Kansas state government collects more tax revenue than most surrounding states. Additionally, severance taxes are a minor contribution to collections, even in Texas.

Note: this visualization has been updated. Click here for the most recent version.

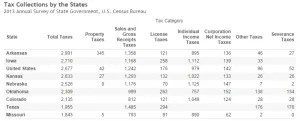

The United States Census Bureau conducts an Annual Survey of State Government Tax Collections. It’s useful to gather figures for Kansas and some nearby states.

The data considers only tax collections by state government. It does not include cities, counties, school districts, or the many other taxing jurisdictions that states may have formed. I have computed this data on a per-person basis. Data is for 2013.

In some cases, state tax collections are substantially lower. Texas collects $1,955 per person per year, which is 25.75 percent less than Kansas.

I’ve created an interactive visualization of this data that you may use. Click here to open the visualization in a new window.