Another Kansas legislator explains why raising taxes was necessary. So he says.

Many members of the Kansas Legislature are writing pieces defending their decision to vote for higher taxes. Don Hineman is one. His explanation merits more than average attention, as he is the Majority Leader of the Kansas House of Representatives. This week the Topeka Capital-Journal published his op-ed Rep. Don Hineman: Why tax reform was necessary. It deserves comment.

Hineman wrote: “This return to common sense tax policy resulted from legislators listening to their constituents and fulfilling the promises they made during 2016 campaigns.”

There may have been some candidates who campaigned on a platform of higher taxes. But most used more subtle language, such as Hineman’s use of the phrase “common-sense tax policy.” Does anyone know what that means? Does it mean the same thing to everyone? Besides, raising taxes was just one issue for most candidates and campaigns. And, voters must vote for candidates, not specific policies. As Justice Antonin Scalia told us, “Campaign promises are, by long democratic tradition, the least binding form of human commitment.” An example comes from Hineman’s web page, which states one of his four core values is “Respect for private property rights.” He has respect for your property, unless that property happens to be your money. Then he wants more.

Hineman: “… restore our state to firmer fiscal ground.”

This could have been done with spending cuts, too.

Hineman: “… a group of 88 representatives and 27 senators from across the political spectrum voted to override the governor’s veto.”

Here, Hineman refers to the coalition of Republicans and Democrats that passed the tax bill notwithstanding the governor’s veto. Because members of both major parties voted the same way, it’s described as nonpartisan. It’s meant as a good thing. But most of the Republicans who voted for higher taxes qualify as Democrats in many ways. They dismiss the Republican Party platform and embrace most aspects of the Democratic Party and progressive goals. There is no “spectrum.” Regarding taxation and the size of government, they’re pretty much the same color. Kansas Policy Institute confirms: “The Freedom Index published by Kansas Policy Institute has repeatedly shown the legislative political division to not be about Democrats and Republicans but about legislators’ view of the role of government, and the above June 2 update of 2017 Freedom Index certainly bears that out. With a score of 50 percent being considered neutral, there are 13 Senators at the top of the list with positive scores and 13 Senators at the bottom of the list — and every one of them is a Republican.” 1

Hineman: “Brownback’s tax plan abandoned the ‘three-legged stool’ approach to funding government, which had served Kansas well for decades by relying on a stable balance of income, sales and property.”

The three-legged stool is one of the most inappropriate analogies ever coined. If the state of Kansas were to develop an additional source of tax revenue, say by slapping a tariff on Budweiser imported from Missouri or Coors from Colorado, we’d hear spenders like Hineman speaking of the virtue of a stable four-legged chair. Many states thrive without one of our three legs, the income tax. And if we’re looking for stability, as Hineman mentions, income taxes are quite volatile compared to the other legs. 2

As far as serving Kansas well: There are a variety of ways to look at the progress of Kansas compared to the nation, but here’s a startling fact: For the 73rd Congress (1933 to 1935) Kansas had seven members in the U.S. House of Representatives. (It had eight in the previous session.) Until 1992 Kansas had five. Today Kansas has four members, and may be on the verge of losing one after the next census. This is an indication of the growth of Kansas in comparison to the nation.

” … sweep from the highway fund … rejected the governor’s short-term fixes as being neither responsible nor conservative …”

In this (heavily edited) sentence, Hineman complains about sweeping money from the state’s highway fund. But: Even after raising taxes, the budget just passed by the legislature continues sweeps from the highway fund in the amount of $288,297,663 in fiscal year 2018. For fiscal year 2018, the total of the quarterly sweeps is $293,126,335. 3

Hineman: “The fiscal strain created by the 2012 tax cuts caused public schools to suffer, increasing class sizes and reducing program offerings.”

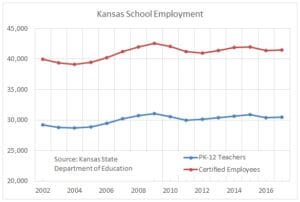

The number of Pre-K through grade 12 teachers rose to 30,431 from 30,413, an increase of 0.06 percent. Certified employees rose to 41,459 from 41,405, or by 0.13 percent.4 These are not the only employees of school districts.5

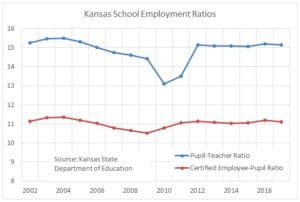

Enrollment fell from 463,504 to 460,491, or 0.61 percent. As a result, the ratios of teachers to students and certified employees to students fell. The pupil-teacher ratio fell from 15.2 pupils per teacher to 15.1. The certified employee-pupil ratio fell from 11.2 to 11.1.

If we look at these ratios over time, we see they are remarkably consistent since 2012. These figures, at least on a state-wide basis, are contrary to the usual narrative, which is that school employment has been slashed, and class sizes are rising rapidly. The pupil-teacher ratios published by KSDE are not the same statistic as class sizes. But if the data shows that the ratio of pupils to teachers is largely unchanged for the past five years and class sizes are rising at the same time, we’re left to wonder what school districts are doing with teachers. And, why are programs being eliminated?

(The relative change in enrollment and employment is not the same in every district. To help Kansas learn about employment trends in individual school districts, I’ve gathered the numbers from the Kansas State Department of Education and present them in an interactive visualization. 6 7)

Hineman: “Though raising taxes is never easy …”

No. Spenders love to raise taxes. In fact, some legislators warned that the tax hikes are not enough, and that they’ll be back for more. Indeed, projections show spending outpacing revenue in just a few years.

Hineman: “… it was unfortunately the only responsible option available. State government has been cut to the point where there is no reasonable way to reduce spending enough to balance the budget.”

No. One example: The efficiency study commissioned by the legislature recommended savings in the method of acquiring health insurance for public school employees. This was not adopted. Therefore, $47,200,000 in general fund spending is added over what the governor recommended. 8 9 This was not cutting services or benefits. It was asking school employees to do something differently in order to save money. But, it didn’t happen.

Can Kansas cut spending? There are many states that spend less than Kansas on a per capita basis. 10

Hineman: “Those who parrot the phrase ‘we have a spending problem, not a revenue problem’ have repeatedly failed to offer realistic suggestions for further cuts.”

Hineman is correct in a small way. To balance the budget this year with cuts alone was probably impossible. The lust for spending other people’s money is just too great. But there have been proposals that should have been followed. First, the legislature should have commissioned the efficiency study in 2012 when taxes were cut. That didn’t happen. Then, the legislature should take the efficiency study seriously. But even simple things — like the recommendation of savings through school employee health insurance acquisition reform — are difficult to accomplish, because the spenders don’t want these reforms.

And, in the past there have been responsible plans for reforming spending and the budget. But these plans were not wanted, nor were they realized. 11

Hineman’s criticism shows that it is difficult to cut spending. People become accustomed to other people paying for their stuff. Legislators want to appear to be doing more for their constituents, providing seemingly free stuff while pushing aside the idea of paying for it. And so government grows, at the expense of our liberty and what might have been had the money been left in the productive private sector.

—

Notes

- Trabert, Dave. “Freedom index: Political division is citizens vs. government, not party lines.* Available at https://kansaspolicy.org/freedom-index-political-division-citizens-vs-government-not-party-lines/. ↩

- Federal Reserve Bank of St. Louis, Gary C. Cornia & Ray D. Nelson. State Tax Revenue Growth and Volatility. 6 Regional Economic Development, 23-58 (2010). Available at https://files.stlouisfed.org/files/htdocs/publications/red/2010/01/Cornia.pdf. ↩

- Weeks, Bob. In Kansas, sweeps to continue. Available at https://wichitaliberty.org/kansas-government/kansas-sweeps-continue/. ↩

- According to KSDE, certified employees include Superintendent, Assoc./Asst. Superintendents, Administrative Assistants, Principals, Assistant Principals, Directors/Supervisors Spec. Ed., Directors/Supervisors of Health, Directors/Supervisors Career/Tech Ed, Instructional Coordinators/Supervisors, All Other Directors/Supervisors, Other Curriculum Specialists, Practical Arts/Career/Tech Ed Teachers, Special Ed. Teachers, Prekindergarten Teachers, Kindergarten Teachers, All Other Teachers, Library Media Specialists, School Counselors, Clinical or School Psychologists, Nurses (RN or NP only), Speech Pathologists, Audiologists, School Social Work Services, and Reading Specialists/Teachers. Teachers include Practical Arts/Vocational Education Teachers, Special Education Teachers, Pre-Kindergarten Teachers, Kindergarten Teachers, Other Teachers, and Reading Specialists/Teachers. See Kansas State Department of Education. Certified Personnel. http://www.ksde.org/Portals/0/School%20Finance/reports_and_publications/Personnel/Certified%20Personnel%20Cover_State%20Totals.pdf. ↩

- There are also, according to KSDE, non-certified employees, which are Assistant Superintendents, Business Managers, Business Directors/Coordinators/Supervisors, Other Business Personnel, Maintenance and Operation Directors/Coordinators/Supervisors, Other Maintenance and Operation Personnel, Food Service Directors/Coordinators/Supervisors, Other Food Service Personnel, Transportation Directors/Coordinators/Supervisors, Other Transportation Personnel, Technology Director, Other Technology Personnel, Other Directors/Coordinators/Supervisors, Attendance Services Staff, Library Media Aides, LPN Nurses, Security Officers, Social Services Staff, Regular Education Teacher Aides, Coaching Assistant, Central Administration Clerical Staff, School Administration Clerical Staff, Student Services Clerical Staff, Special Education Paraprofessionals, Parents as Teachers, School Resource Officer, and Others. See Kansas State Department of Education. Non-Certified Personnel Report. http://www.ksde.org/Portals/0/School%20Finance/reports_and_publications/Personnel/NonCertPer%20Cov_St%20Totals.pdf. ↩

- Weeks, Bob. Kansas school spending, an interactive visualization. Available at https://wichitaliberty.org/wichita-kansas-schools/kansas-school-spending-interactive-visualization/. ↩

- Weeks, Bob. Kansas school employment. Available at https://wichitaliberty.org/politics/kansas-school-employment-2/. ↩

- “The FY 2018 budget assumes savings of $47.2 million from implementation of Alvarez & Marsal efficiency recommendations to include K-12 health benefit consolidation and sourcing select benefit categories on a statewide basis.” Budget Report, p. 17 ↩

- “Add $47.2 million, all from the State General Fund, for removing savings associated with A&M recommendations for health insurance and procurement for FY 2018.” Bill Explanation For 2017 Senate Sub. For House Bill 2002, p. 10. ↩

- Weeks, Bob. Spending in the states, per capita. https://wichitaliberty.org/economics/spending-states-per-capita-2/. ↩

- Kansas Policy Institute. A Five-Year Budget Plan for the State of Kansas: How to balance the budget and have healthy ending balances without tax increases or service reductions. Available at https://kansaspolicy.org/kpi-analysis-5-year-kansas-budget-plan/. ↩

Leave a Reply