Wichita’s mayor pens an op-ed that is counter to facts that he knows, or should know.

In the pages of the Wichita Eagle Wichita Mayor Jeff Longwell wrote: “The city of Wichita has held its mill levy steady for the past 22 years.”1

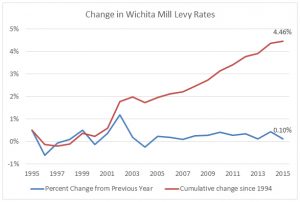

That’s the mayor’s opinion. The facts, as can be easily found in government documents, are that the Wichita mill levy rises nearly every year.2 Since 2005 it has risen every year.

But the county sets the mill levy based on two factors, one the city controls: The amount it decides to spend. The other factor, the assessed valuation of property, is not controlled by the city. So it is understandable that the mill levy may vary by small amounts from year to year when the two numbers are melded to form the actual mill levy. Some years the levy might rise, and in some years, it may fall. If it is a truly random matter, we should expect that over time the number of rising years and falling years should be equal, and that the overall change should be near zero.

But in Wichita, the mill levy rises nearly every year. And over time, since 1995, it has risen by 4.46 percent.

What should concern Wichitans about their mayor’s op-ed is that he knows these facts. Or, at least he should. Despite the data that is readily available in the city’s comprehensive annual financial reports, Mayor Longwell has chosen to remain misinformed and/or uninformed, and to spread that to citizens.

Following are excerpts from the minutes of the August 7, 2012 council meeting, which Jeff Longwell attended as council member, and following that, video.

Wichita City Council, August 7, 2012

Bob Weeks 2451 Regency Lakes Court stated we say the City has not raised its mill levy in a long time and thinks it is true that this Council has not taken action to raise the mill levy, but it has increased. Stated in 2002 the City’s mill levy was 31.845 and last year 32.359, which is an increase of about half a mill or 1.6 percent. Stated we should also recognize that property tax revenue increased from about $83 million to $118 million dollars or 42 percent. Stated we did not experience anything near that in the rate of growth of population or inflation? even the two put together. Stated in the City sales tax collection for the same years, $41 million to about $55 million or 34 percent increase. Stated City revenues have increased quite a bit even though the Council has not taken explicit action to increase either the sales tax rate or the property tax rate. Stated another thing he is concerned about is shifting one mill of property tax revenue from the debt service fund to the general fund. Stated over the past years since 2007 there has been a shift of about 2.5 mills, which is more than the explicit policy of one mill, which will be ending over the next two years. Stated we have not delayed paying off debt in the sense that we have not made our scheduled bond payments but that 2.5 mills could have been used to retire debt instead of supporting current spending. Stated we could have repurchased some of our outstanding bonds or we could have used that money to pay for things that we borrowed for. Stated we need to realize that we have been not taking advantage of opportunities to retire longterm debt and had been redirecting that spending to current fund spending, which is where Cowtown and the Nature Center come from. Stated we need to be aware of these types of things as we make the policies going forward.

Mayor Brewer asked staff to explain the figures that Mr. Weeks was talking about.

Kelly Carpenter Finance Director stated regarding the mill levy, they started out at 10 mills in the capital improvement plan. Stated they reduced that down to 7.5 mills and now we are gradually increasing that mill levy back up in the debt service fund to 8.5 mills over the next two years.

Council Member O’Donnell stated he was referring that the mill levy has actually increased.

Kelly Carpenter Finance Director stated the overall mill levy has not increased within the last 19 years. Stated there has been a shift between the general fund and the debt service fund but the overall mill levy of the 32 mills has not increased.

Council Member O’Donnell asked Mr. Weeks to return to the podium and asked where his figures are from.

Bob Weeks stated from the 2011 Comprehensive Annual Financial Report, page H17. Stated they are the numbers that he extracted from that report. Stated it may not be that this Council took an action to raise the mill levy but somehow it did increase.

Council Member O’Donnell asked staff to answer that.

Mark Manning Finance Department the mill levy is set by the county and what they tell the Council each year is that the mill levy in the proposed budget is not changed from the mill levy certified by the county, the prior year. Stated they do not know what the mill levy will be for 2013 right now and will not know until November when the county finalizes its evaluation. Stated it may be slightly higher or lower and that is why you see those annual fluctuations. Stated Mr. Weeks is correct? some years it goes up and some years it goes down a little bit. Stated it does fluctuate and there is nothing we can do to control that but the general policy has been to keep it level for the last 19 years.

- Mayor Jeff Longwell: Property tax lid needs exemption for public safety. Wichita Eagle. Available at www.kansas.com/opinion/opn-columns-blogs/article74286642.html. ↩

- Weeks, Bob. Wichita property tax rate: Up again. Voice For Liberty in Wichita. Available at.wichitaliberty.org/wichita-government/wichita-property-tax-rate-up-again/. ↩

Leave a Reply