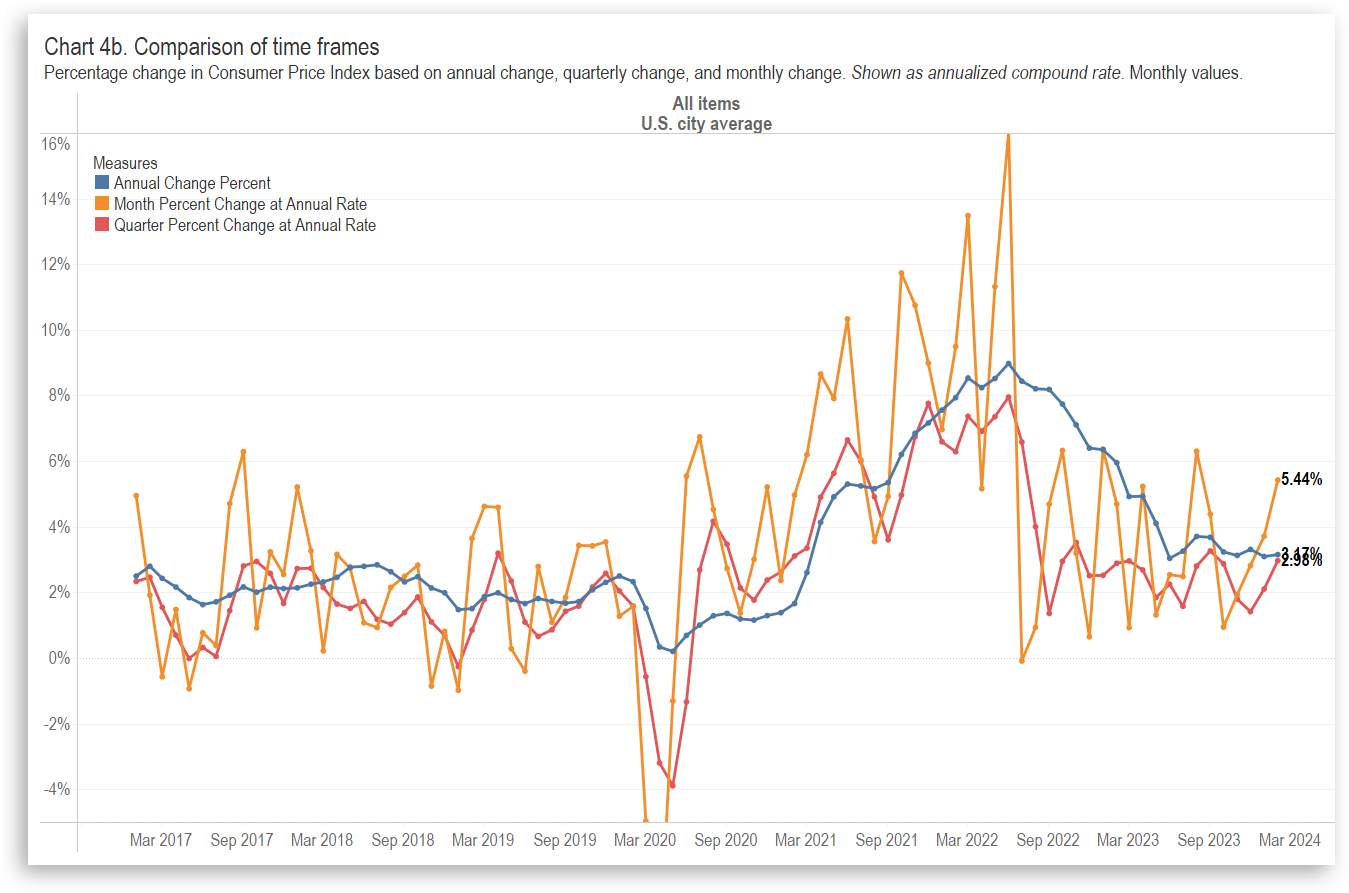

Consumer Price Index, February 2024

Looking at inflation calculations in a different way.

-

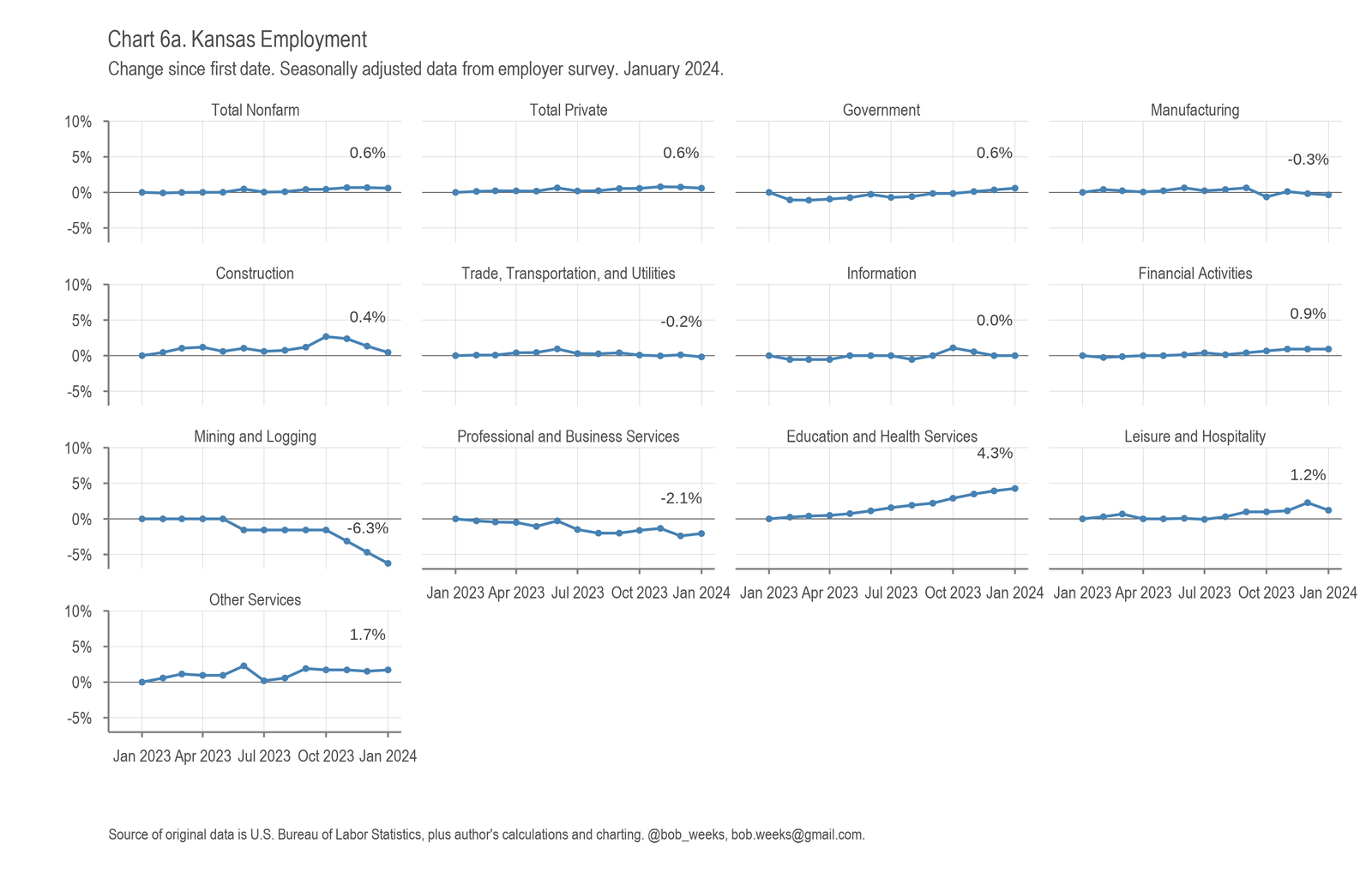

Kansas Employment Situation, January 2024

In Kansas in January 2024, the labor force fell, the number of jobs fell, and the unemployment rate was unchanged compared to the previous month. Over the year, Kansas is near the bottom of states in job growth.

-

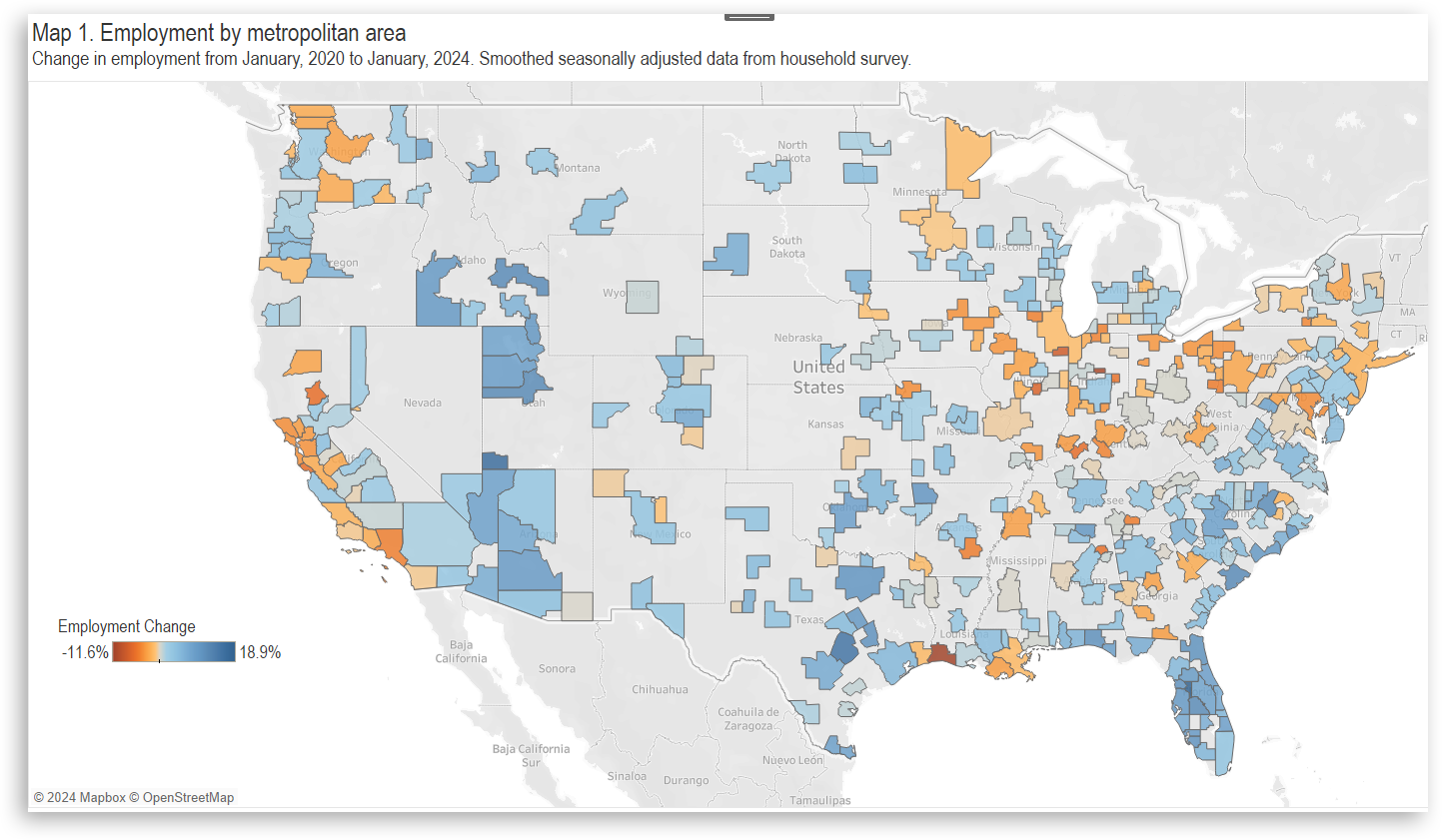

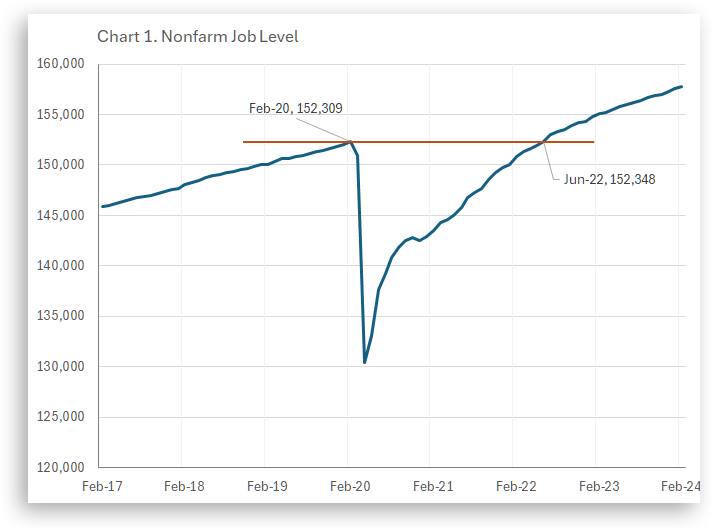

Employment, pre- and post-Covid

Comparing job growth before and after the Covid pandemic, attempting to remove the effect of the pandemic.

-

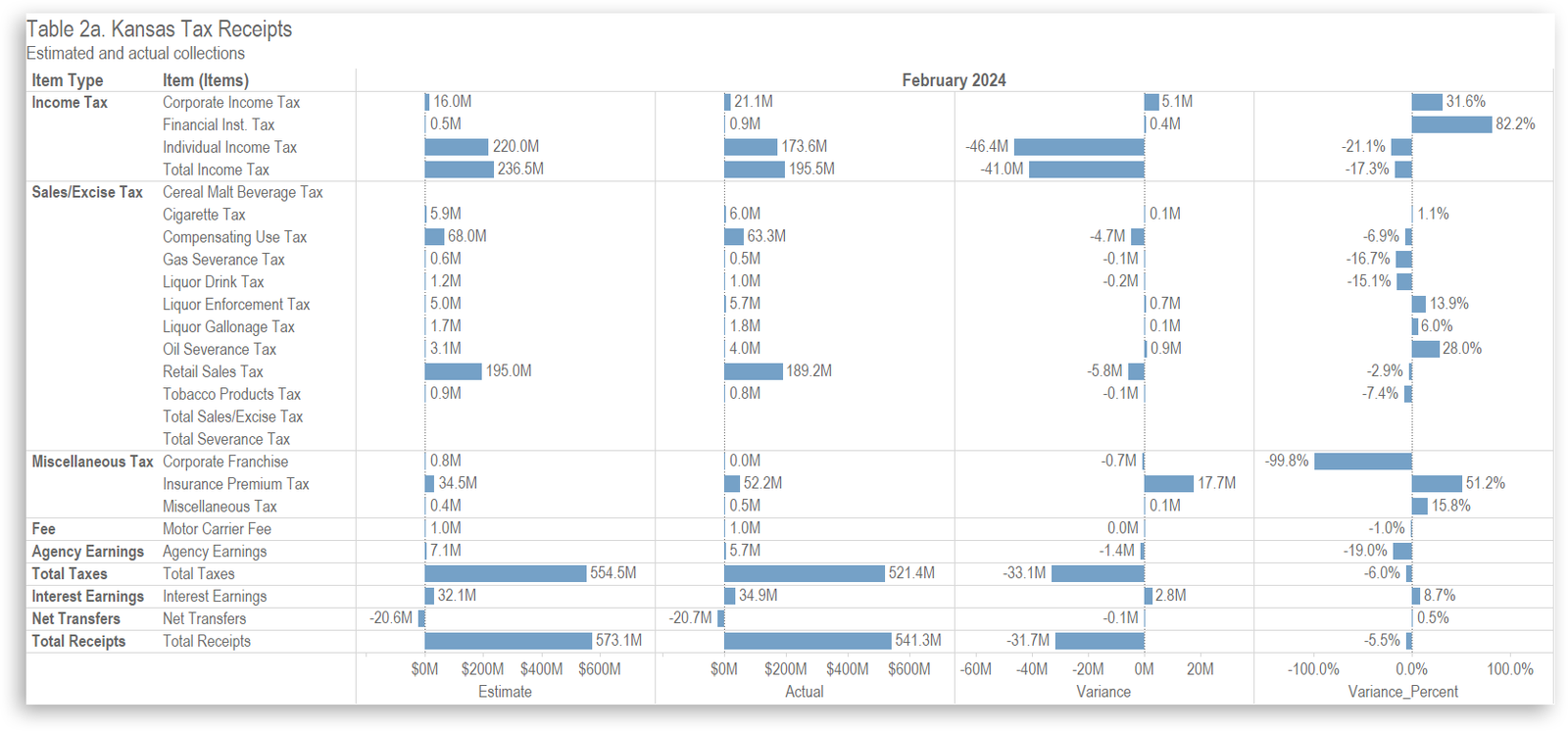

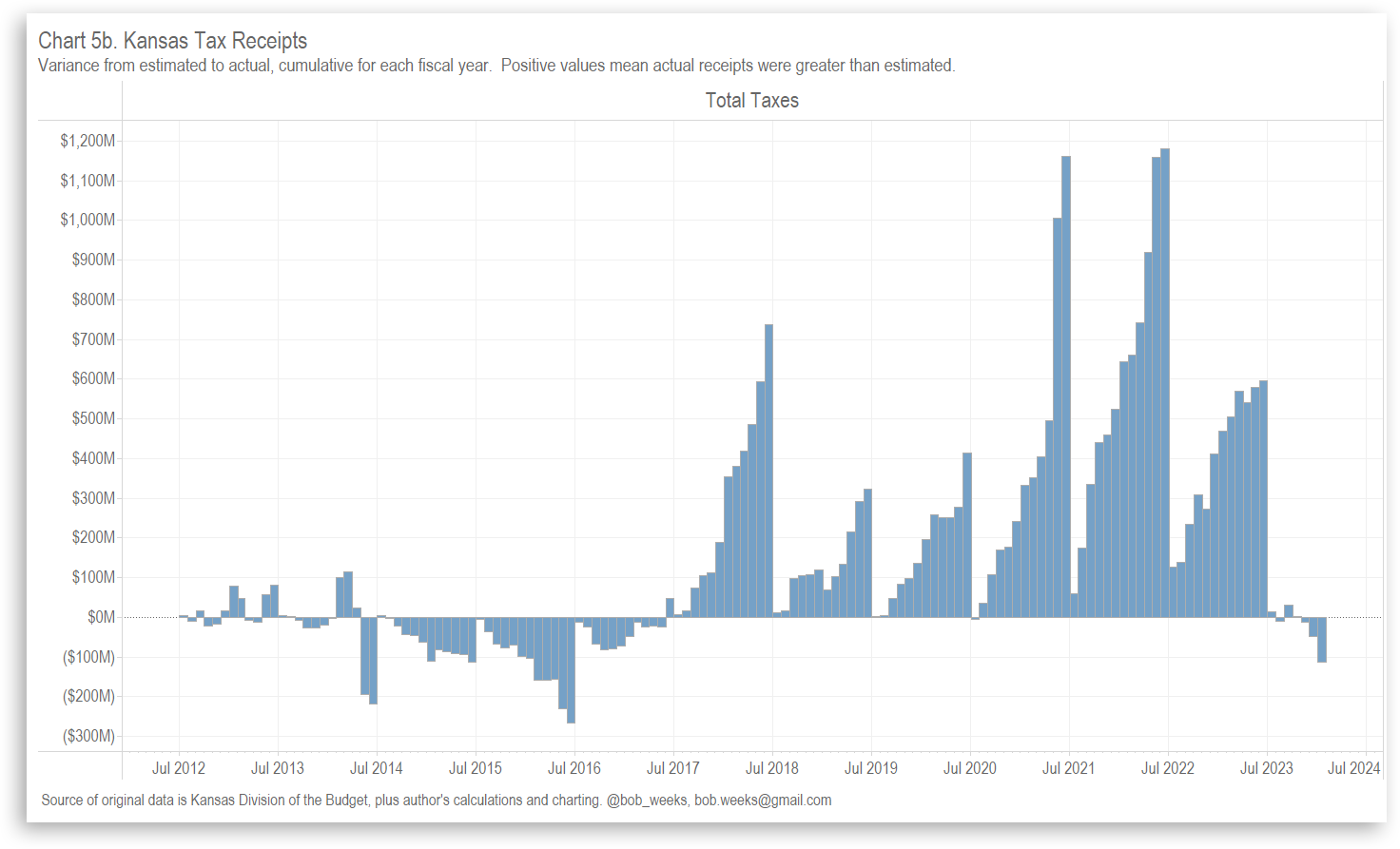

Kansas Tax Revenue, February 2024

For February 2024, Kansas tax revenue was 5.2 percent lower than February 2023, and 6.0 percent lower than estimated.

-

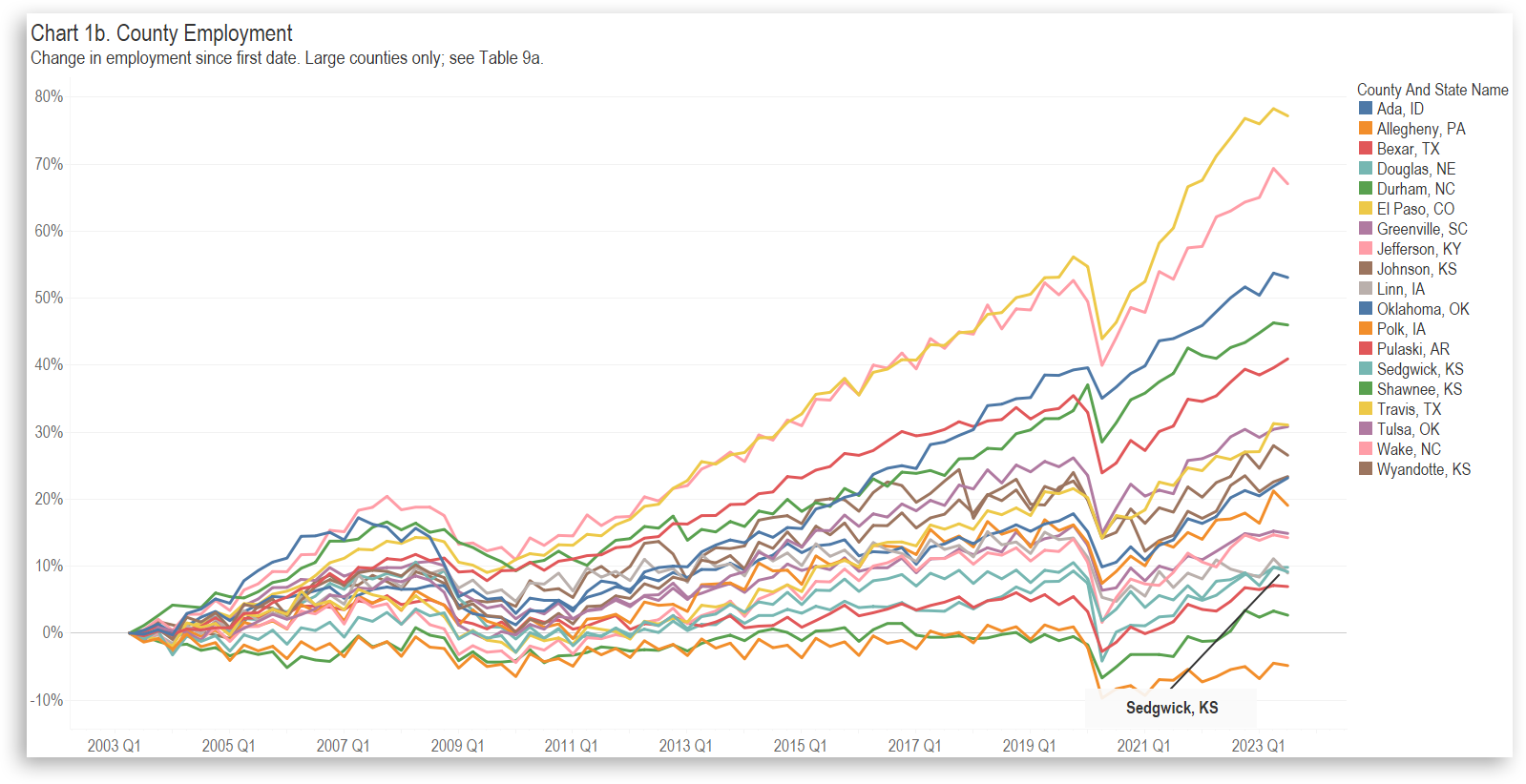

Large County Employment, Third Quarter 2023

Employment in large counties, including Sedgwick County and others of interest.

-

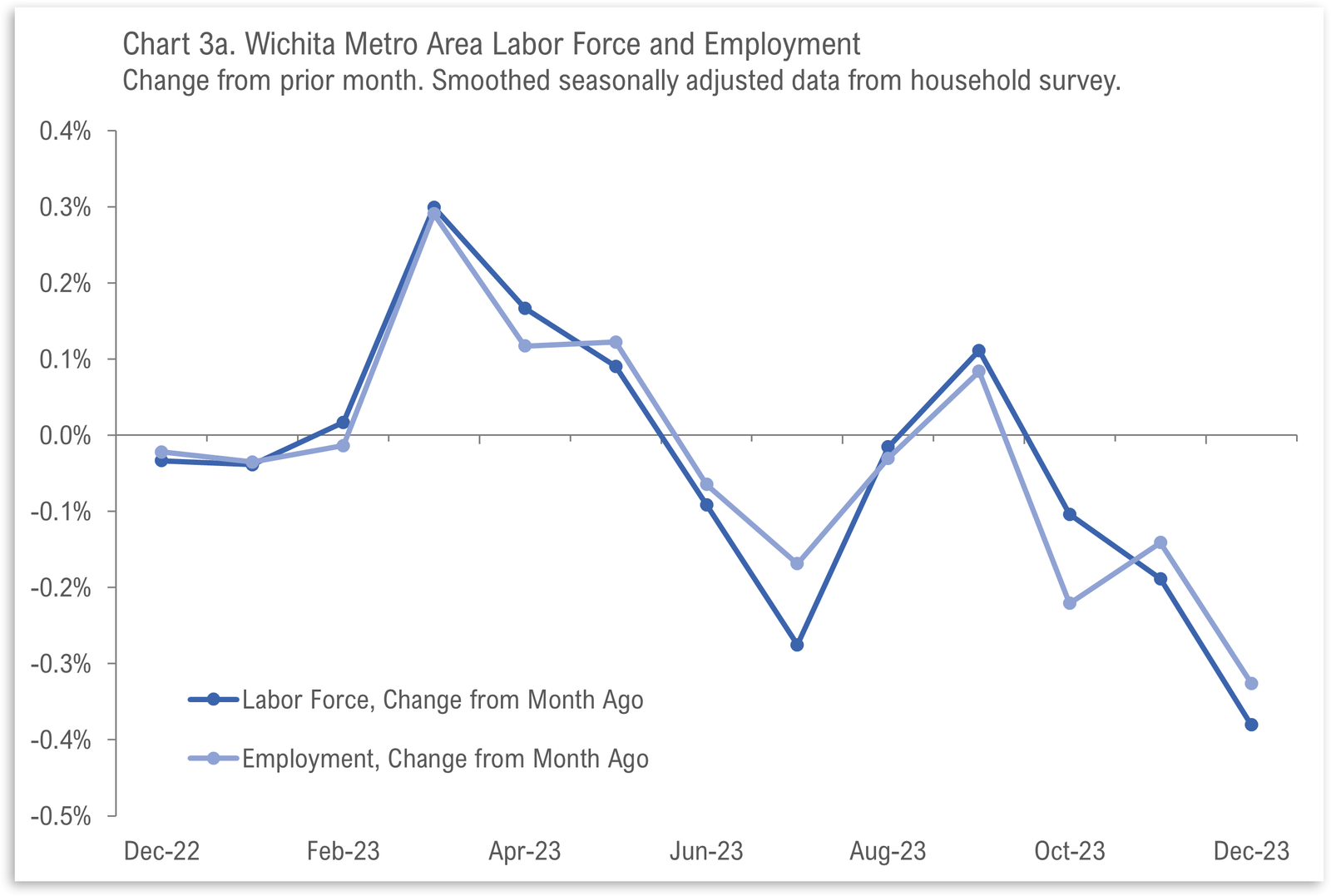

Wichita Employment Situation, December 2023

For the Wichita metropolitan area in December 2023, major employment indicators declined from the prior month, and the unemployment rate also fell. Wichita continues to perform poorly compared to its peers.

-

Kansas Tax Revenue, January 2024

For January 2024, Kansas tax revenue was 11.3 percent lower than January 2023, and 6.5 percent lower than estimated.