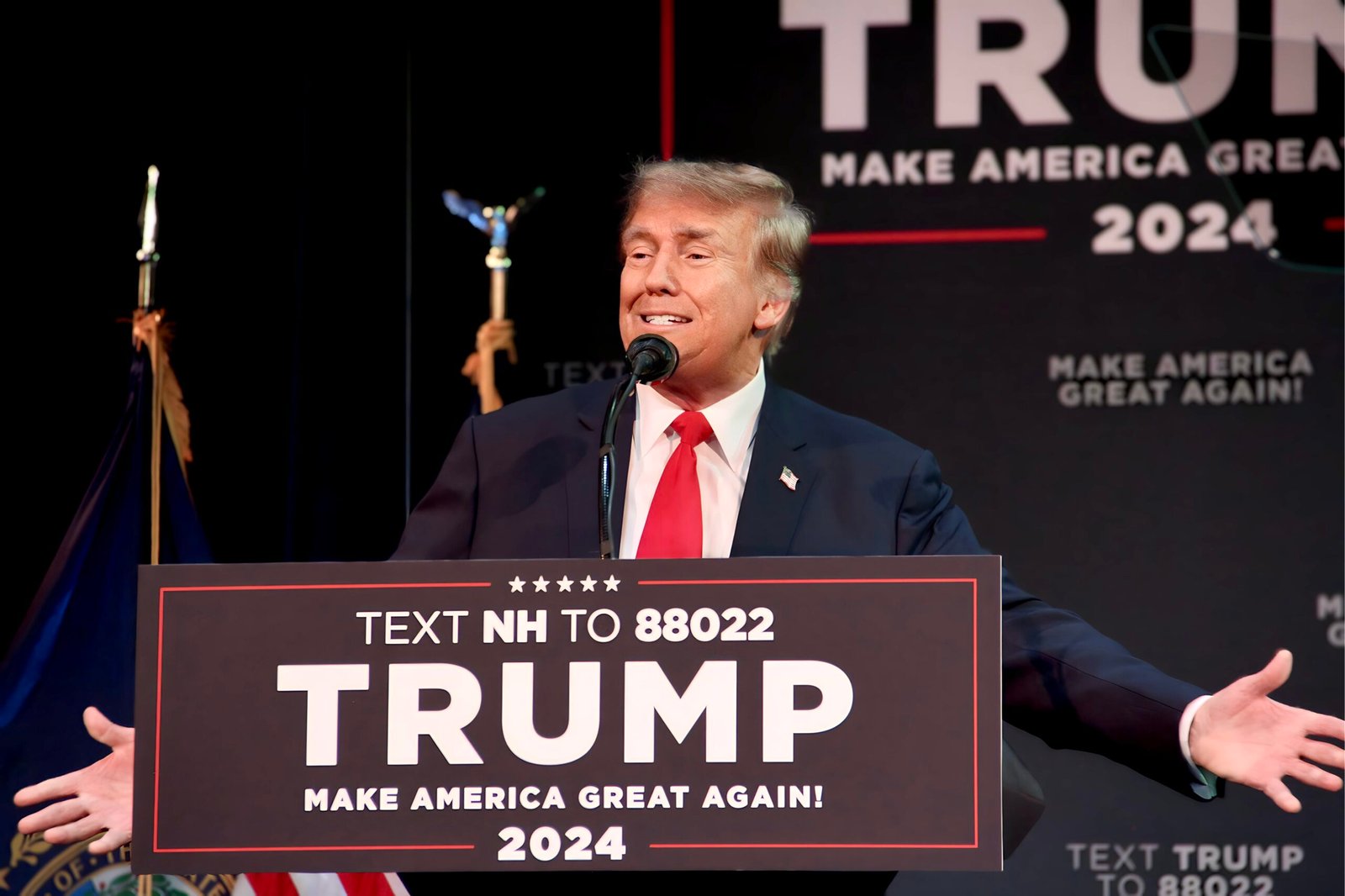

Trump Versus 100-day Polls

Let’s critically examine the claims made by Donald J. Trump in this post, focusing on his accusations against The New York Times, ABC/Washington Post, and Fox News polls, as well as his broader assertions about election fraud and media bias.