Tag: Free markets

-

The $80 Billion Nuclear Bet: Understanding the Trump Administration’s Westinghouse Deal

The core question is not whether nuclear power has technical merit. Rather, it’s whether this particular arrangement represents sound policy or a costly mistake that mixes industrial policy with crony capitalism. Is this another step towards Trump’s version of state capitalism, or even outright socialism?

-

The Employment and Wage Effects of Trump’s Steel Tariffs

Research on the Trump administration’s 2018-2020 steel tariffs reveals significant negative net employment effects despite modest gains in steel production jobs. While steel workers experienced some wage increases, the broader economic impact included substantial job losses in steel-using industries and higher costs for consumers.

-

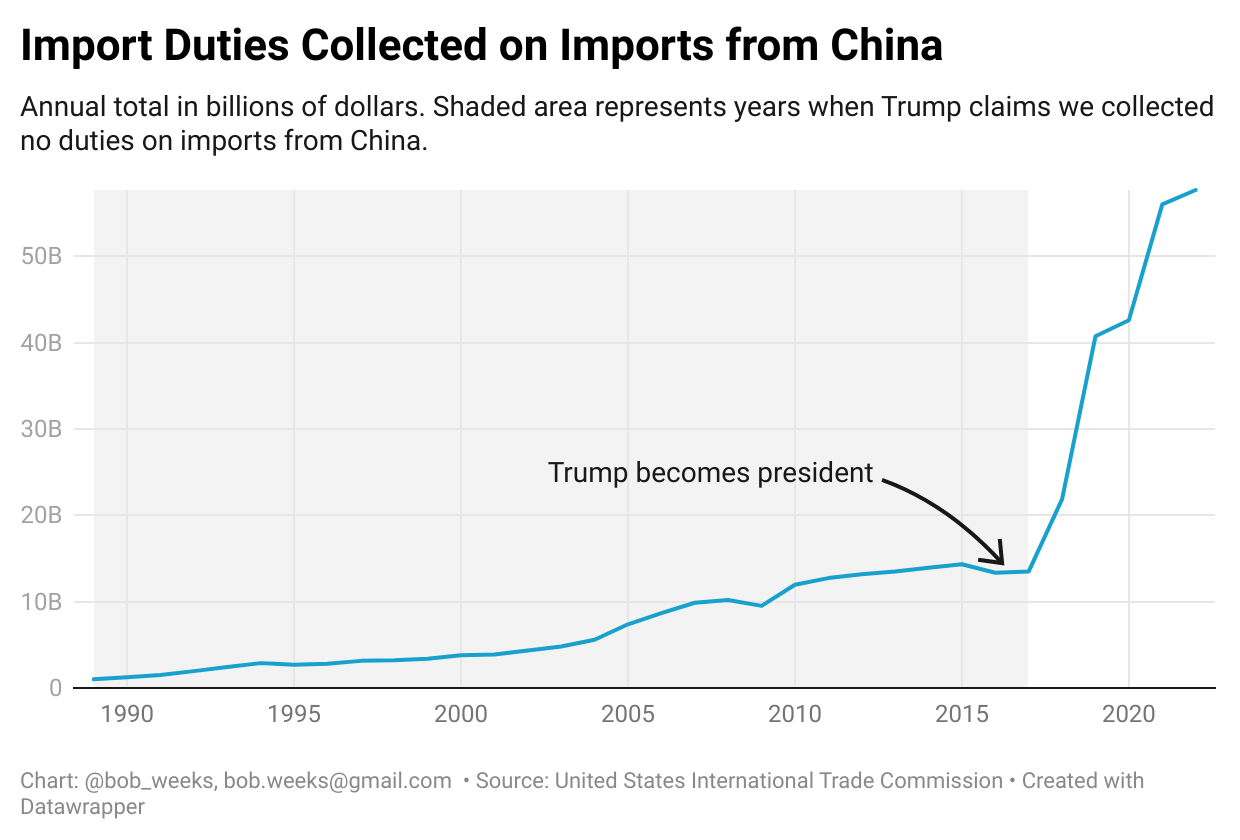

Trump’s Tariffs

On the campaign trail, former president Donald J. Trump praises his import taxes on Chinese imports. But he is wrong on the data, and wrong on the economic effects.

-

Say no to special tax treatment, again

In Kansas, a company seeks to avoid paying property taxes, again.

-

From Pachyderm: Robert L. Bradley, Jr.

From the Wichita Pachyderm Club: Robert L. Bradley, Jr. speaking on the topic “The Contra-Capitalist Corporation (In Search of Heroic Capitalism).”

-

WichitaLiberty.TV: Sedgwick County and Wichita issues

The end of a Sedgwick County Commission election, the *Wichita Eagle* editorializes on school spending and more taxes, and Wichita Mayor Jeff Longwell seems misinformed on the Wichita economy.

-

WichitaLiberty.TV: Larry Reed, Foundation for Economic Education

Lawrence W. Reed, President of Foundation for Economic Education, joins Bob and Karl to discuss the connection between liberty and character, our economic future, and I, Pencil.

-

WichitaLiberty.TV: Dr. Tom G. Palmer and the causes of wealth

Dr. Tom G. Palmer of Atlas Network joins Bob Weeks to explain why the usual approach to foreign aid isn’t working, and what Atlas Network is doing to change the lives of the poor across the world.

-

WichitaLiberty.TV: After the Kansas tax increases

Jonathan Williams, chief economist at American Legislative Exchange Council (ALEC), joins Bob Weeks and Karl Peterjohn to discuss what ALEC does, and then topics specific to Kansas.

-

WichitaLiberty.TV: The regulatory and administrative state

Fred L. Smith, Jr. is the founder of the Competitive Enterprise Institute. He explains the problems with excessive regulation and a large administrative state.

-

WichitaLiberty.TV: Dr. James Otteson on capitalism

Dr. James Otteson is executive director of the BB&T Center for the Study of Capitalism at Wake Forest University. He was in Wichita to speak at the Bastiat Society and stopped by the WichitaLiberty.TV studios to discuss capitalism.

-

WichitaLiberty.TV: Immunizations, spending and taxing in Kansas, and getting data from Wichita

In this episode of WichitaLiberty.TV: Should Sedgwick County be in competition with the private sector? What are attitudes towards taxation and spending in Kansas? Finally, what is it like to request data from the City of Wichita? Episode 138, broadcast February 12, 2017.