Tag: Economic development

-

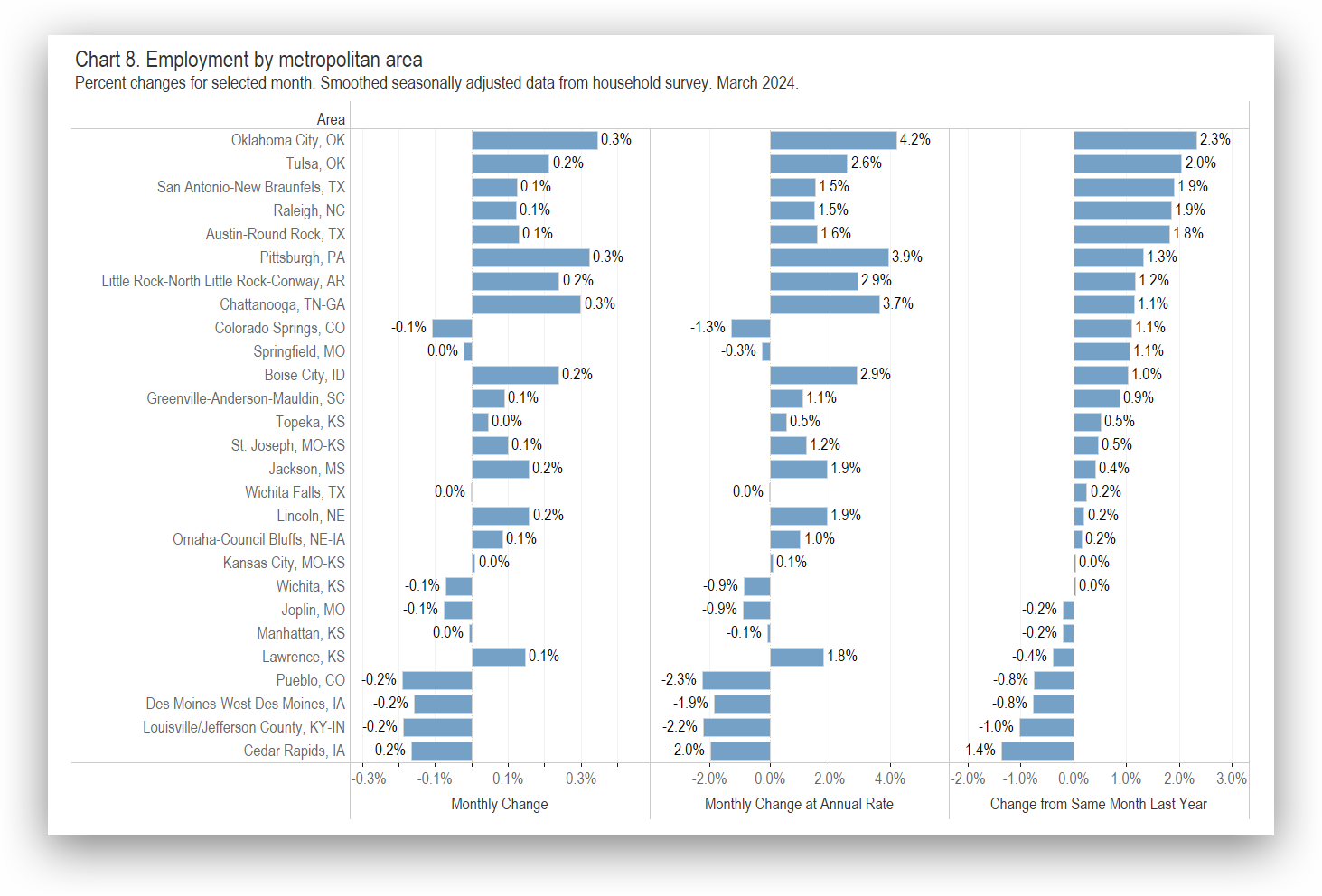

Wichita Employment Situation, March 2024

For the Wichita metropolitan area in March 2024, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers.

-

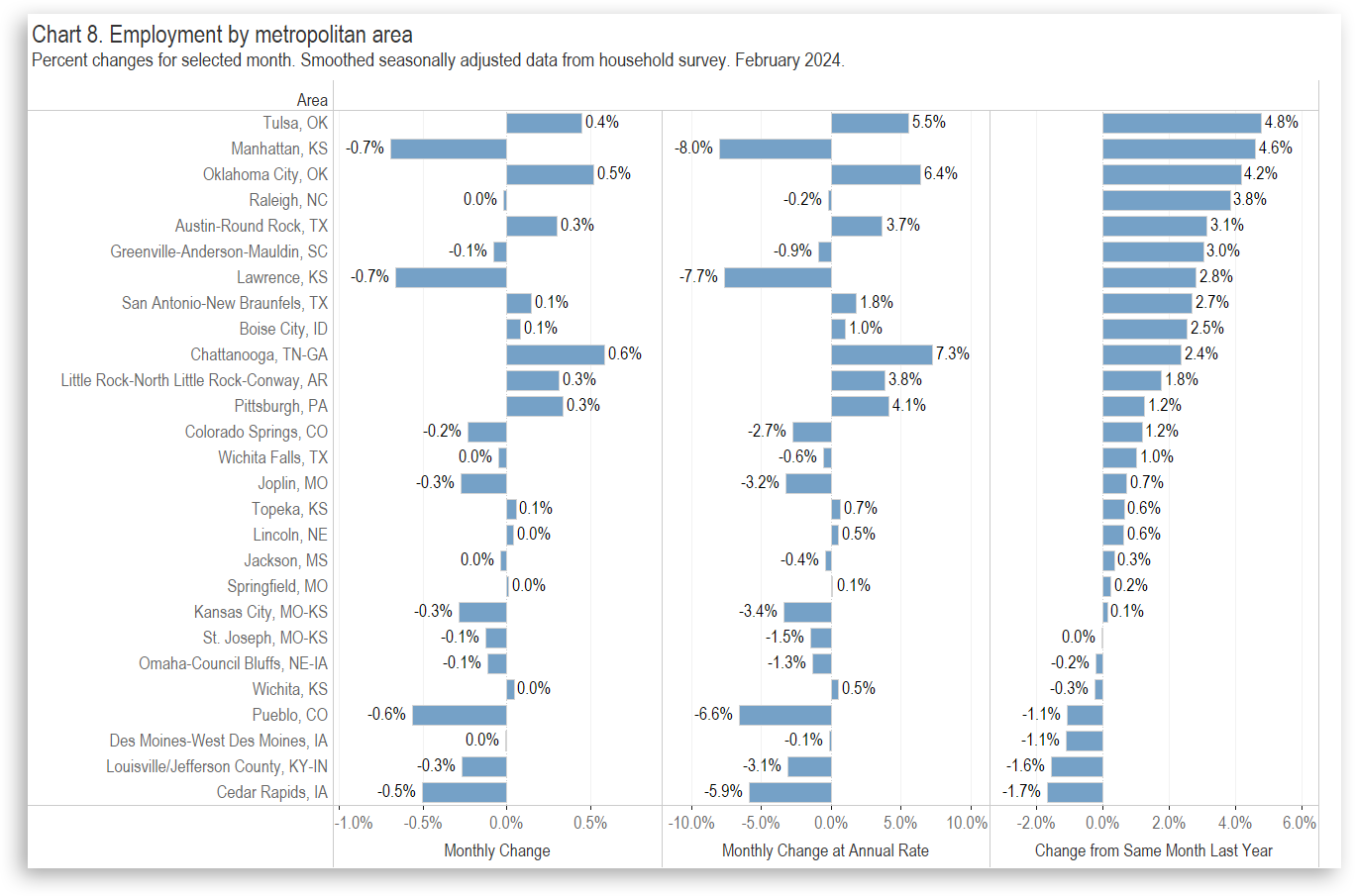

Wichita Employment Situation, February 2024

For the Wichita metropolitan area in February 2024, most employment indicators changed only slightly from the prior month, and the unemployment rate did not change. Wichita continues to perform poorly compared to its peers.

-

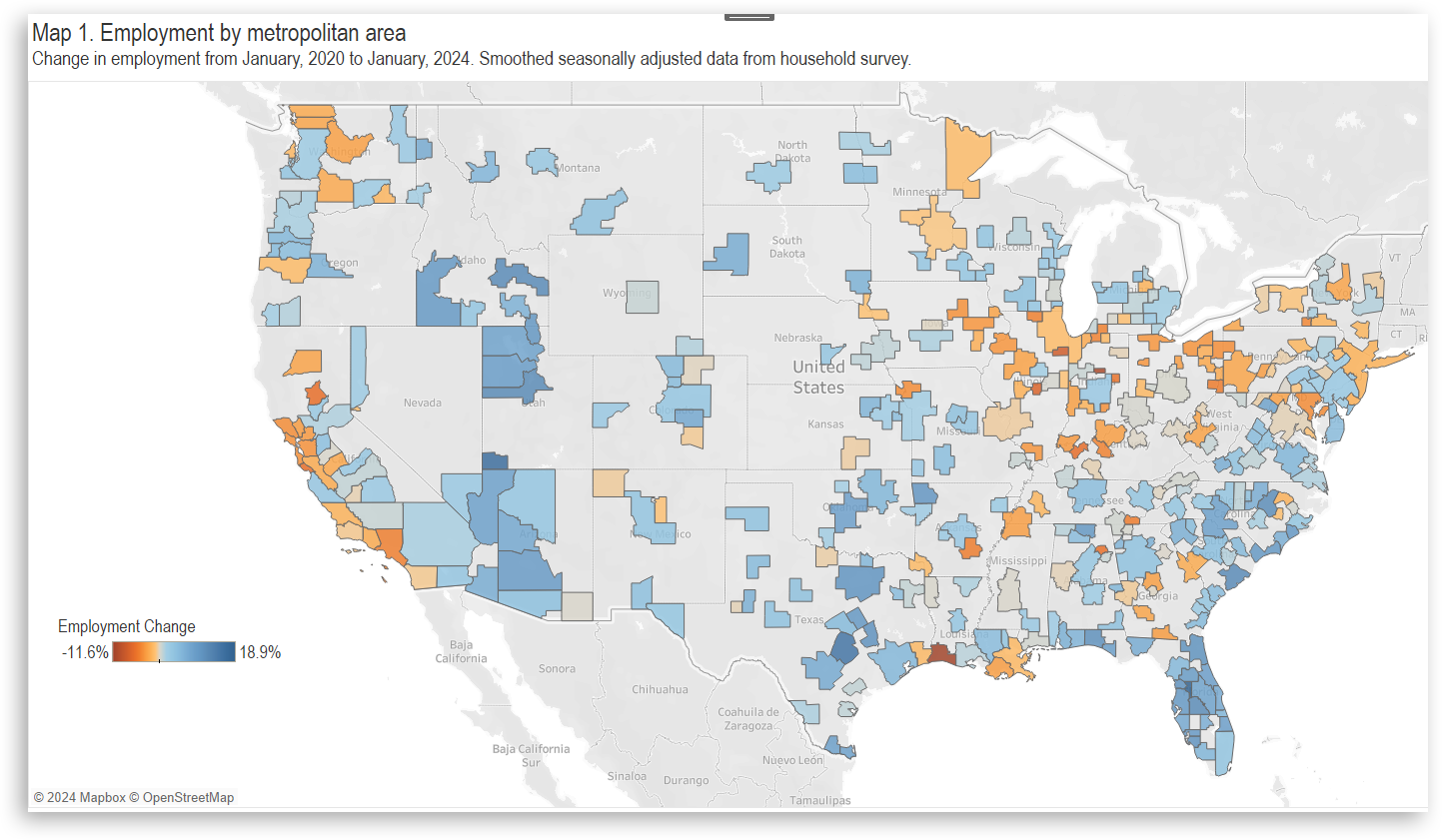

Wichita Employment Situation, January 2024

For the Wichita metropolitan area in January 2024, most employment indicators declined slightly from the prior month, and the unemployment rate did not change. Wichita continues to perform poorly compared to its peers.

-

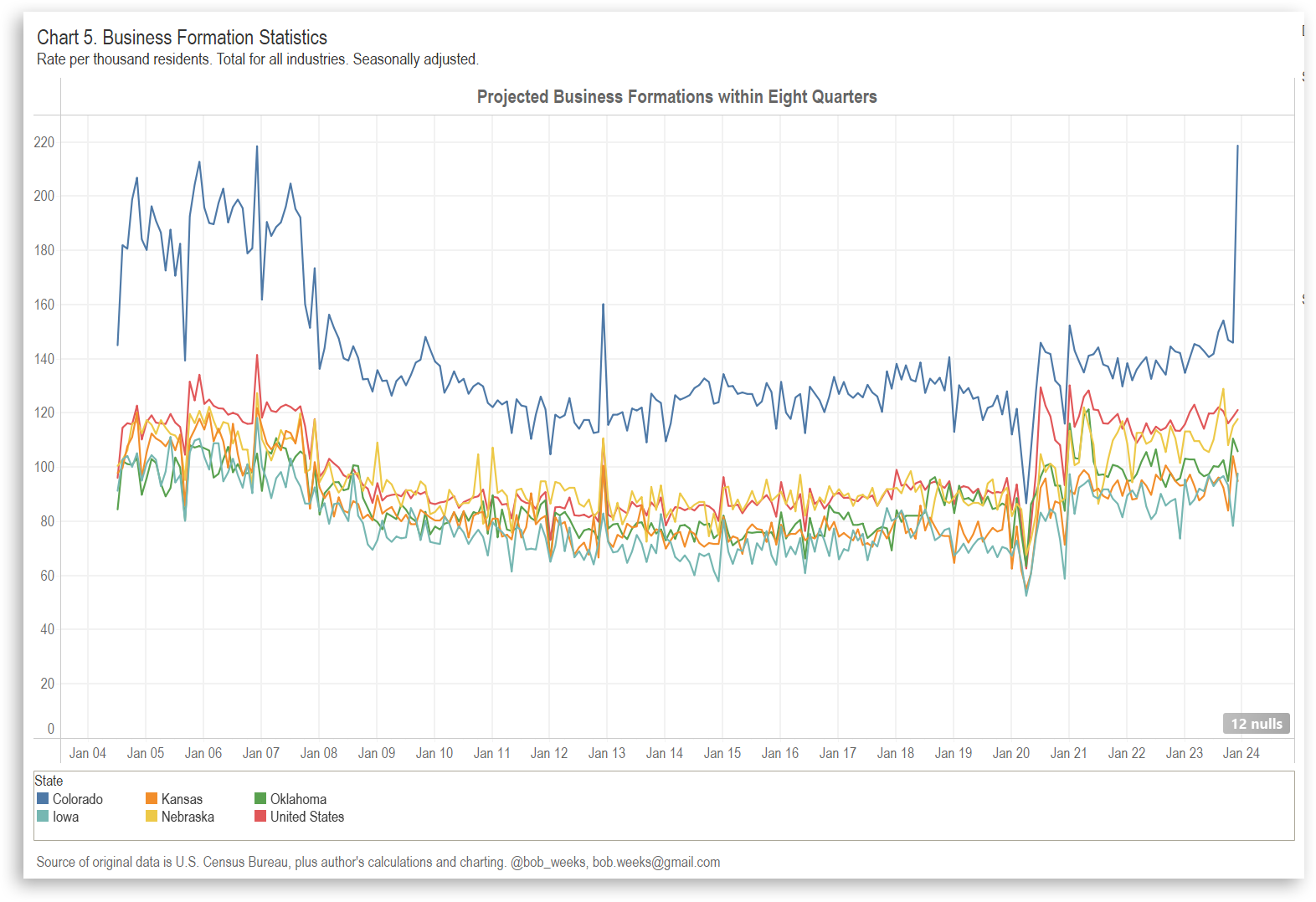

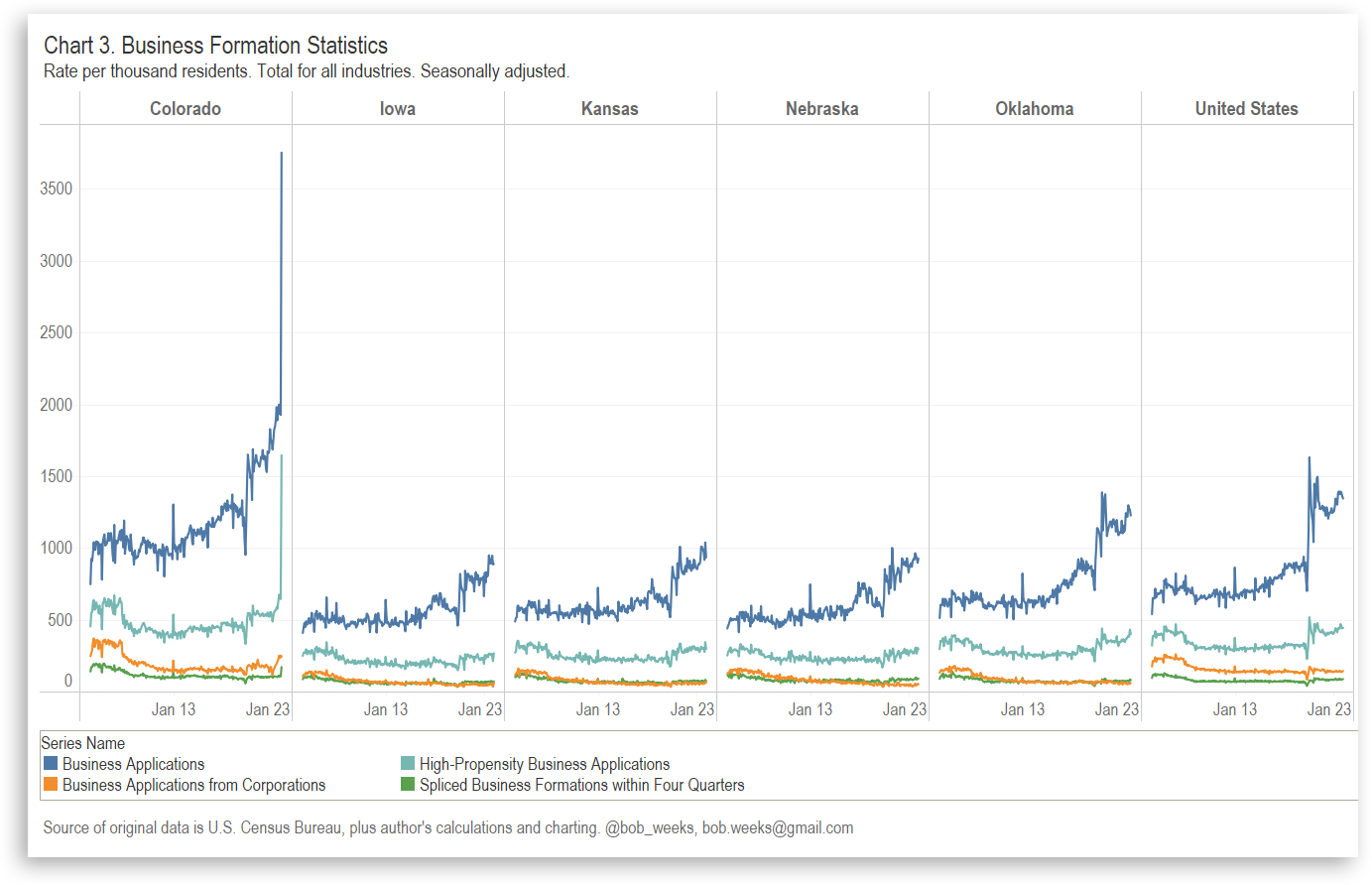

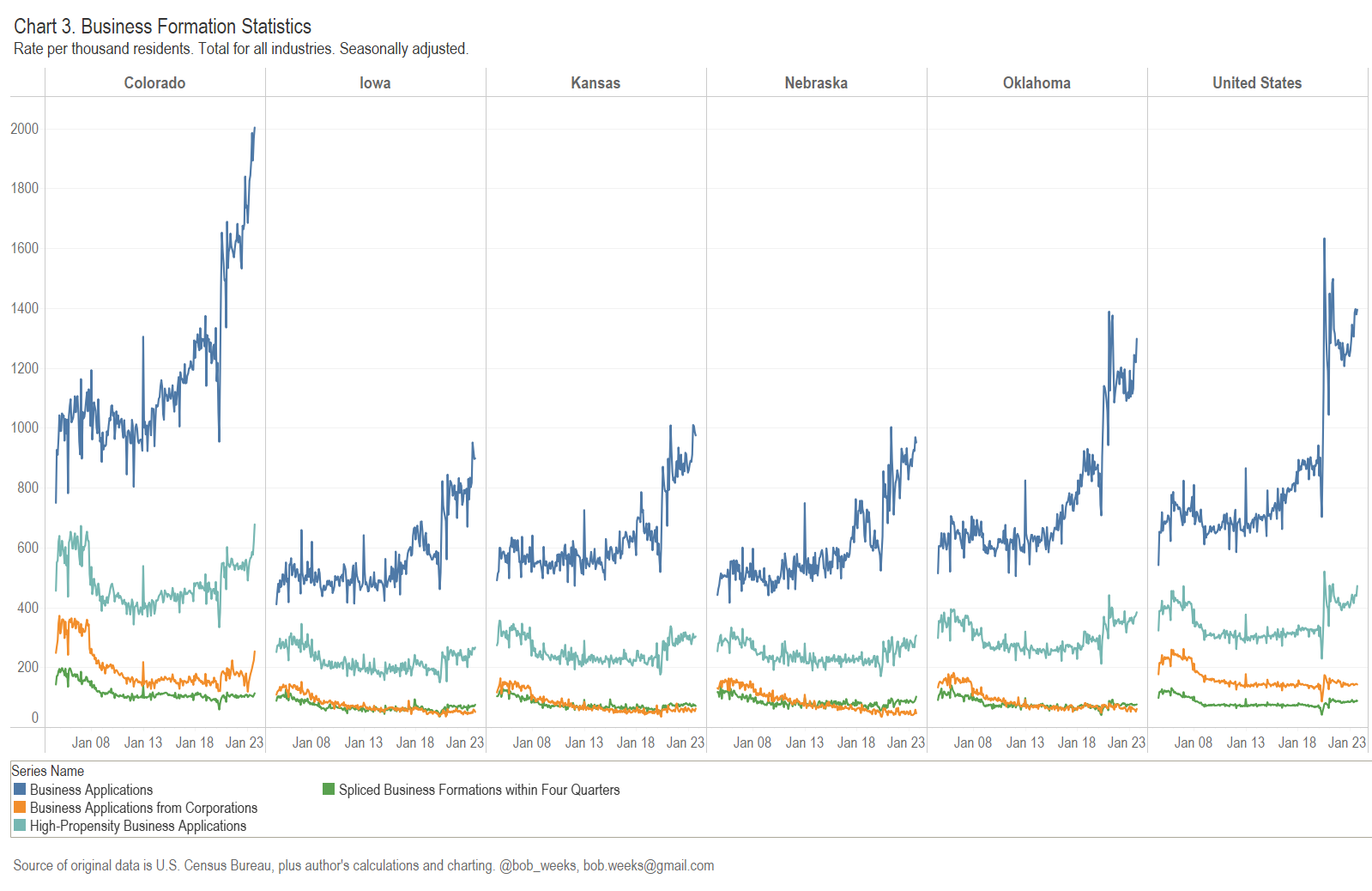

Business Formation in States

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.

-

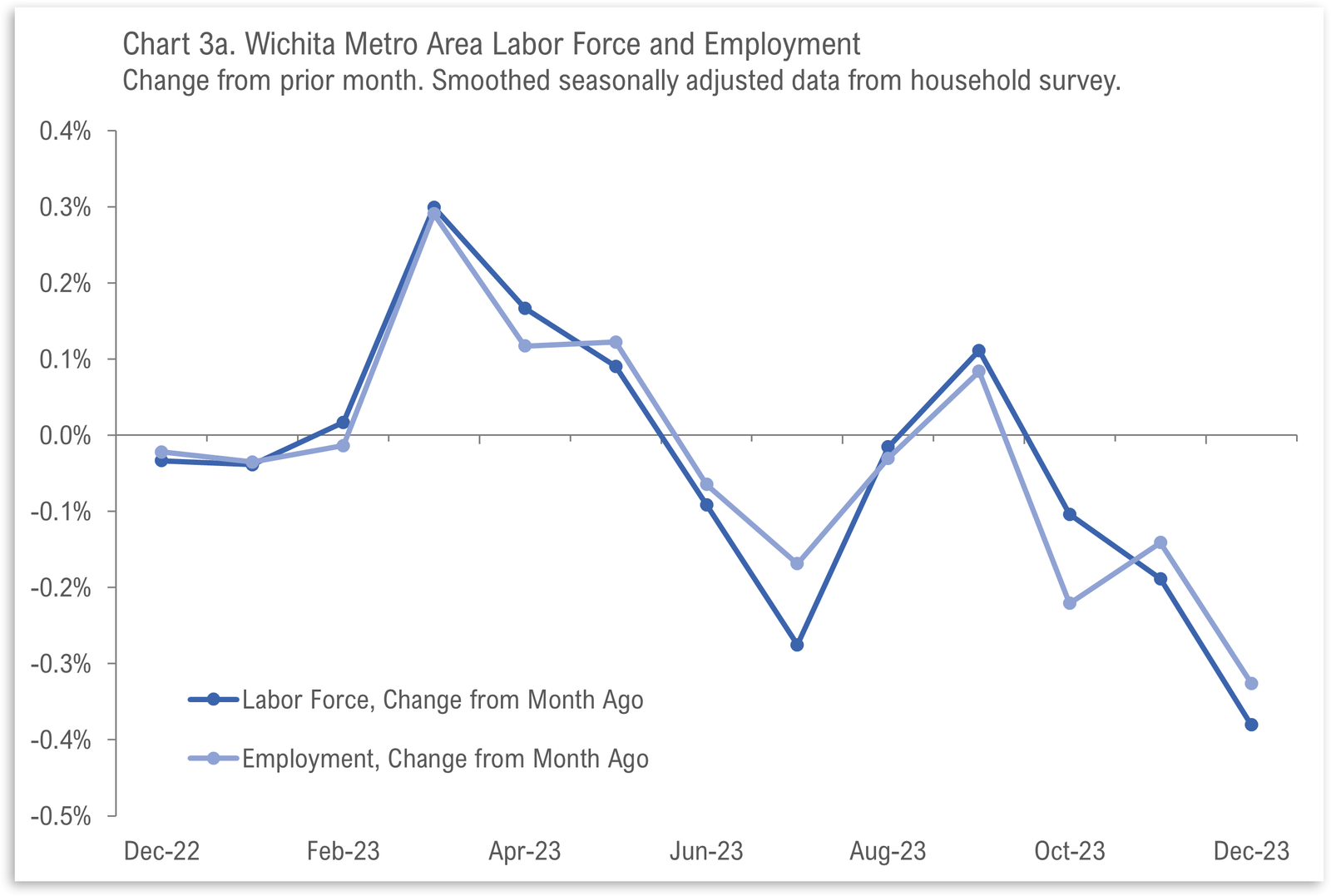

Wichita Employment Situation, December 2023

For the Wichita metropolitan area in December 2023, major employment indicators declined from the prior month, and the unemployment rate also fell. Wichita continues to perform poorly compared to its peers.

-

Business Formation in States

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.

-

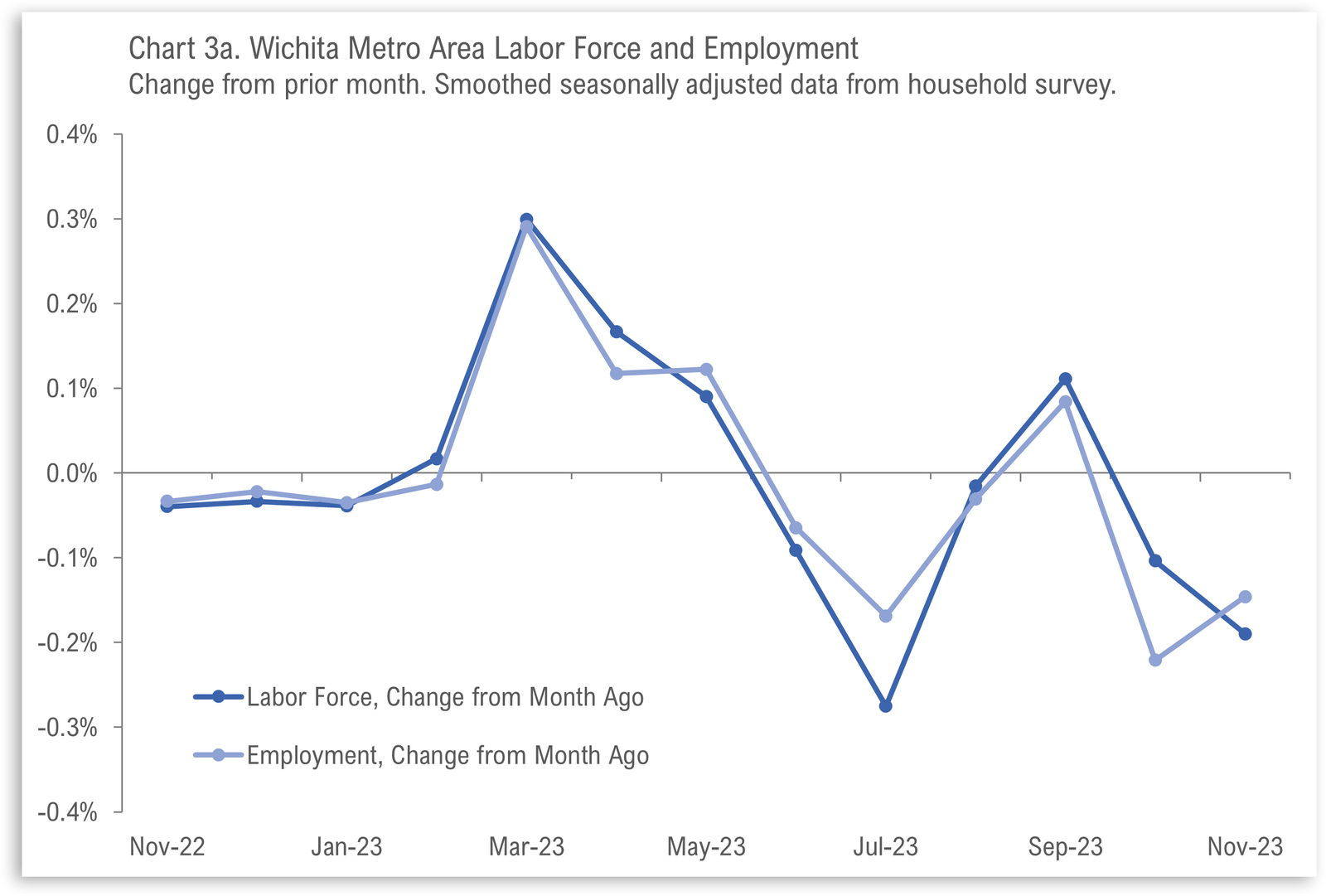

Wichita Employment Situation, November 2023

For the Wichita metropolitan area in November 2023, major employment indicators declined from the prior month. Wichita continues to perform poorly compared to its peers.

-

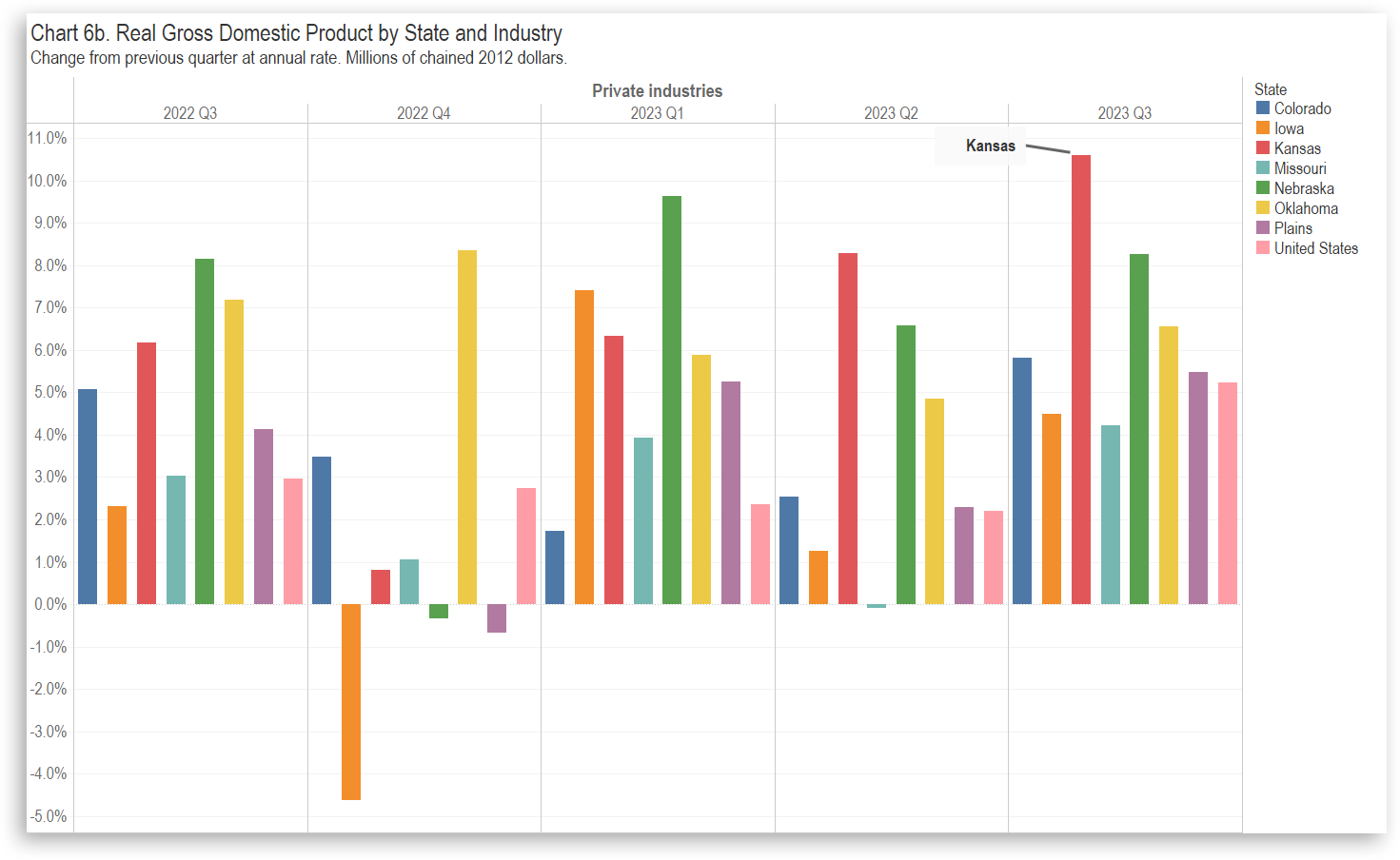

Kansas GDP, Third Quarter of 2023

In the third quarter of 2023, the Kansas economy grew at the annual rate of 9.7 percent. Real Gross Domestic Product rose in all states, with Kansas ranking first.

-

Business Formation in Kansas

For both business applications and business formations, Kansas does better than some states, but lags many states and the nation.