Tag: Kansas state government

-

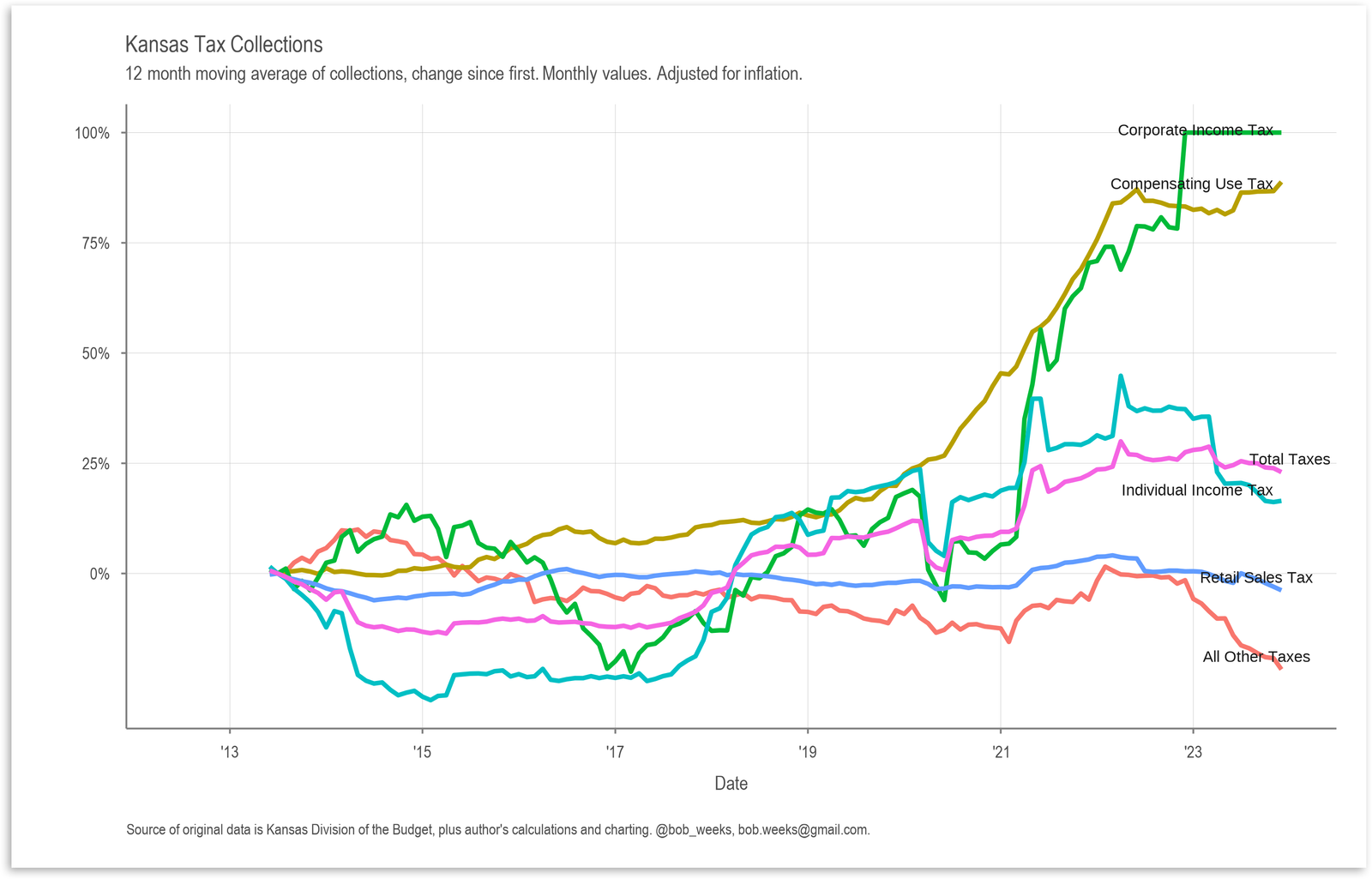

Kansas Tax Revenue, December 2023

For December 2023, Kansas tax revenue was 3.8 percent lower than December 2022, and 3.4 percent lower than estimated.

-

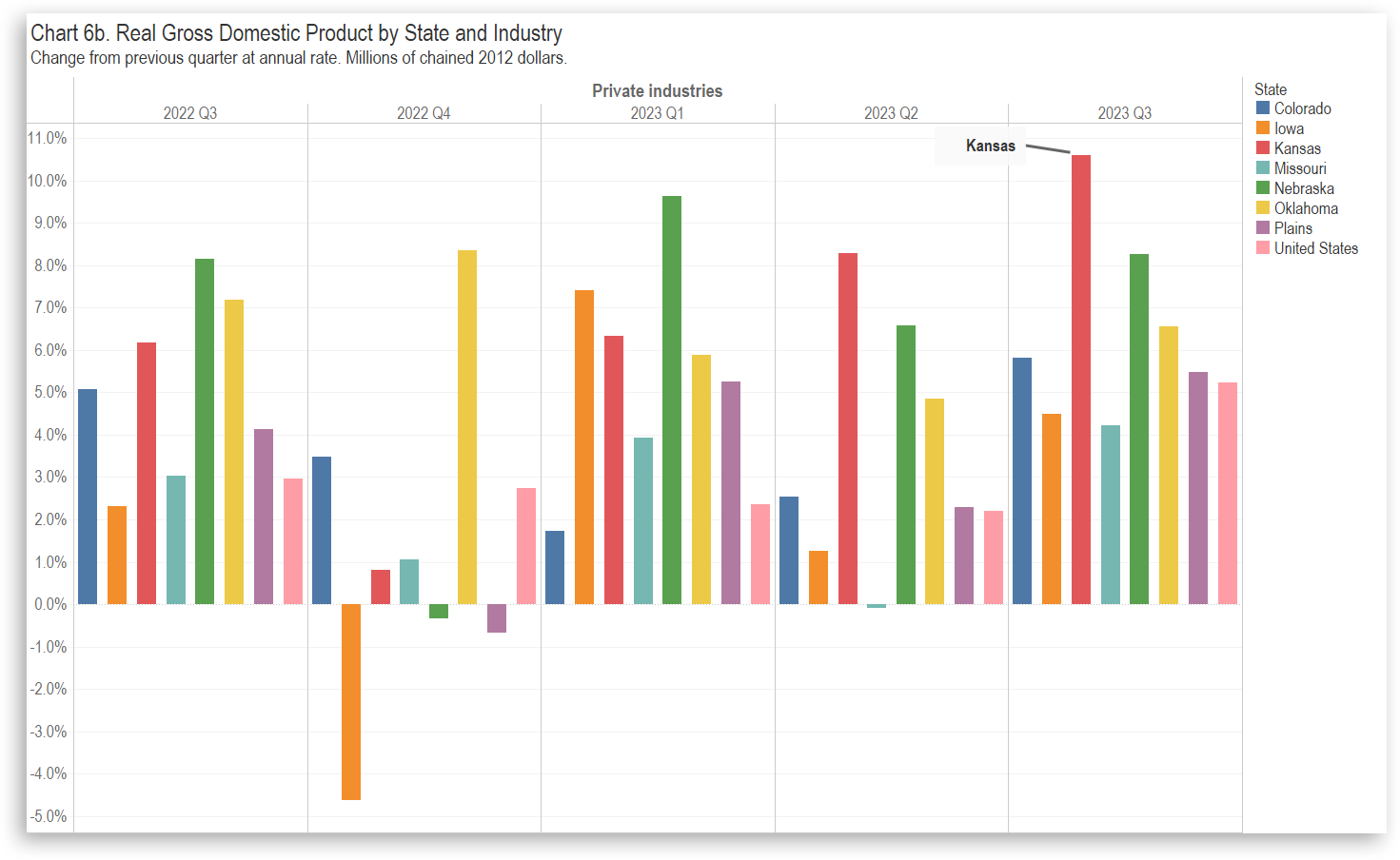

Kansas GDP, Third Quarter of 2023

In the third quarter of 2023, the Kansas economy grew at the annual rate of 9.7 percent. Real Gross Domestic Product rose in all states, with Kansas ranking first.

-

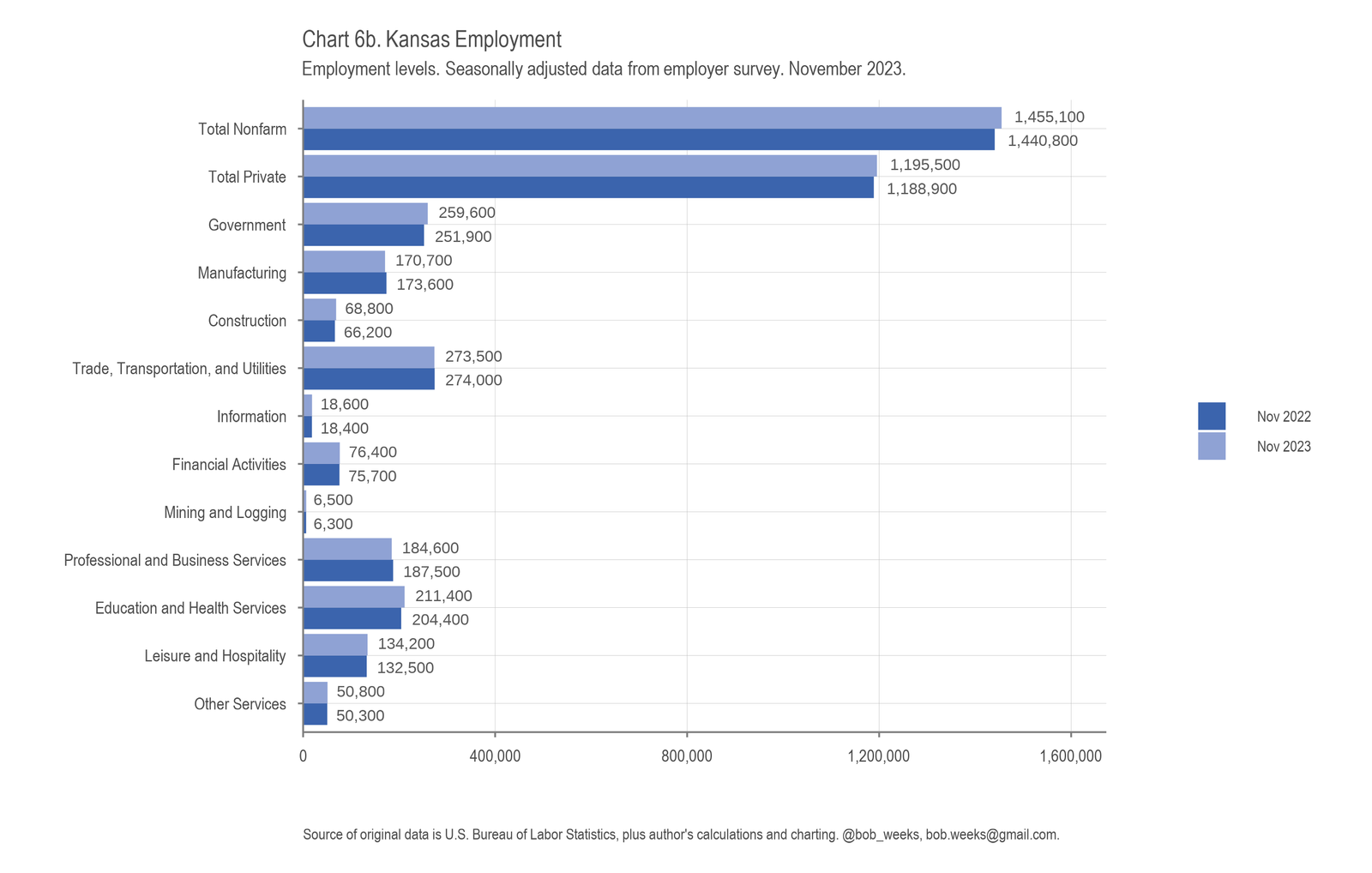

Kansas Employment Situation, November 2023

In Kansas for November 2023, the labor force fell, the number of jobs rose, and the unemployment rate was unchanged when compared to the previous month. Over the year, Kansas is below the middle of the states in job growth.

-

Kansas GDP, Second Quarter of 2023

In the second quarter of 2023, the Kansas economy grew at the annual rate of 7.4 percent. Real Gross Domestic Product rose in 44 states, with Kansas ranking second.

-

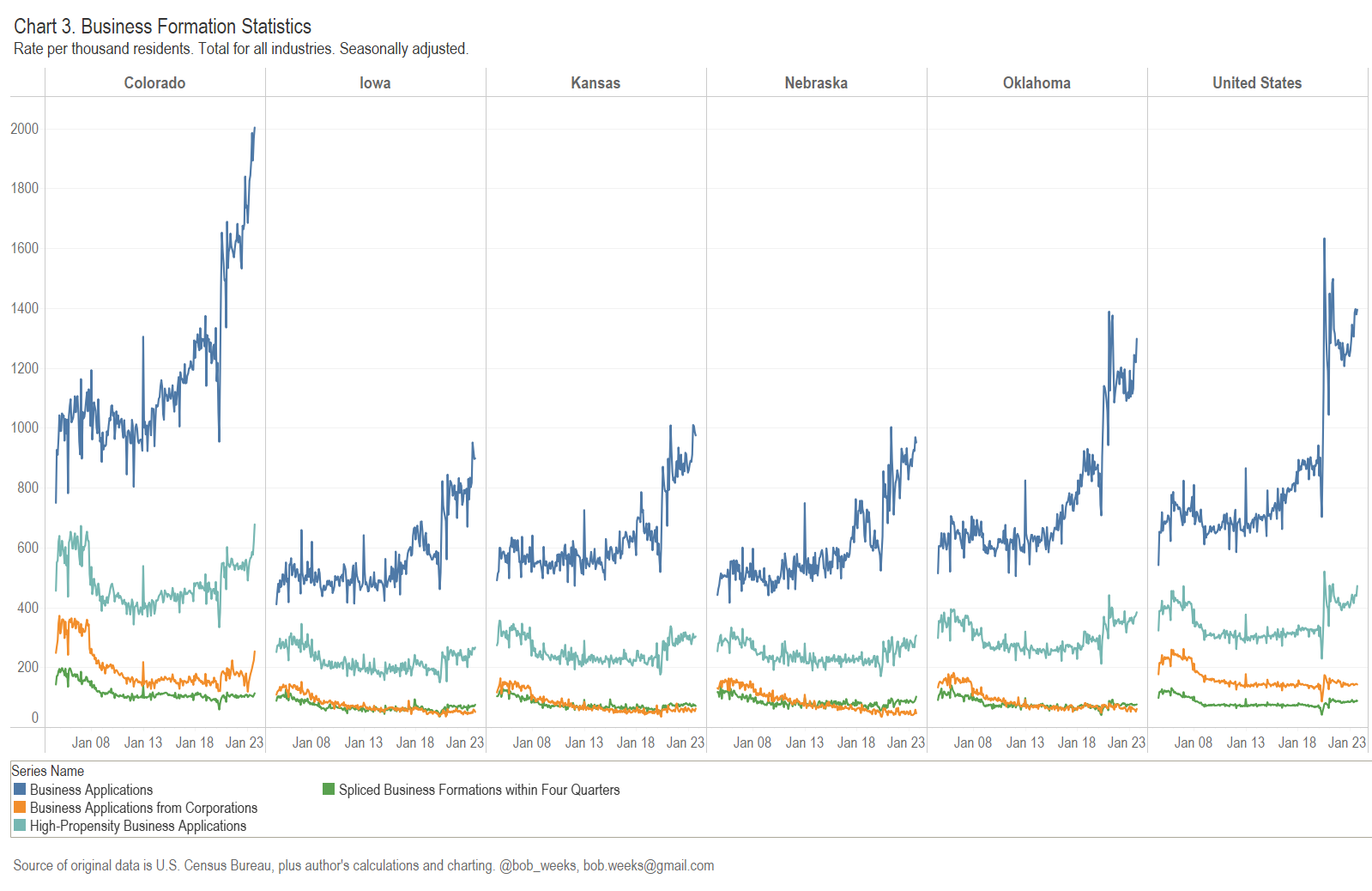

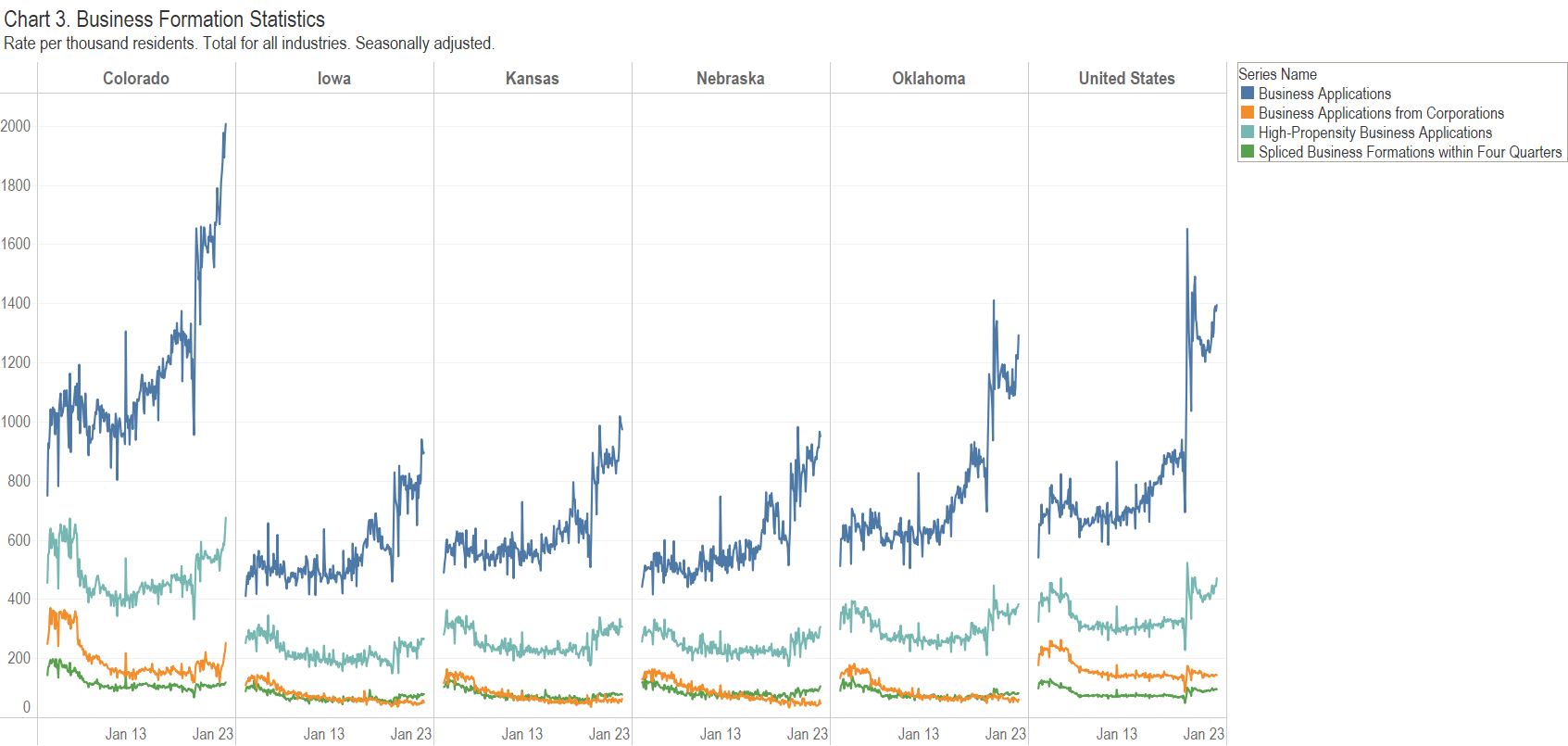

Business Formation in Kansas

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.

-

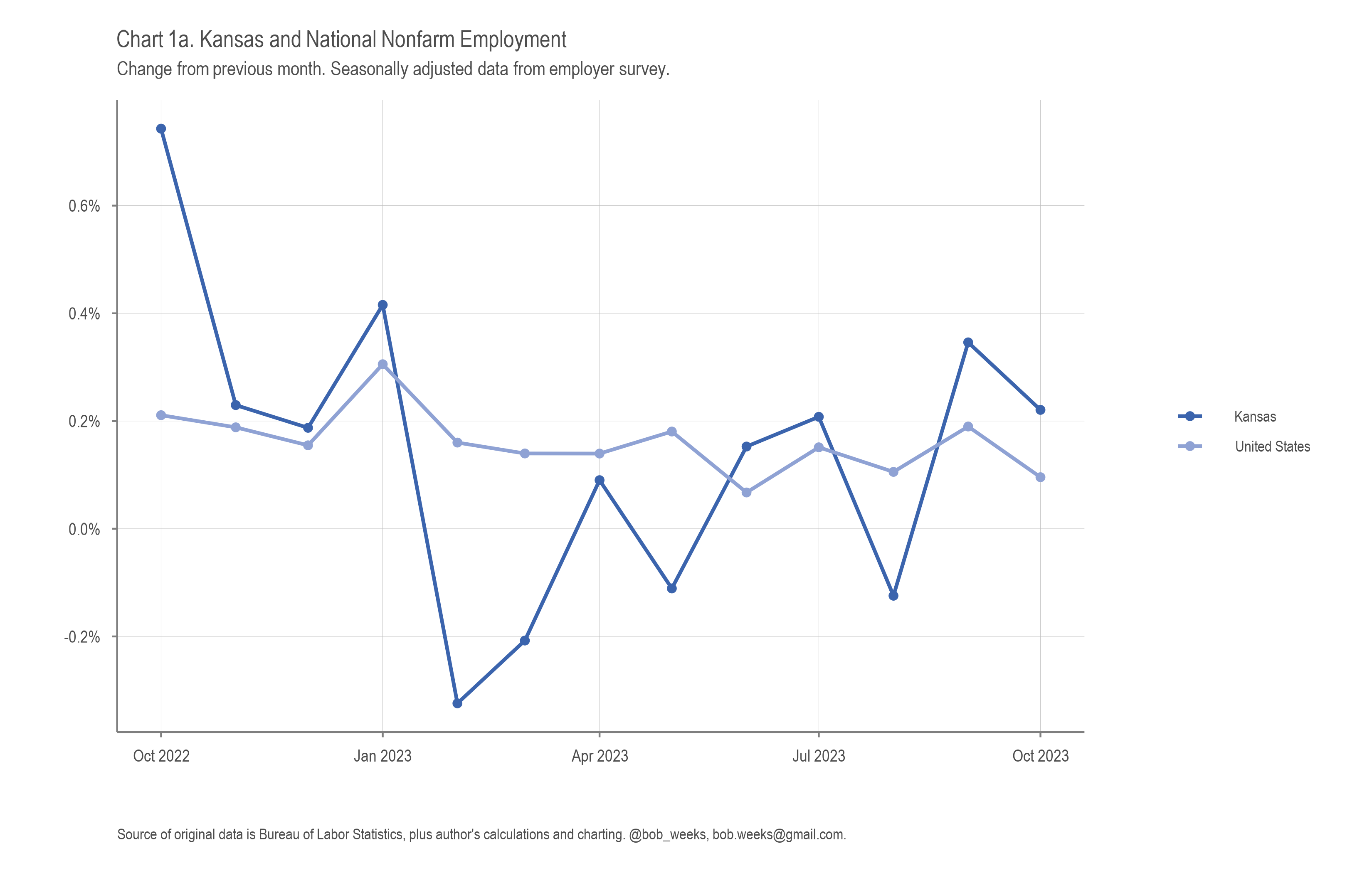

Kansas Employment Situation, October 2023

In Kansas for October 2023, the labor force was steady, the number of jobs rose, and the unemployment rate fell slightly when compared to the previous month. Over the year, Kansas is below the middle of the states in job growth.

-

Kansas Tax Revenue, October 2023

For October 2023, Kansas tax revenue was 7.4 percent lower than October 2022, and 4.1 percent lower than estimated.

-

Kansas Employment Situation, September 2023

In Kansas for September 2023, the number of jobs and the labor force rose, and the unemployment rate ticked up slightly when compared to the previous month. Over the year, Kansas is below the middle of the states in job growth.

-

Business Formation in Kansas

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.