-

Trump Jan 2026 Briefing: Operation Midnight Hammer, Gulf of America & Border Claims

Read more: Trump Jan 2026 Briefing: Operation Midnight Hammer, Gulf of America & Border ClaimsOn Jan 20, 2026, President Trump marked his administration’s first anniversary. He touted “Operation Midnight Hammer” against Iran , claimed a 77% drop in the trade deficit , and declared the border “secure” with zero illegal entries.

-

Article Summaries for January 2026

Read more: Article Summaries for January 2026Article Summaries for January 2026

-

Trump vs. GOP: Inside the Senate Revolt & The ‘Greenland Plot’ Failure

Read more: Trump vs. GOP: Inside the Senate Revolt & The ‘Greenland Plot’ FailureA new political rift exposes the fragility of Trump’s control over the GOP. As Senators resist the “Greenland plot,” the cost of silence finally outweighs the cost of resistance. Learn how Bill Cassidy’s experience and Senate pushback signal a critical turning point for party loyalty.

-

Trump Celebrates Boulevard Naming at Mar-a-Lago, Touts Economic Gains and Venezuela Operation

Read more: Trump Celebrates Boulevard Naming at Mar-a-Lago, Touts Economic Gains and Venezuela OperationPresident Trump attended a January 16, 2026 ceremony at Mar-a-Lago celebrating the renaming of a major Palm Beach boulevard in his honor. Trump used the occasion to announce dramatic claims about his first-year achievements, including $18 trillion in investments.

-

Comprehensive Fact-Check: Trump Pre-Departure Press Gaggle – January 19, 2025

Read more: Comprehensive Fact-Check: Trump Pre-Departure Press Gaggle – January 19, 2025The press gaggle demonstrates a pattern where Trump’s most verifiable claims (stock market records, inauguration timing) prove accurate, while his most sweeping assertions (historical investment levels, inflation characterizations, war-ending claims, NATO spending achievements) range from misleading to disputed to factually incorrect. The economic claims in particular show a tendency to overstate achievements while the India-Pakistan…

-

Trump Pre-Davos Press Gaggle: Greenland Claims, Economic Boasts, and Board of Peace Updates – January 19, 2025

Read more: Trump Pre-Davos Press Gaggle: Greenland Claims, Economic Boasts, and Board of Peace Updates – January 19, 2025President Trump held a wide-ranging press conference before departing for Davos, celebrating his first year with sweeping economic claims while doubling down on Greenland acquisition efforts. He confirmed inviting Putin to his Board of Peace initiative and threatened massive tariffs on France.

-

Kansas State of the State 2026: Where Kelly and Republicans Agree and Disagree on Taxes, Schools, and Spending

Read more: Kansas State of the State 2026: Where Kelly and Republicans Agree and Disagree on Taxes, Schools, and SpendingGovernor Laura Kelly and House Speaker Dan Hawkins both celebrated Kansas achievements in 2026, from landing the Chiefs to cutting taxes. But their speeches reveal competing narratives about who deserves credit and fundamental disagreements over government spending and program expansion.

-

DOJ Opposes Khanna-Massie Motion in Ghislaine Maxwell Case Over Epstein Files Transparency Act

Read more: DOJ Opposes Khanna-Massie Motion in Ghislaine Maxwell Case Over Epstein Files Transparency ActThe Justice Department filed a forceful opposition to Representatives Ro Khanna and Thomas Massie’s attempt to appear as amici curiae in the closed Ghislaine Maxwell criminal case, arguing the lawmakers lack standing to enforce the Epstein Files Transparency Act through judicial oversight and are misusing the amicus curiae mechanism for improper adversarial purposes.

-

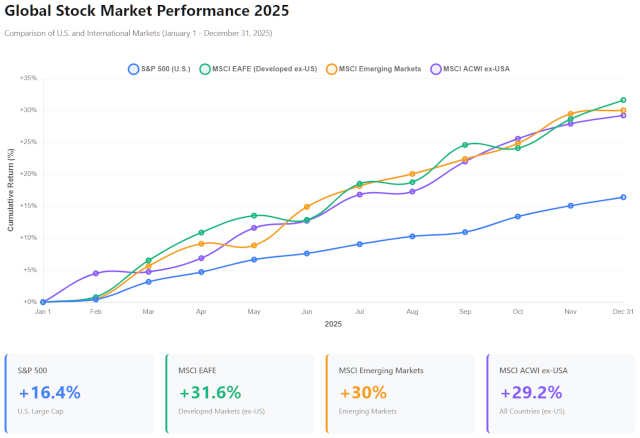

Market Performance in 2025: U.S and World

Read more: Market Performance in 2025: U.S and WorldU.S. stock markets had outperformed the world, until 2025.

-

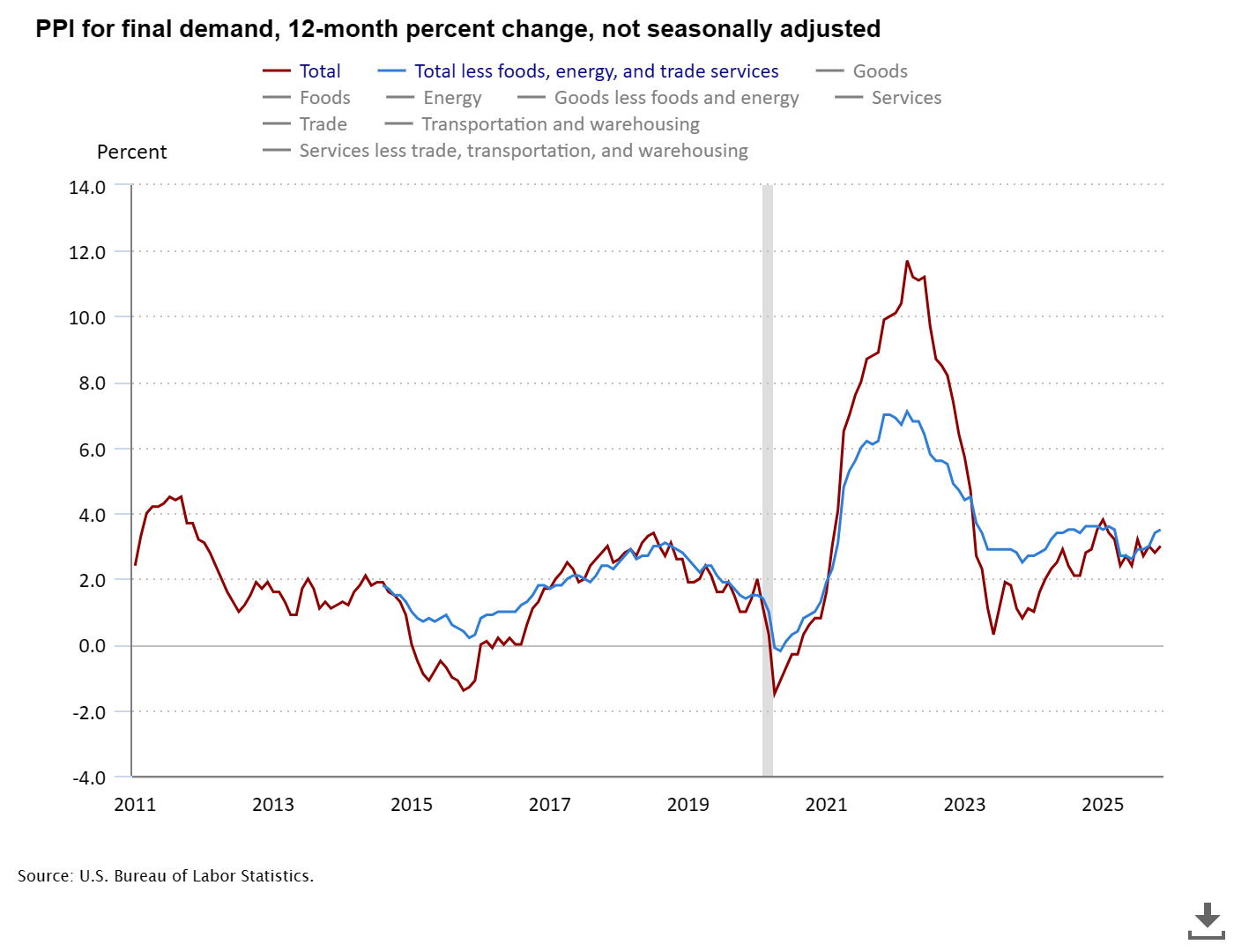

Producer Price Indexes — November 2025

Read more: Producer Price Indexes — November 2025The Producer Price Index for final demand increased 0.2 percent in November 2025, driven primarily by a 0.9 percent rise in final demand goods (especially a 10.5 percent jump in gasoline prices), while final demand services remained unchanged.

-

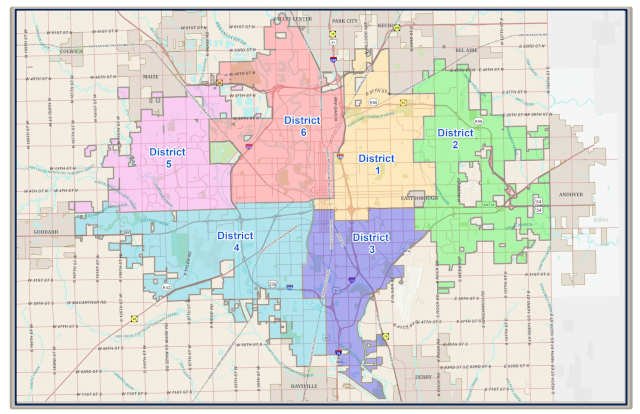

Wichita City Council Selects New City Manager After 16-Year Era: November 25, 2025 Meeting Analysis

Read more: Wichita City Council Selects New City Manager After 16-Year Era: November 25, 2025 Meeting AnalysisIn a historic November 25, 2025 session, Wichita City Council voted 5-2 to negotiate with Dennis Marstall as next City Manager, ending Robert Layton’s 16-year tenure. Council Member Johnson raised process concerns while supporting future search. Meeting also featured housing safety advocacy and cemetery preservation updates.

-

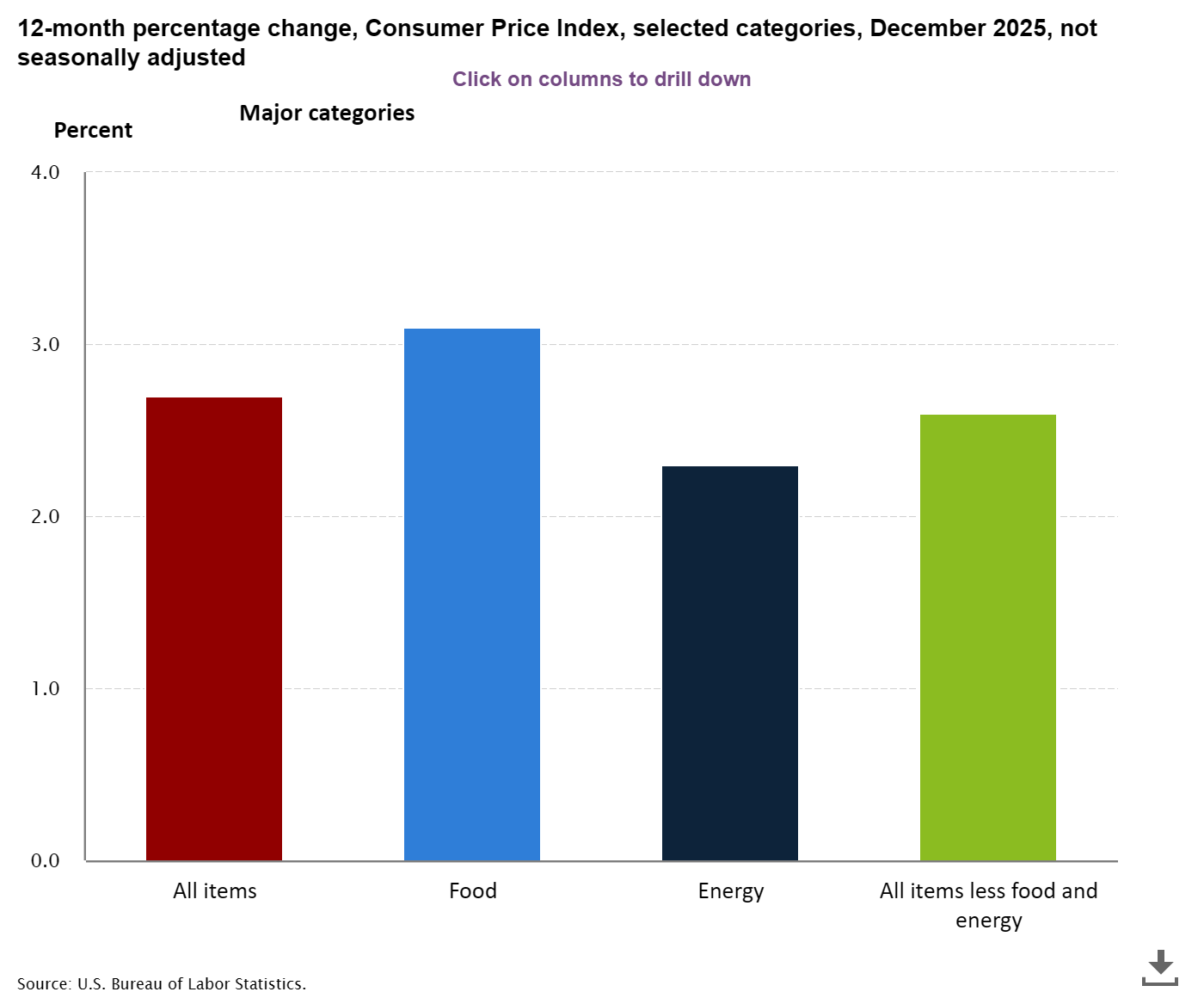

December 2025 CPI Report Explained: Inflation Holds at 2.7% as Housing and Food Costs Rise

Read more: December 2025 CPI Report Explained: Inflation Holds at 2.7% as Housing and Food Costs RiseThe December 2025 Consumer Price Index reveals inflation holding steady at 2.7% year-over-year, with monthly prices rising 0.3%. Housing remains the primary driver at 3.2% annual growth, while food prices climbed 3.1%. Core inflation stayed at 2.6%, suggesting underlying price pressures remain elevated above the Federal Reserve’s target.