Category: Kansas state government

-

Kansas State of the State 2026: Where Kelly and Republicans Agree and Disagree on Taxes, Schools, and Spending

Governor Laura Kelly and House Speaker Dan Hawkins both celebrated Kansas achievements in 2026, from landing the Chiefs to cutting taxes. But their speeches reveal competing narratives about who deserves credit and fundamental disagreements over government spending and program expansion.

-

Kelly v. Kobach: A High-Stakes Battle Over Kansas’s Election Fraud Prosecution Authority

Governor Laura Kelly challenges Attorney General Kris Kobach’s authority to prosecute election fraud cases in a high-stakes separation of powers dispute before the Kansas Supreme Court. The case asks whether the Legislature can grant the AG criminal prosecution authority or if this unconstitutionally transfers executive power from the Governor.

-

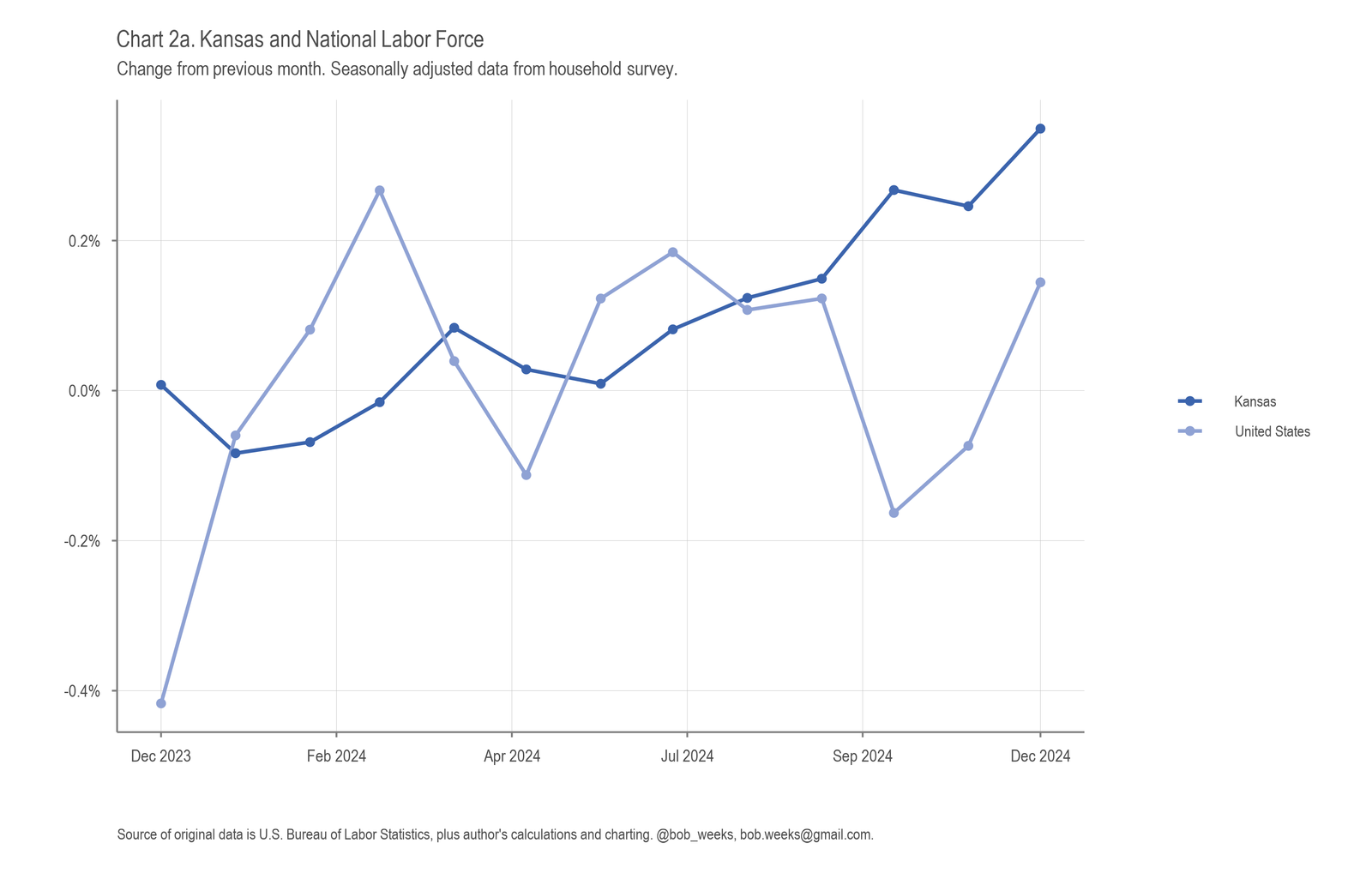

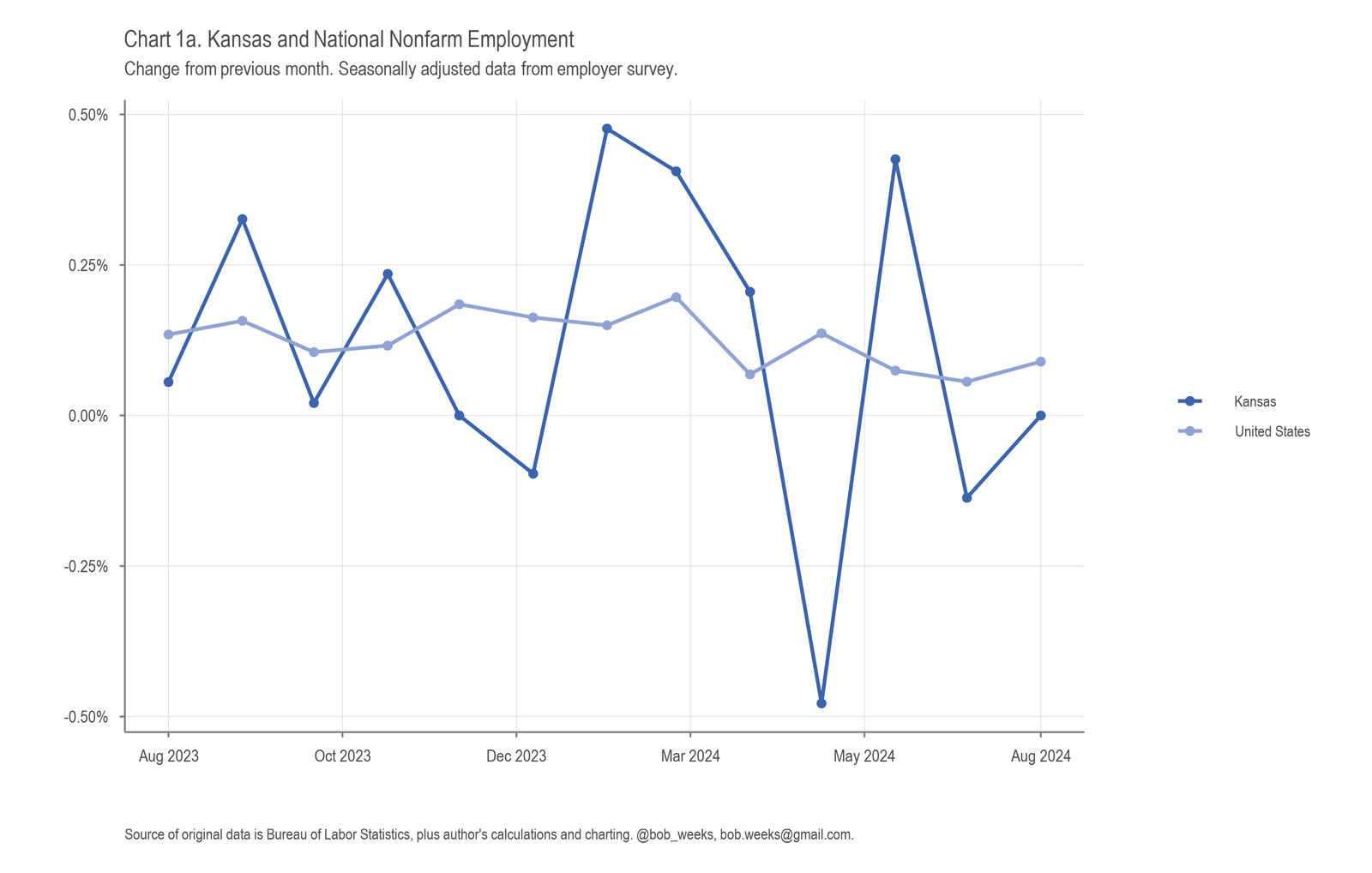

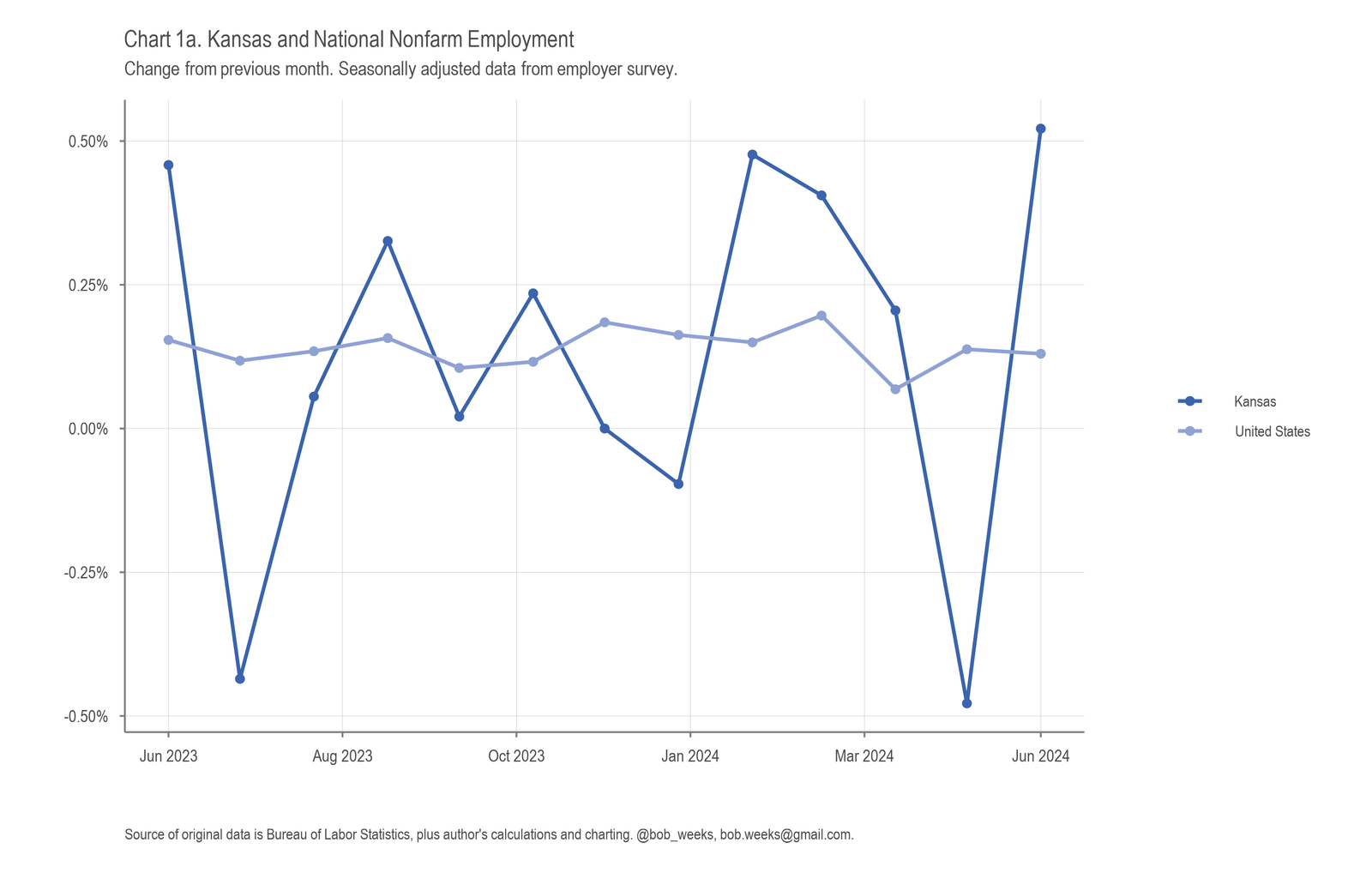

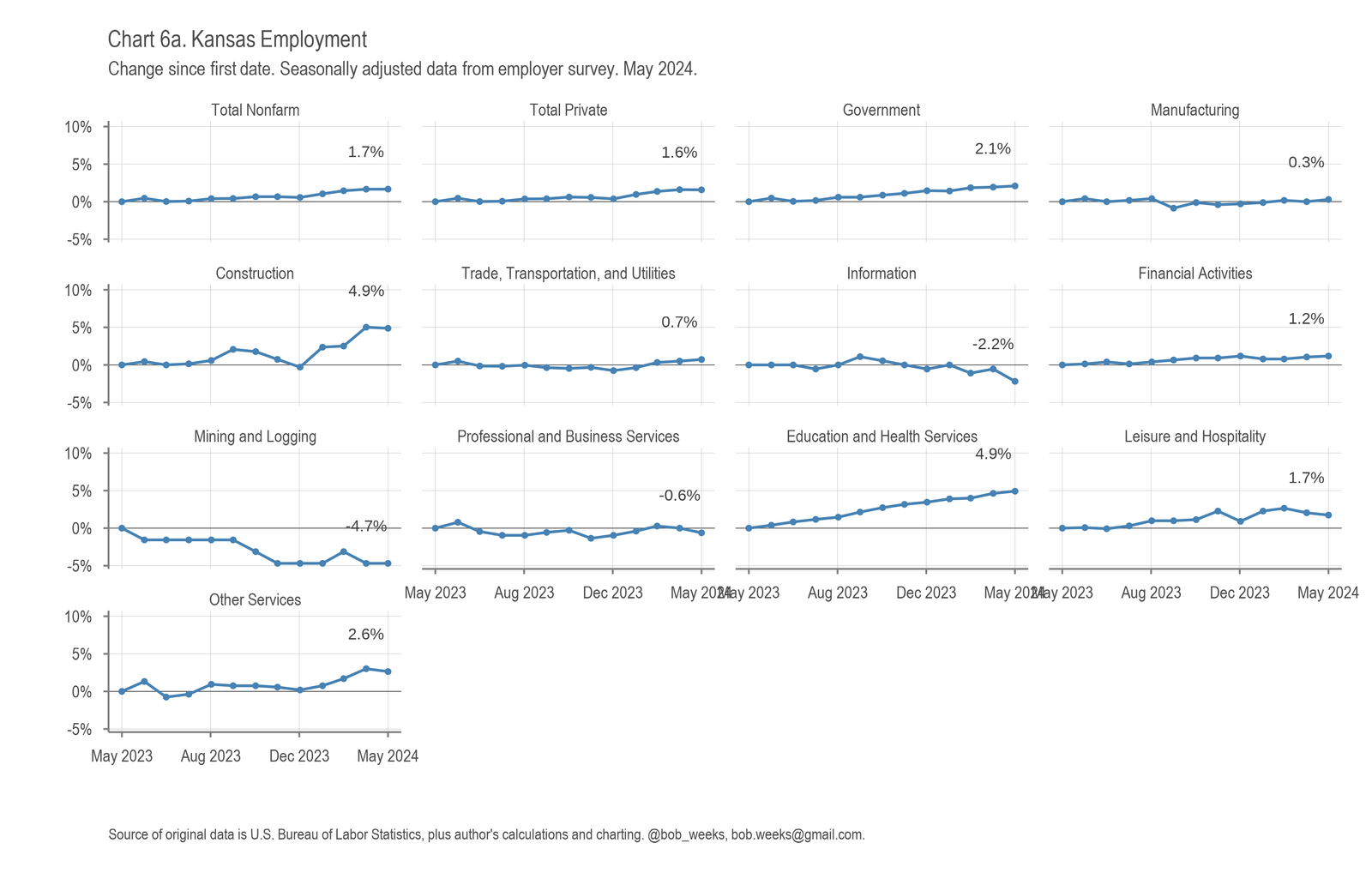

Kansas Employment Situation, December 2024

In Kansas in December 2024, the labor force rose, the number of jobs was rose, and the unemployment rate rose compared to the previous month, all by modest amounts. Over the year, Kansas is near the midpoint of states in job growth.

-

Kansas Employment Situation, August 2024

In Kansas in August 2024, the labor force rose, the number of jobs was unchanged, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth.

-

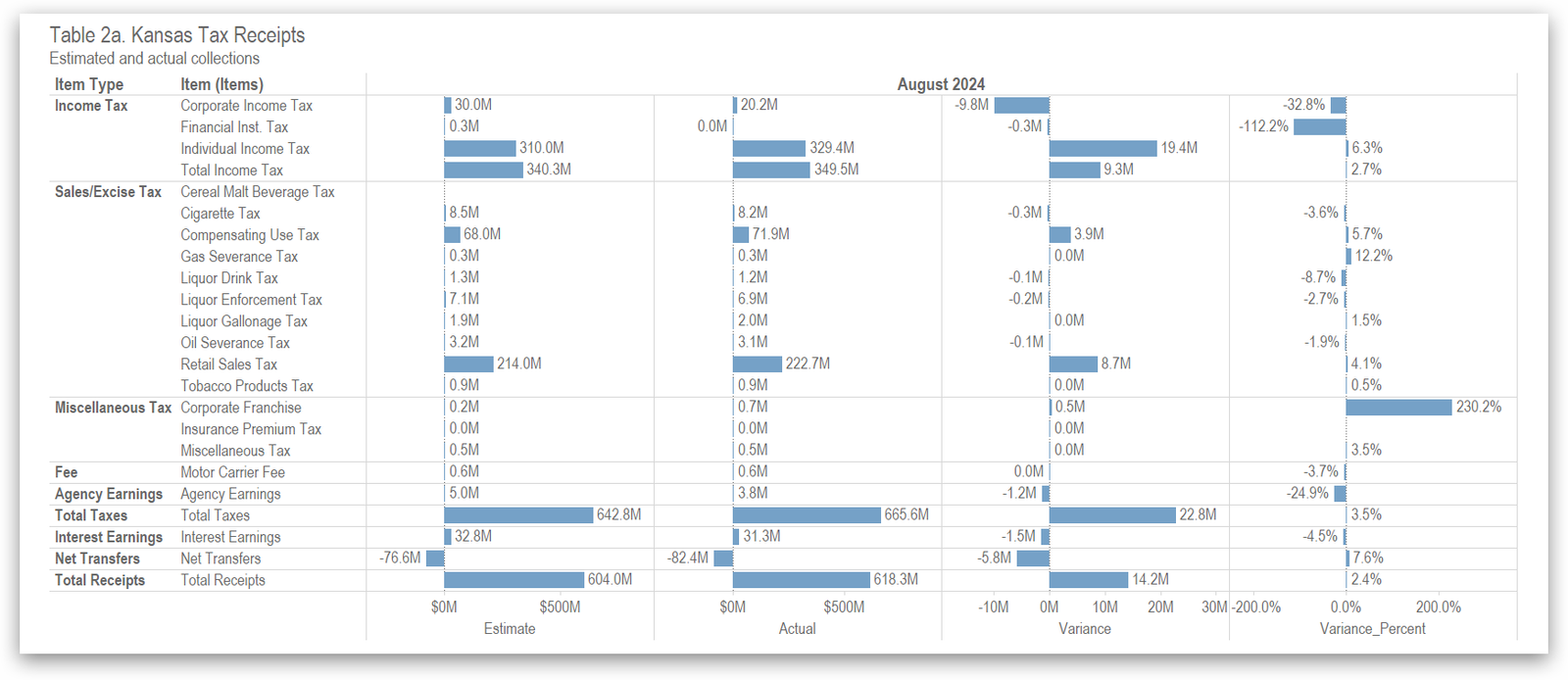

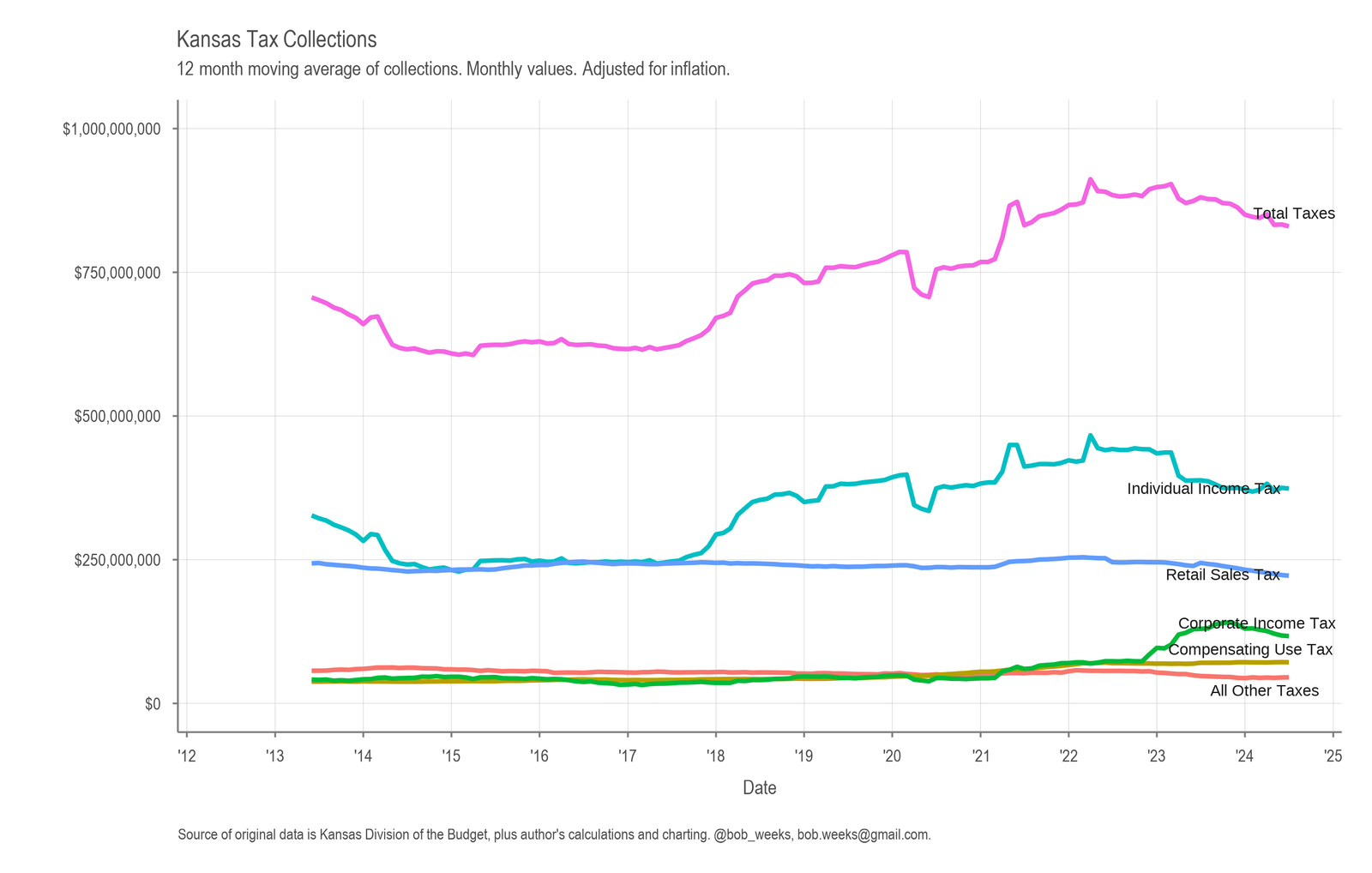

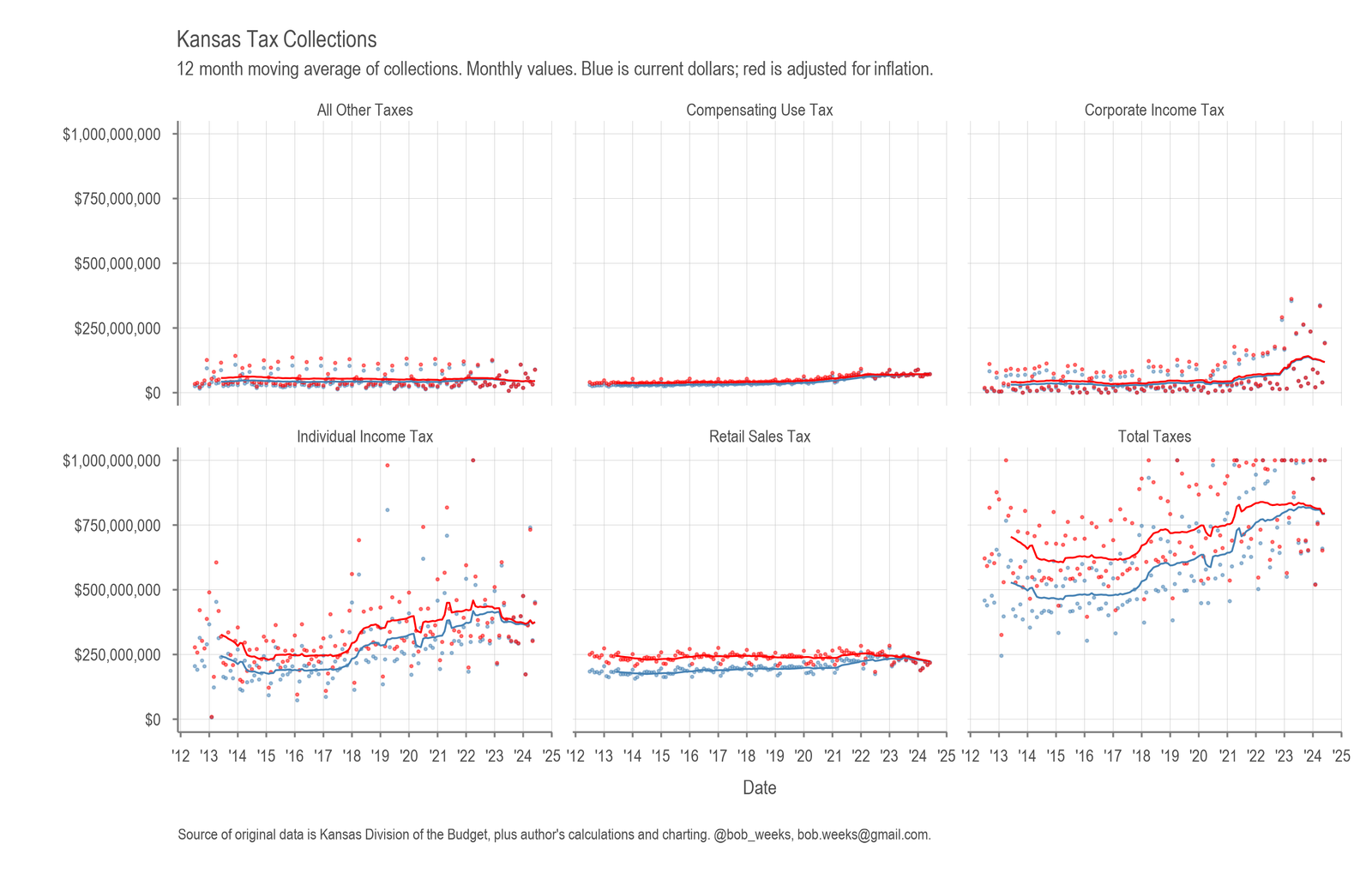

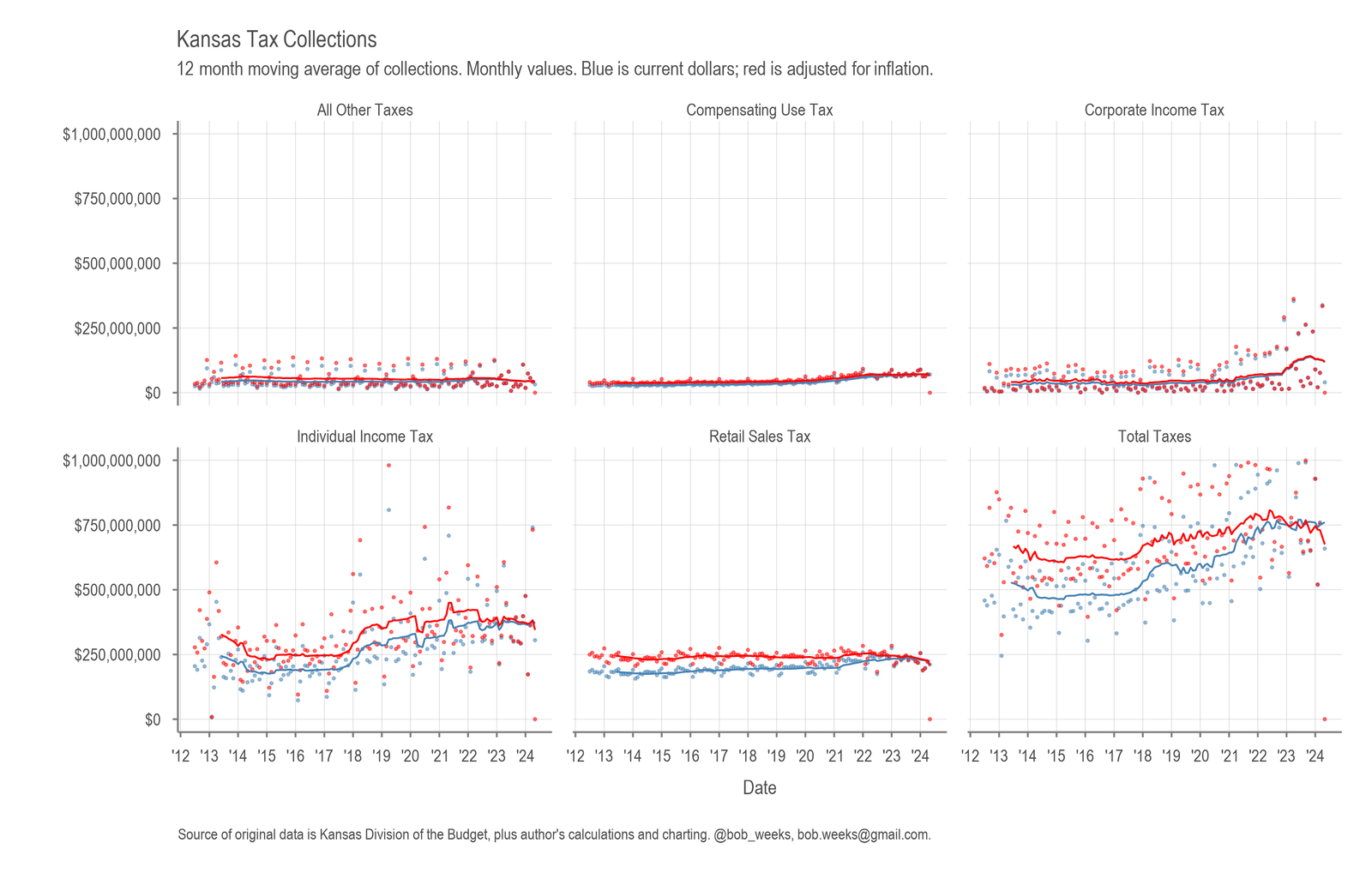

Kansas Tax Revenue, August 2024

For August 2024, Kansas tax revenue was 4.0 percent higher than August 2023, and 3.5 percent higher than estimated.

-

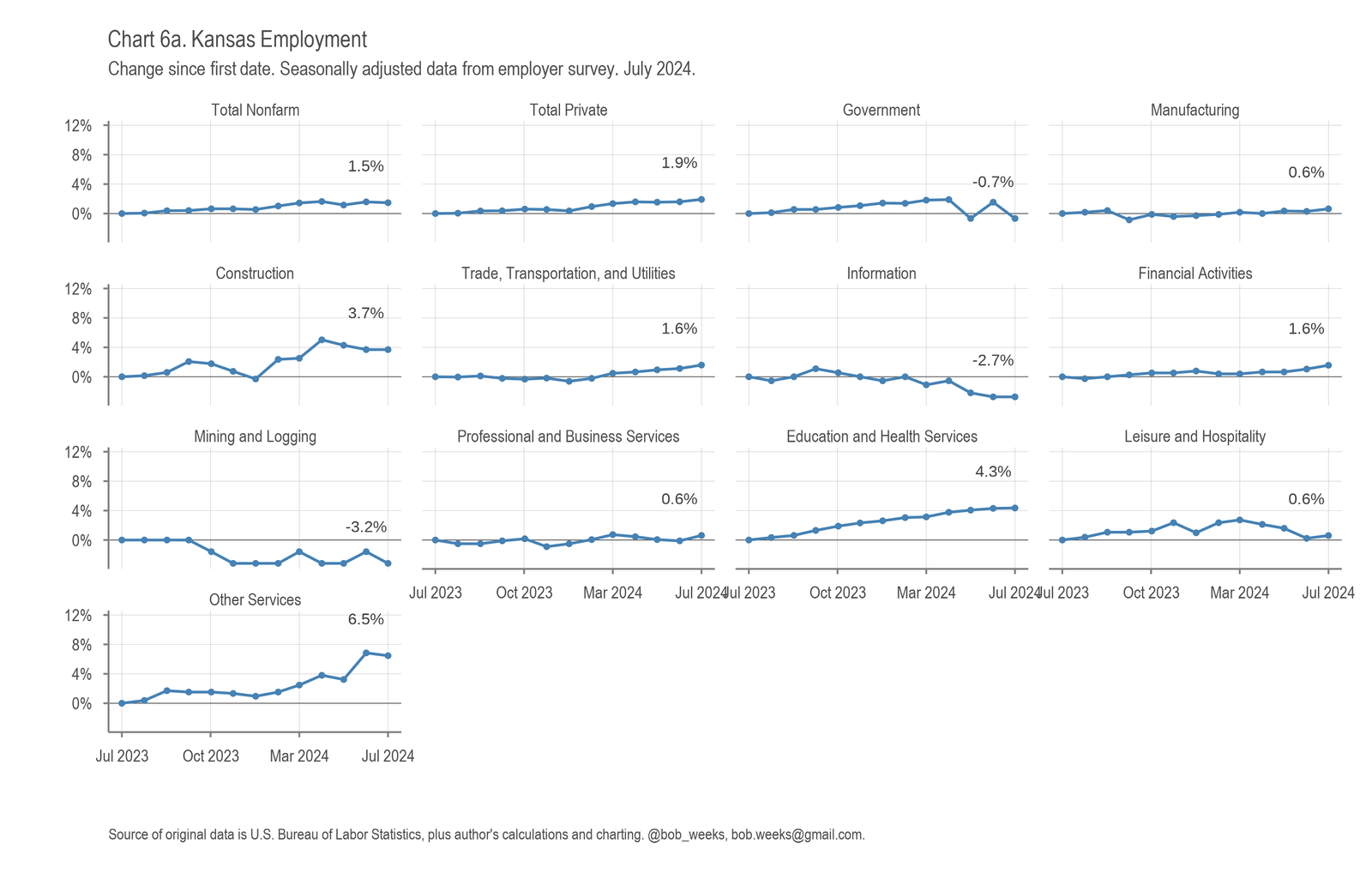

Kansas Employment Situation, July 2024

In Kansas in July 2024, the labor force rose, the number of jobs fell, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth.

-

Kansas Tax Revenue, July 2024

For July 2024, Kansas tax revenue was 3.0 percent lower than July 2023, and 1.0 percent less than estimated.

-

Kansas Employment Situation, June 2024

In Kansas in June 2024, the labor force was steady, the number of jobs and the number of unemployed people rose, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth.*

-

Kansas Tax Revenue, June 2024

For June 2024, Kansas tax revenue was 3.9 percent higher than June 2023, and 2.4 percent higher than estimated. For the just-completed fiscal year, collections were lower by 1.5 percent than the previous year, and 2.0 percent lower than estimated.

-

Kansas Employment Situation, May 2024

In Kansas in May 2024, the labor force, the number of jobs, and the unemployment rate changed little compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth.

-

Kansas Tax Revenue, May 2024

For May 2024, Kansas tax revenue was 23.1 percent lower than May 2023, and 22.7 percent lower than estimated.

-

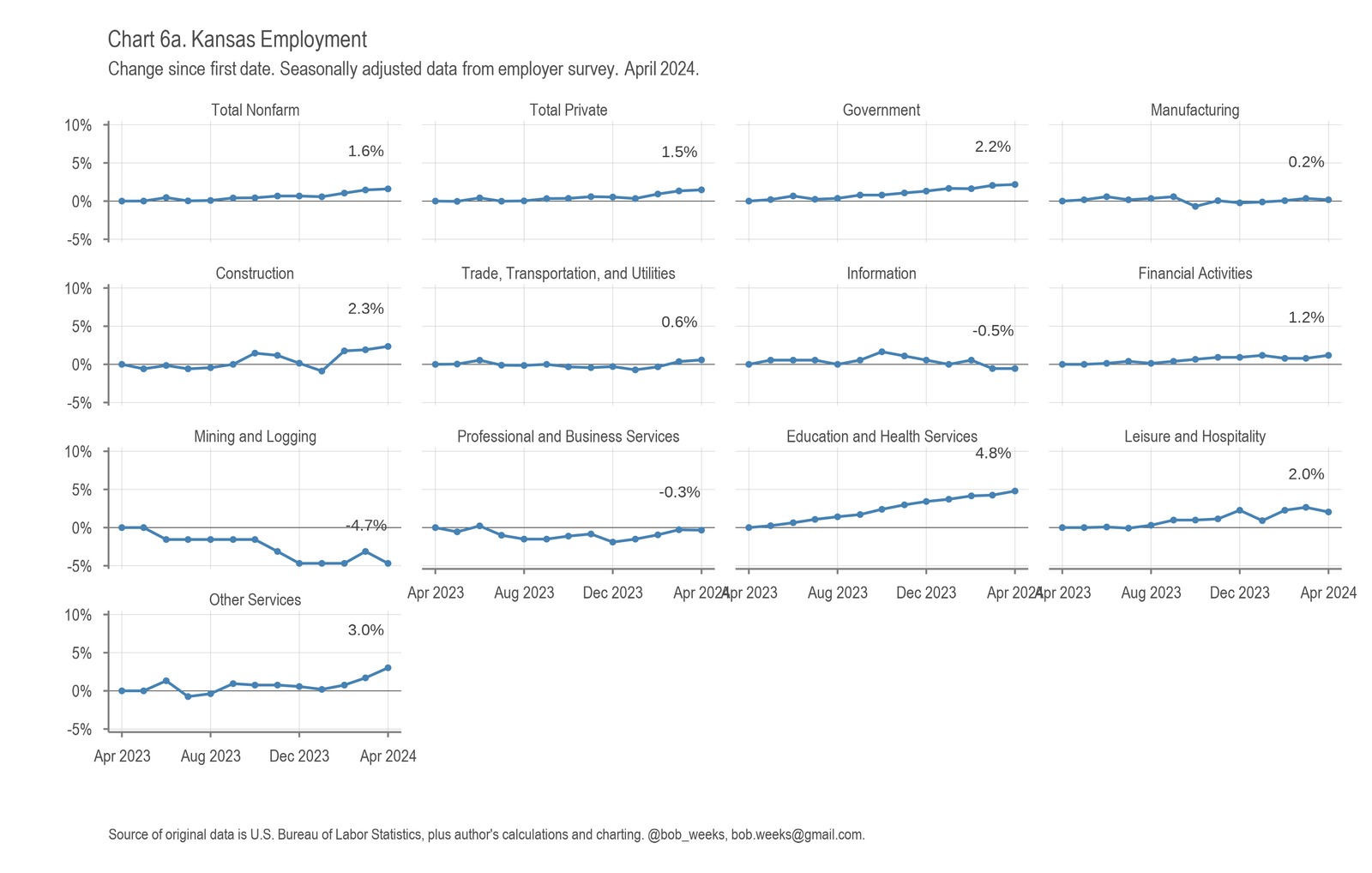

Kansas Employment Situation, April 2024

In Kansas in April 2024, the labor force rose, the number of jobs rose, and the unemployment rate rose compared to the previous month. Over the year, Kansas is at the midpoint of states in job growth.