Tag: Kansas state government

-

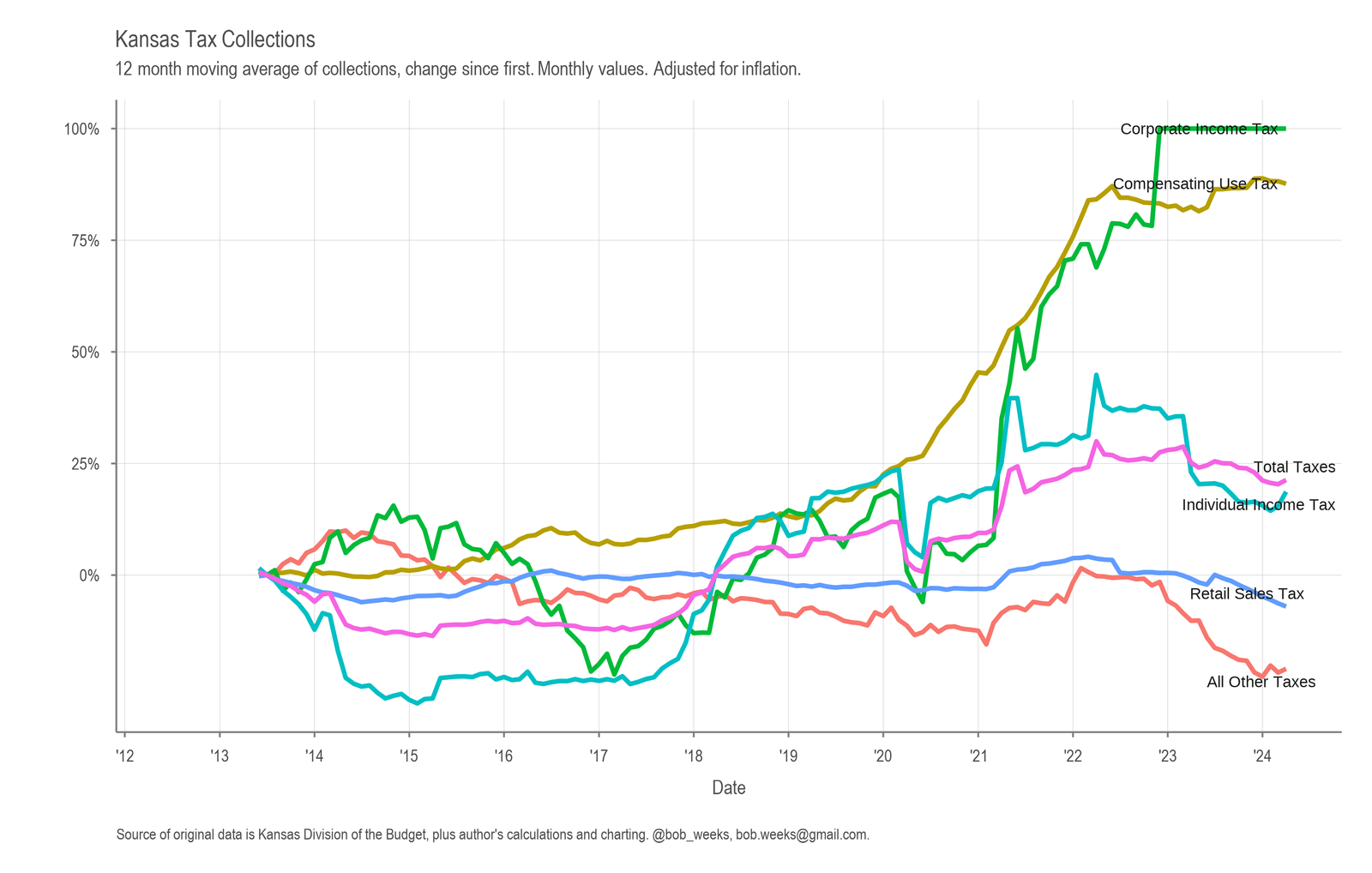

Kansas Tax Revenue, April 2024

For April 2024, Kansas tax revenue was 9.6 percent higher than April 2023, and 7.7 percent higher than estimated.

-

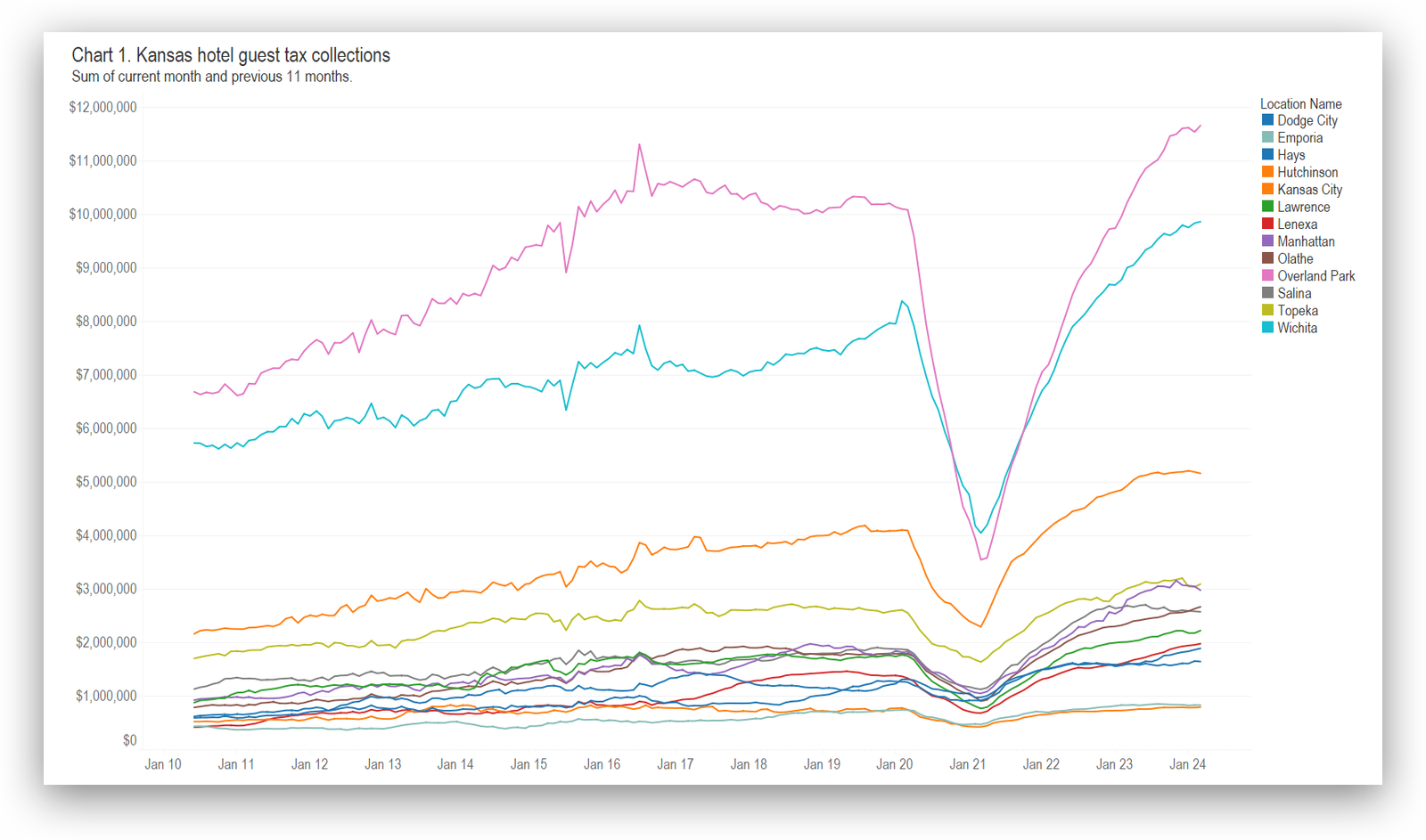

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through March 2024.

-

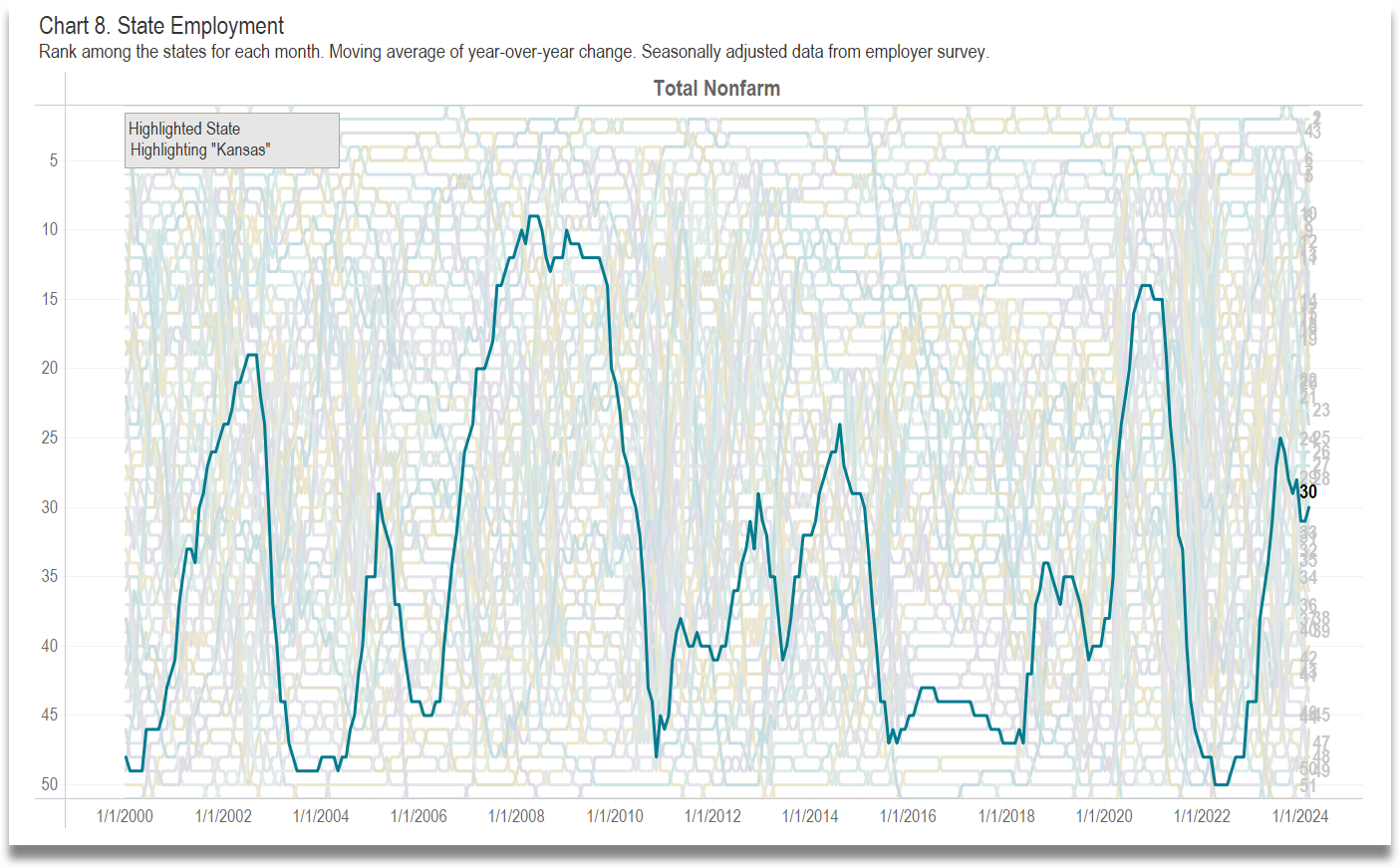

Kansas Employment Situation, March 2024

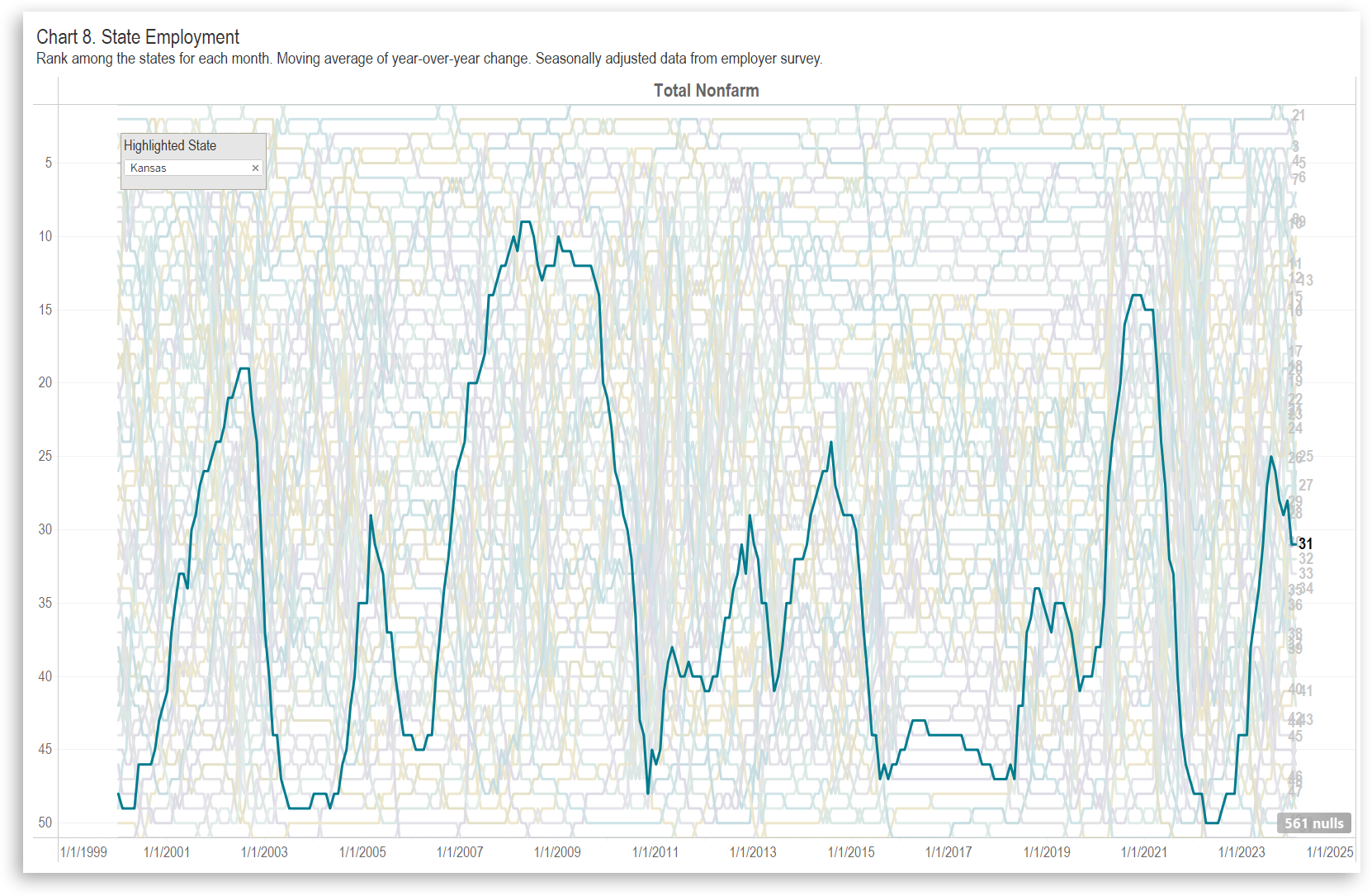

In Kansas in March 2024, the labor force fell slightly, the number of jobs rose, and the unemployment was unchanged compared to the previous month. Over the year, Kansas is at the midpoint of states in job growth.

-

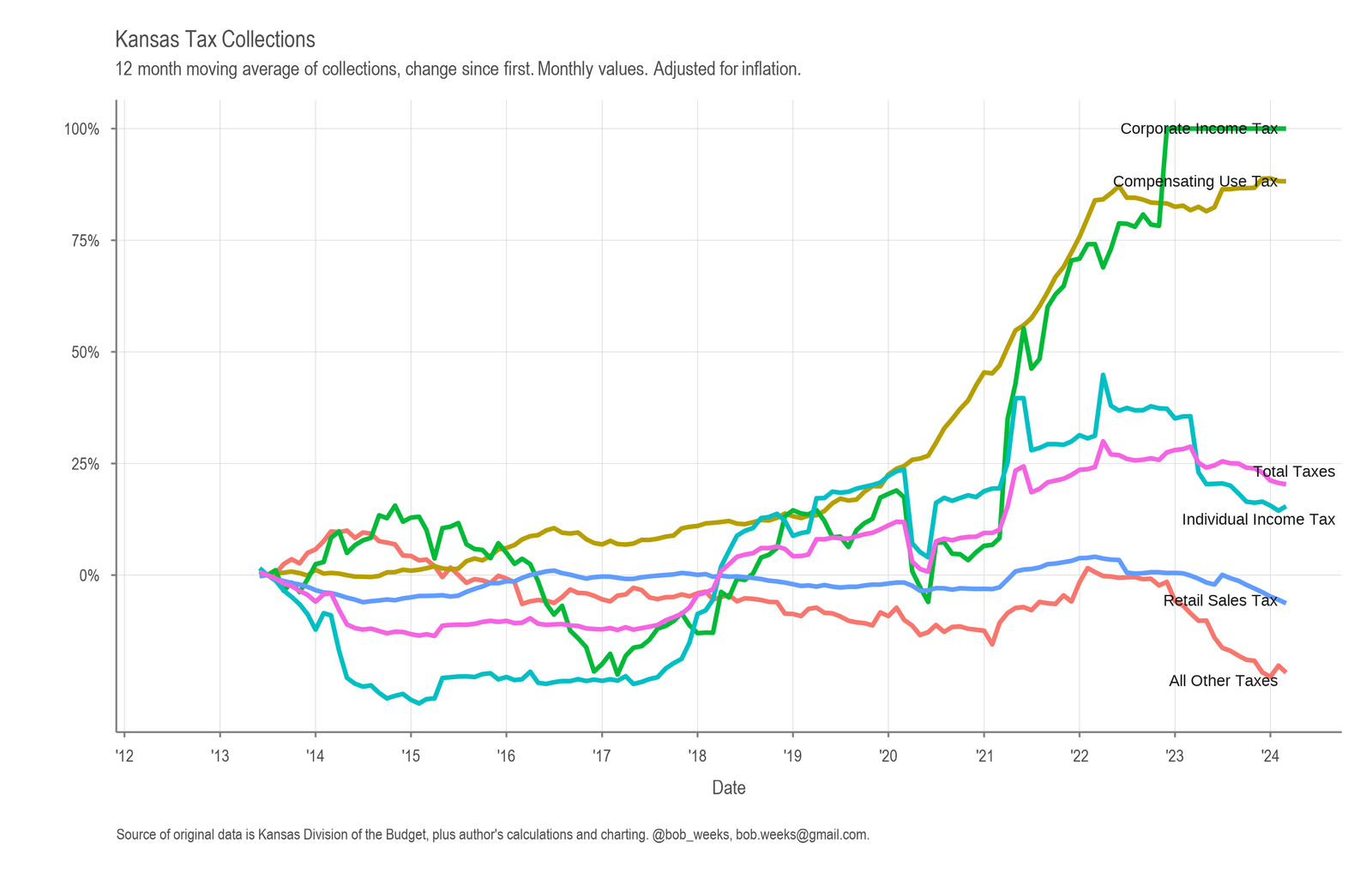

Kansas Tax Revenue, March 2024

For March 2024, Kansas tax revenue was 0.3 percent higher than March 2023, and 0.9 percent higher than estimated.

-

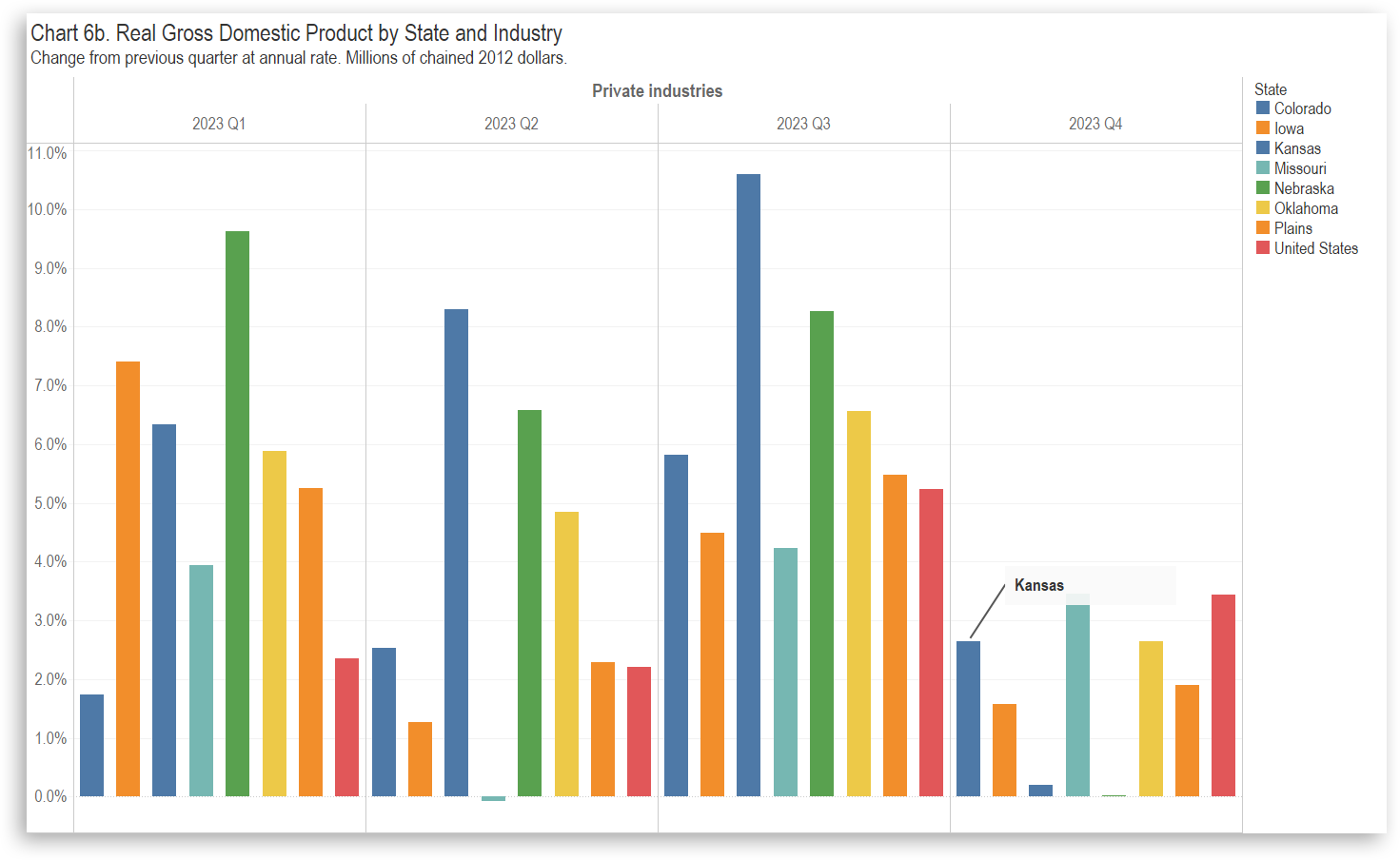

Kansas GDP, Fourth Quarter of 2023

In the fourth quarter of 2023, the Kansas economy grew at the annual rate of 0.6 percent. Real Gross Domestic Product rose in all states, with Kansas ranking forty-ninth.

-

Kansas Employment Situation, February 2024

In Kansas in February 2024, the labor force fell, the number of jobs rose, and the unemployment rate rose compared to the previous month. Over the year, Kansas is lower than most states in job growth.

-

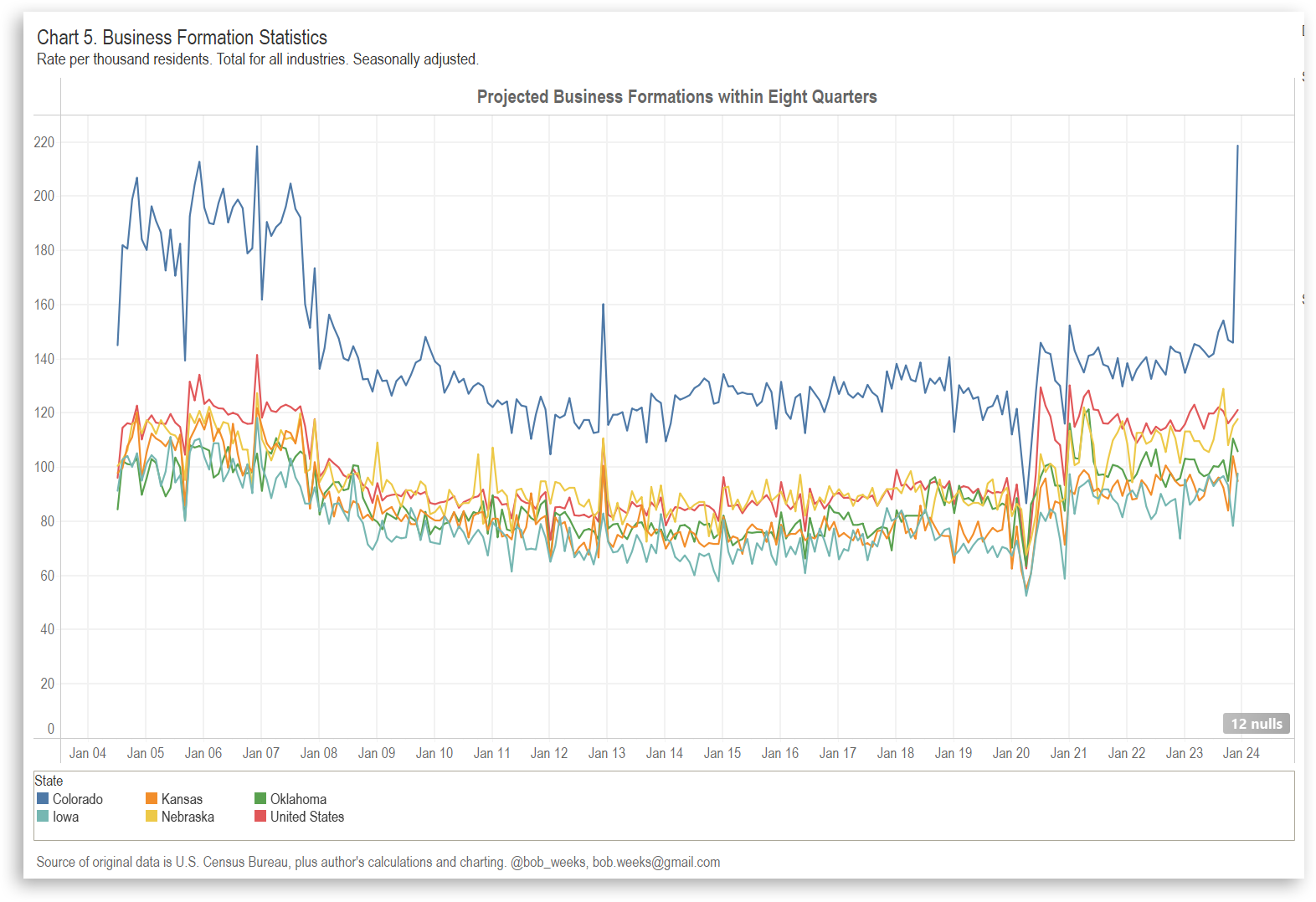

Business Formation in States

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.

-

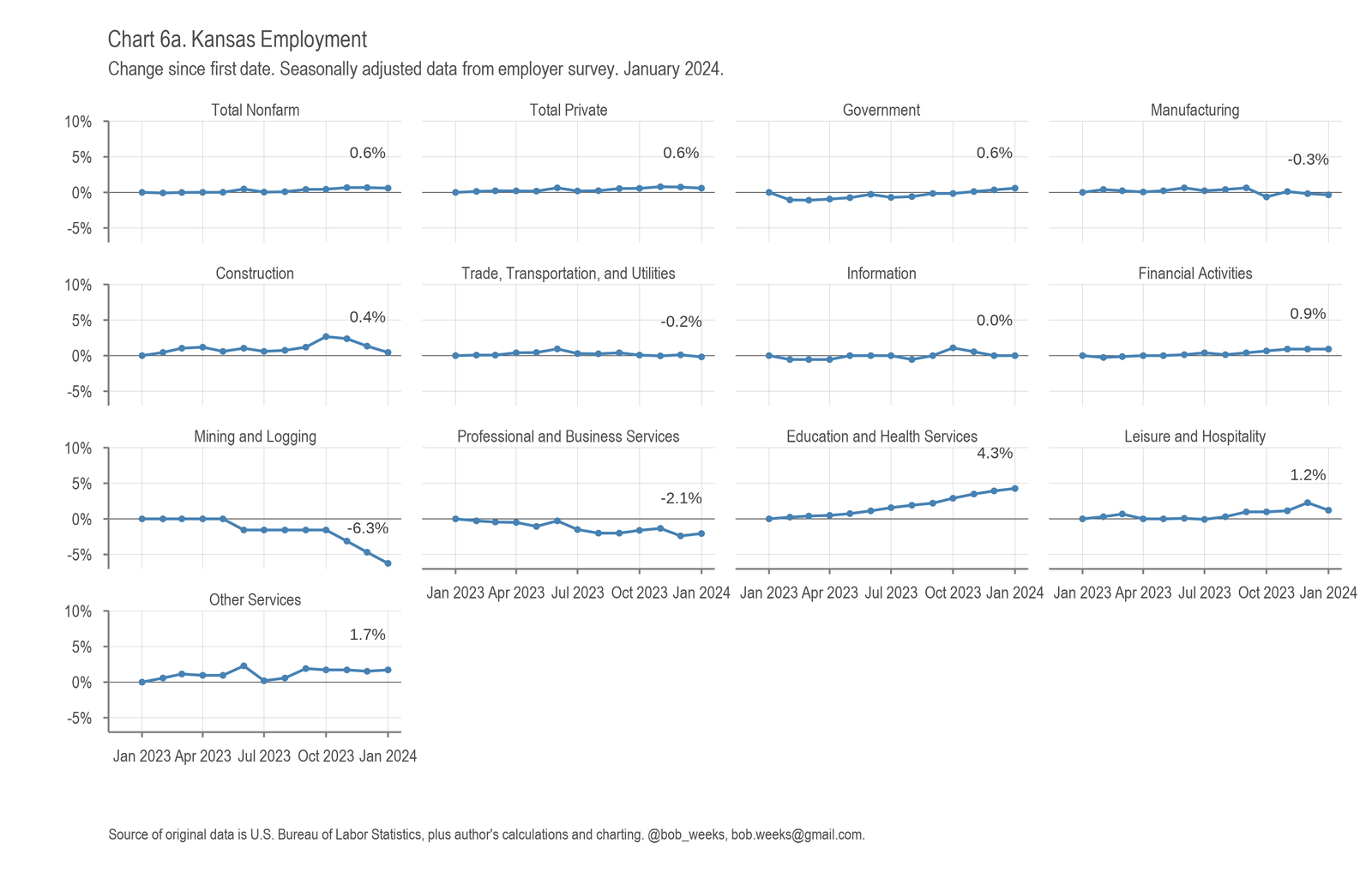

Kansas Employment Situation, January 2024

In Kansas in January 2024, the labor force fell, the number of jobs fell, and the unemployment rate was unchanged compared to the previous month. Over the year, Kansas is near the bottom of states in job growth.

-

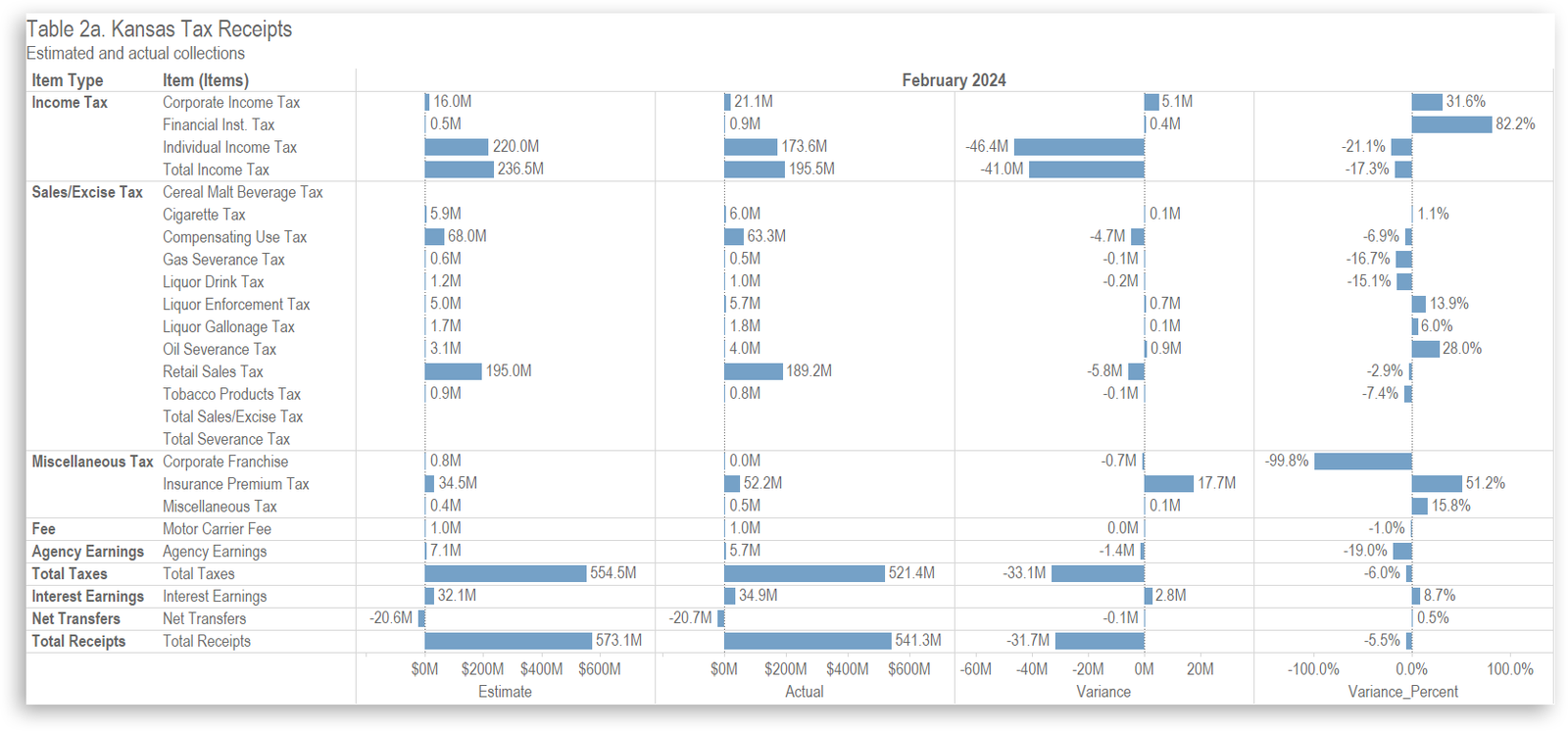

Kansas Tax Revenue, February 2024

For February 2024, Kansas tax revenue was 5.2 percent lower than February 2023, and 6.0 percent lower than estimated.