-

Trump Launches Americas Counter Cartel Coalition at Shield of the Americas Summit

Read more: Trump Launches Americas Counter Cartel Coalition at Shield of the Americas SummitPresident Trump launched the Americas Counter Cartel Coalition with 17 nations at the inaugural Shield of the Americas Summit in Doral, FL — offering allies precision military strikes against cartel leaders while announcing a Venezuela gold deal and U.S. diplomatic recognition.

-

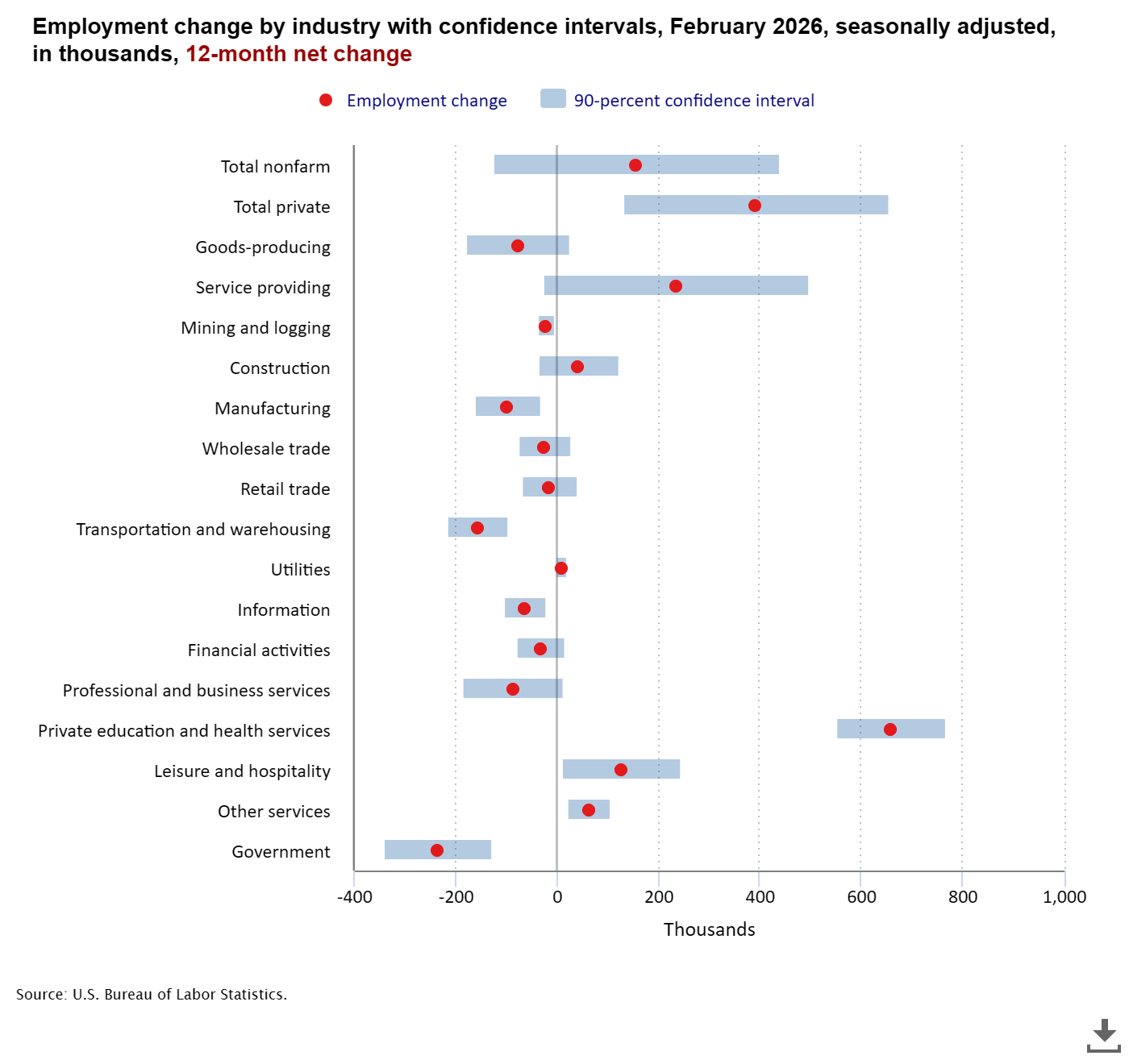

The U.S. shed 92,000 jobs in February 2026 as a physicians’ strike and federal layoffs hit payrolls. Unemployment holds at 4.4%. Full expert analysis inside.

Read more: The U.S. shed 92,000 jobs in February 2026 as a physicians’ strike and federal layoffs hit payrolls. Unemployment holds at 4.4%. Full expert analysis inside.The U.S. economy lost 92,000 jobs in February 2026 — a sharp miss driven by a physicians’ strike and continued federal workforce cuts. Unemployment held at 4.4%, wages grew 3.8%, and long-term joblessness is rising. Here’s what the numbers actually mean.

-

Kristi Noem Fired: DHS Fact-Check & Multi-Source Analysis

Read more: Kristi Noem Fired: DHS Fact-Check & Multi-Source AnalysisPresident Trump fired DHS Secretary Kristi Noem on March 5, 2026 — but accounts of why differ sharply depending on the source. We analyzed eight outlets across the political spectrum to separate confirmed facts from contested claims, identify what all sides agree on, and surface what nearly every publication left out.

-

Article Summaries for February 2026

Read more: Article Summaries for February 2026Article Summaries for February 2026.

-

JD Vance Wisconsin Speech: VP Claims 2.4% Inflation, Attacks Democrats Over State of Union Response — Full Transcript & Fact-Check

Read more: JD Vance Wisconsin Speech: VP Claims 2.4% Inflation, Attacks Democrats Over State of Union Response — Full Transcript & Fact-CheckVice President JD Vance delivered a February 26, 2026 speech in Plover, Wisconsin claiming the Trump administration reduced inflation to 2.4%, increased average wages by $1,700, and achieved century-low murder rates while attacking Democrats for their State of the Union behavior. Full transcript with comprehensive fact-checking of all major claims.

-

Article Summaries for November 2025

Read more: Article Summaries for November 2025Article Summaries for November 2025.

-

Trump’s 2026 State of the Union: Full Transcript Breakdown and Fact-Check — Economy, Iran Strike, Hostages, and Medals of Honor

Read more: Trump’s 2026 State of the Union: Full Transcript Breakdown and Fact-Check — Economy, Iran Strike, Hostages, and Medals of HonorPresident Trump delivered his first State of the Union of his second term on Feb. 24, 2026, claiming sweeping first-year wins on the economy, border, and foreign policy — while two Medals of Honor and a Legion of Merit were awarded live on the House floor.

-

Trump Signs National Angel Family Day Proclamation, Touts 21,000 Arrests Under Laken Riley Act

Read more: Trump Signs National Angel Family Day Proclamation, Touts 21,000 Arrests Under Laken Riley ActPresident Trump hosted Angel Families at the White House on Feb. 23, 2026, signing a proclamation establishing National Angel Family Day. Family members of Americans killed by undocumented immigrants testified, and Trump highlighted results of the Laken Riley Act.

-

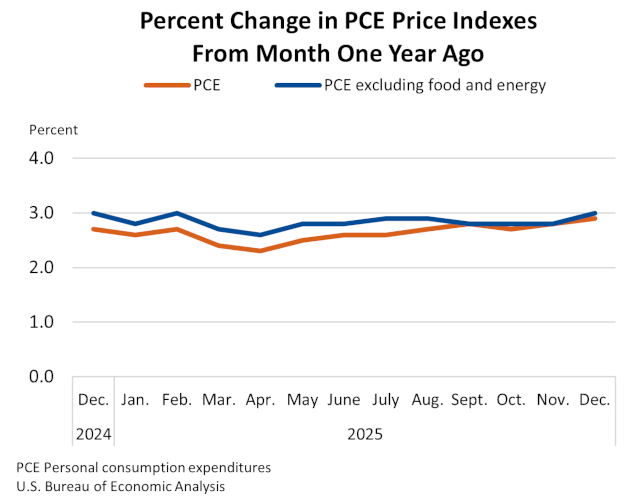

December 2025 PCE Report: Inflation Ticks Up, Savings Drop, and Spending Holds On

Read more: December 2025 PCE Report: Inflation Ticks Up, Savings Drop, and Spending Holds OnThe BEA’s December 2025 Personal Income and Outlays report shows inflation rising to 2.9% annually while Americans dip into savings to keep spending. Here’s what it means for your wallet and the Fed’s next move.

-

Psychological Analysis of Authoritarian Communication: Trump’s Supreme Court Tariff Response (February 2026)

Read more: Psychological Analysis of Authoritarian Communication: Trump’s Supreme Court Tariff Response (February 2026)A structured psychological analysis of Trump’s response to the Supreme Court’s tariff ruling reveals consistent patterns of grandiose self-presentation, binary moral framing, defeat-reframing, and institutional delegitimization — mapped against known authoritarian leadership influence profiles.

-

Trump Defiant After Supreme Court Strikes Down IEEPA Tariffs: “We Have Alternatives”

Read more: Trump Defiant After Supreme Court Strikes Down IEEPA Tariffs: “We Have Alternatives”President Trump responded defiantly to the Supreme Court’s 6-3 ruling striking down his IEEPA tariffs, calling it “deeply disappointing” while announcing an immediate 10% global tariff under Section 122. He left unanswered whether $175 billion in collected revenue would be refunded.

-

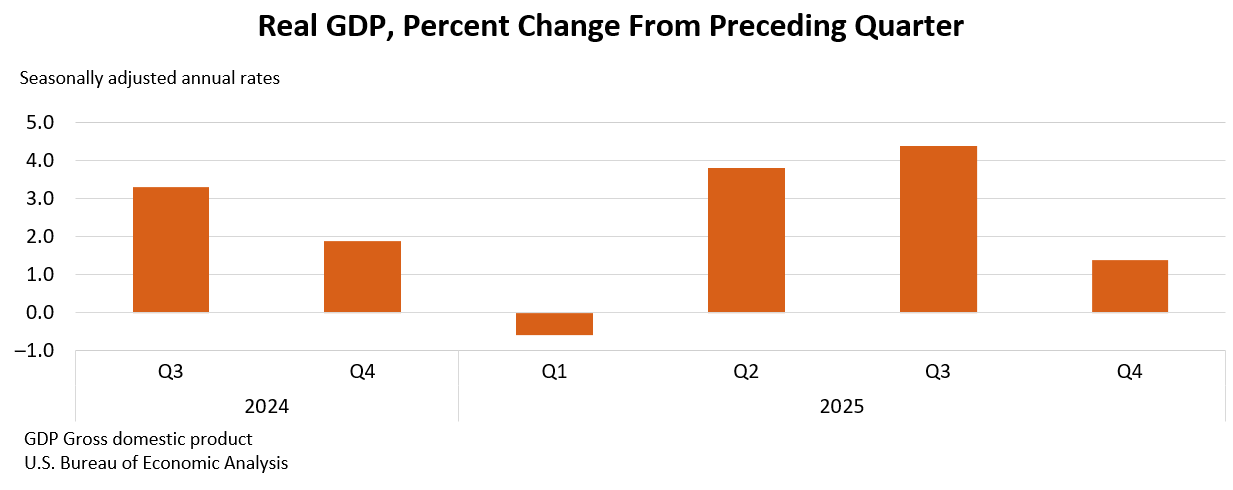

Q4 2025 GDP: Why the 1.4% Growth Rate Is Misleading — And What the Real Number Is

Read more: Q4 2025 GDP: Why the 1.4% Growth Rate Is Misleading — And What the Real Number IsThe government reported 1.4% GDP growth for Q4 2025, a sharp drop from summer’s 4.4% pace. But a six-week federal shutdown distorted the numbers. Strip that out and the private economy grew 2.4% — a healthy pace. Here’s a plain-English breakdown of what really happened.